What is the procedure for exemption from import and export duties in Vietnam?

What is the procedure for exemption from import and export duties in Vietnam?

Based on Article 13 of Circular 06/2021/TT-BTC, the procedure for exemption from import tax for re-imported exports as stipulated in Article 33 of Decree 134/2016/ND-CP and export tax exemption for re-exported imports as stipulated in Article 34 of Decree 134/2016/ND-CP is implemented as follows:

(1) Responsibilities of the Taxpayer

- Declare fully, accurately, truthfully, and be responsible for the contents declared in the tax exemption application dossier.

+ In case of import tax exemption for re-imported exports as stipulated in Article 33 of Decree 134/2016/ND-CP, taxpayers send a written request for tax exemption through the System following Form No. 6 Annex 2 issued together with Circular 06/2021/TT-BTC, or paper form following Form No. 14/TXNK Annex 1 issued together with Circular 06/2021/ TT-BTC: 01 original; and documents as stipulated in Article 33 of [Decree 134/2016/ND-CP](https://lawnet.vn/vb/Nghi-dich-134-2016- ND-CP-huong-dan-Luat-thue-xuat-khau-thue-nhap-khau-4F012.html#dieu_3) include:

++ Proof of payment for exports if payment has been made: 01 certified copy by the tax exemption requesting authority;

++ Export contract, export entrustment contract if in the form of export entrustment (if any): 01 certified copy by the tax exemption requesting authority;

++ Commercial invoice according to the export contract for exports that have to be re-imported (except for export into non-tariff zones managed according to point a.1.4 clause 1 Article 13 of [Circular 06/2021/TT-BTC](https://lawnet.vn/vb/Thong-tu-06-2021- TT-BTC-huong-dan-Luat-Quan-ly-thue-quan-ly-thue-doi-voi-hang-hoa-xuat-nhap-khau-714ED.html#dieu_13)): 01 certified copy by the tax exemption requesting authority;

++ Invoice from the exporter as per the law for export invoices in case the goods exported into the non-tariff zones have to be re-imported: 01 certified copy by the tax exemption requesting authority;

++ Goods have to be re-imported due to refusal by foreign customers or lack of receivers according to the carrier's notice, additional foreign customer's notice or agreement document on returning goods or transporter's notice on lack of receivers with clear reasons, quantity, and types of returned goods: 01 certified copy by the tax exemption requesting authority.In cases of force majeure or if the taxpayer self-detects that goods have defects that must be re-imported, this document is not required but the reason for returning imports must be stated clearly in the tax exemption request letter;

++ Goods exported by organizations or individuals in Vietnam to organizations or individuals abroad via postal and international express delivery services but cannot be delivered and have to be re-imported, an additional notice from the postal enterprise or international express delivery service about non-delivery to the recipient is required: 01 certified copy by the tax exemption requesting authority;

+ In case of export tax exemption for re-exported imports as stipulated in Article 34 of [Decree 134/2016/ND-CP](https://lawnet.vn/vb/Nghi-dich-134-2016-ND-CP-huong-dan-Luat-thue-xuat-khau- thue-nhap-khau-4F012.html#dieu_34), taxpayers send a written request for tax exemption through the System following Form No. 6 Annex 2 issued together with Circular 06/2021/TT-BTC, or paper form following Form No. 14/TXNK Annex 1 issued together with Circular 06/2021/TT-BTC: 01 original; and documents as stipulated in Article 34 of Decree 134/2016/ND-CP include:

++ Invoice from the exporter as per the law for export invoices for goods re-imported and then exported into non-tariff zones: 01 certified copy by the tax exemption requesting authority;

++ Commercial invoice according to the export contract for re-imports that must be re-exported abroad (except for those exported into non-tariff zones managed as per point a.2.1 clause 1 Article 13 of [Circular 06/2021/TT-BTC](https://lawnet.vn/vb/Thong-tu-06-2021-TT-BTC- huong-dan-Luat-Quan-ly-thue-quan-ly-thue-doi-voi-hang-hoa-xuat-nhap-khau-714ED.html#dieu_13)): 01 certified copy by the tax exemption requesting authority;

++ Commercial invoice according to the import contract for re-exports returned to foreign owners: 01 certified true copy by the tax exemption requesting authority, with a written agreement to return goods to the foreign side: 01 certified copy by the tax exemption requesting authority;

++ Export contract for re-exported imports sold abroad or into non-tariff zones; export entrustment contract if in the form of export entrustment: 01 certified copy by the tax exemption requesting authority;

++ Import contract for imports; import entrustment contract if in the form of import entrustment; proof of payment for imports if payment has been made: 01 certified copy by the tax exemption requesting authority;

++ Notice from the postal enterprise or international express delivery service about non-delivery to the recipient: 01 certified copy by the tax exemption requesting authority;

++ Confirmation document from the shipping service provider about the quantity and value of goods purchased from the import focal enterprise actually supplied to foreign ships, accompanied by a statement of payment proof from foreign shipping companies: 01 original;

- Explain, supplement information on time to the customs authority where the proposed tax amount for exemption arises.- Comply with tax processing decisions of the customs authority in accordance with tax management law.

(2) Responsibilities of the Customs Authority

- The customs authority where the proposed tax exemption amount arises shall receive and process the tax exemption dossier through the System. If receiving paper forms, the customs authority stamps receipt and enter them into the log.- Within 03 working days from the date of receiving the tax exemption dossier, the customs authority notifies the taxpayer about the acceptance of the dossier and the processing time via the System using Form No. 3 Annex 2 issued together with [Circular 06/2021/TT-BTC](https://lawnet.vn/vb/Thong-tu-06-2021-TT-BTC- huong-dan-Luat-Quan-ly-thue-quan-ly-thue-doi-voi-hang-hoa-xuat-nhap-khau-714ED.html#dieu_3_1), for paper forms, it is notified using Form No. 04/TXNK Annex 1 issued together with [Circular 06/2021/TT-BTC](https://lawnet.vn/vb/Thong-tu-06-2021-TT-BTC- huong-dan-Luat-Quan-ly-thue-quan-ly-thue-doi-voi-hang-hoa-xuat-nhap-khau-714ED.html#chuong_pl_5).

In case an explanation or supplementation is needed, the customs authority shall notify the taxpayer via the System using Form No. 4 Annex 2 issued together with [Circular 06/2021/TT-BTC](https://lawnet.vn/vb/Thong-tu-06-2021-TT-BTC- huong-dan-Luat-Quan-ly-thue-quan-ly-thue-doi-voi-hang-hoa-xuat-nhap-khau-714ED.html#dieu_4_1), for paper forms, it is notified using Form No. 05/TXNK Annex I issued together with [Circular 06/2021/TT-BTC](https://lawnet.vn/vb/Thong-tu-06-2021-TT-BTC-huong-dan-Luat-Quan-ly- thue-quan-ly-thue-doi-voi-hang-hoa-xuat-nhap-khau-714ED.html#chuong_pl_6).

- Tax Exemption Procedures:

+ For the initial customs declaration of exported/imports that do not generate the tax amount proposed for refund and the taxpayer submits the tax exemption dossier at the customs clearance time:

The customs authority where the taxpayer proposes for the tax amount exemption shall examine the dossier, inspect the actual goods (except for prioritized enterprises), and if there is sufficient basis to determine that the re-imports are the previously exports and the re-exports are the previously imports, it issues the Decision on import tax exemption for re-imports and export tax exemption for re-exports within the customs clearance time. The customs clearance time follows the provisions of Article 23 of [Customs Law 2014](https://lawnet.vn/vb/Luat-Hai-quan- 2014-3A42D.html#dieu_23).

+ In the case that the initial customs declaration of exported/imports generates the tax amount proposed for refund:

++ For re-imported/re-exports that do not match the initial export/import gate:

The customs authority where the re-import/export declaration is registered shall issue the Decision on exemption for the re-imported or re-exports after the customs authority where the proposed tax amount arises determines that there are sufficient conditions for refund for the initially exported or imports. The paid tax amount for re-imported or re-exports is processed according to the overpaid tax regulations stated in Article 10 of [Circular 06/2021/TT-BTC](https://lawnet.vn/vb/Thong-tu-06-2021-TT-BTC-huong-dan- Luat-Quan-ly- thue-quan-ly-thue-doi-voi-hang-hoa-xuat-nhap-khau-714ED.html#dieu_10).

++ For re-imported/re-exports at the same gate as the initial export/import:

The customs authority handling the re-import/export procedures shall process tax exemption for re-imported, re-exports after completing the tax refund procedures for the initial export/import.

+ For the initial customs declaration of exported/imports that do not generate the tax amount proposed for refund but the taxpayer has paid the tax for re-import/export declarations and submits the tax exemption dossier after customs clearance:

++ The taxpayer submits the tax exemption dossier as stipulated in point a clause 1 Article 13 of Circular 06/2021/TT-BTC.

++ The customs authority shall receive and process the tax exemption dossier for re-imported/exports as per points a and b clause 2 Article 13 of [Circular 06/2021/TT-BTC](https://lawnet.vn/vb/Thong-tu-06-2021-TT- BTC-huong-dan-Luat- Quan-ly-thue-quan-ly-thue-doi-voi-hang-hoa-xuat-nhap-khau-714ED.html#dieu_13).

++ The paid tax amount for re-imported or re-exports is processed according to the overpaid tax regulations stated in Article 10 of [Circular 06/2021/TT-BTC](https://lawnet.vn/vb/Thong-tu-06-2021-TT-BTC- huong-dan- Luat-Quan-ly- thue-quan-ly-thue-doi-voi-hang-hoa-xuat-nhap-khau-714ED.html#dieu_10).

- Authority to Issue Tax Exemption Decisions

The Head of the Customs Sub-department where the export/import declaration generating the tax amount proposed for exemption is registered, has the authority to issue tax exemption decisions.

What is the procedure for exemption from import and export duties in Vietnam? (Image from Internet)

What are cases of collection of import and export duties in Vietnam?

Based on Article 37 of [Decree 134/2016/ND-CP](https://lawnet.vn/vb/Nghi-dinh-134-2016-ND-CP-huong-dan-Luat- thue-xuat-khau-thue- nhap-khau-4F012.html#dieu_37), supplemented by clause 19 of Article 1 of [Decree 18/2021/ND-CP](https://lawnet.vn/vb/Nghi-dinh-18-2021-ND-CP-sua-doi-Nghi-dinh-134-2016- ND-CP-huong-dan-Luat- Thue-xuat-nhap-khau- 5E511.html#dieu_1), the circumstances under which import and export duties is not collected are as follows:

- Tax is not collected for goods eligible for a tax refund but tax has not been paid according to the provisions of Articles 33, 34, 35, 36, and 37 of [Decree 134/2016/ND-CP](https://lawnet.vn/vb/Nghi-dinh-134-2016- ND-CP- huong-dan-Luat- thue-xuat-khau- thue-nhap-khau-4F012.html#dieu_33).

- Tax is not collected for goods not subject to import/export tax as stipulated in Articles 33 and 34 of [Decree 134/2016/ND-CP]( https://lawnet.vn/vb/Nghi-dinh-134-2016- ND-CP-huong-dan-Luat-thue-xuat-khau-thue-nhap-khau-4F012.html#dieu_33).

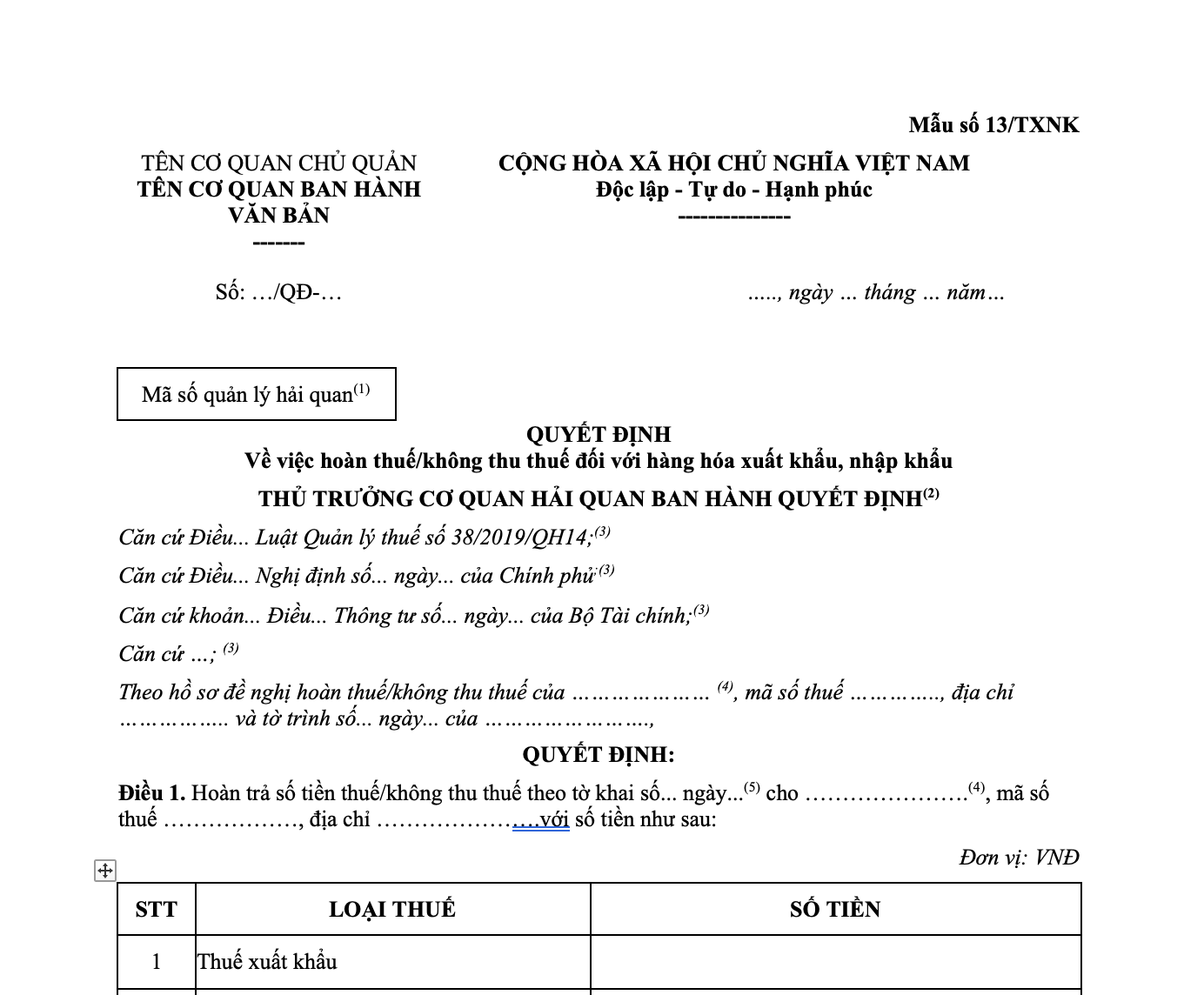

What is the current tax exemption decision form for exported and imports in Vietnam?

The current tax exemption decision form for exported and imports is Form 13/TXNK in Annex 1 issued together with [Circular 06/2021/TT-BTC](https://lawnet.vn/vb/Thong-tu-06-2021-TT-BTC- huong-dan-Luat-Quan-ly-thue- quan-ly-thue-doi-voi-hang-hoa-xuat-nhap-khau-714ED.html#chuong_pl_14).

Download the tax exemption decision form for exported and imports: Here