What is the price of Pi Network on the today? Is trading Pi Network subject to personal income tax in Vietnam?

What is the price of Pi Network on the today?

At 3:00 PM on February 20, 2025 (Vietnam time), Pi Network officially transitioned to the Open Network phase of its Mainnet. This allowed Pi Network to connect with external blockchain systems, expanding the transaction and application capabilities of the Pi currency.

The Pi Network (PI) has been officially listed on several large cryptocurrency exchanges such as OKX, Bitget, Gate.io, and BitMart. However, there is a significant price variation of PI across different exchanges.

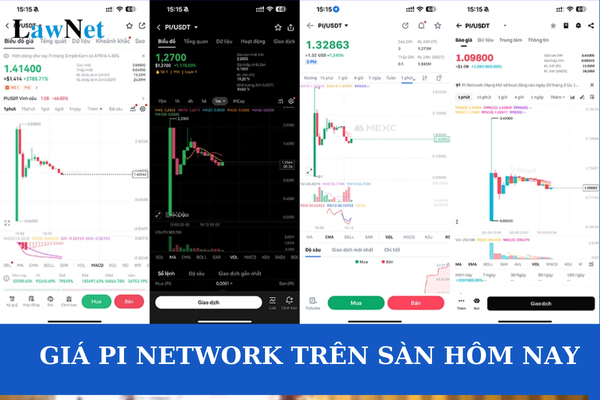

The price of Pi Network on the market today is as follows:

- OKX: The starting price of PI on the OKX platform was 0.1 USD. Then the price rose to over 2 USD, before falling to approximately 1.3 USD at 3:30 PM on February 20, 2025.

- Bitget: At 3:15 PM on the same day, the price of PI on the Bitget platform was 1.09 USD.

- Gate.io: At the same time of 3:15 PM, the price of PI on the Gate.io platform was 1.41 USD.

Before its official listing, PI was traded on the "black market" at prices ranging from 30,000 to 50,000 VND per PI.

Note that the cryptocurrency market is always highly volatile and contains many risks. Before investing, you should thoroughly research and carefully consider your options.

What is the price of Pi Network on the today? Is trading Pi Network subject to personal income tax in Vietnam? (Image from the Internet)

Is trading Pi Network subject to personal income tax in Vietnam?

Based on Clause 1, Article 3 of the Law on Personal Income Tax 2007, as amended by Clause 1, Article 2 of the Law Amending Various Laws on Tax 2014, the provisions are as follows:

Taxable Income

Taxable personal income includes the following types of income, except for income exempt from tax as specified in Article 4 of this Law:

- Income from business, including:

a) Income from production and business activities of goods and services;

b) Income from independent professional activities of individuals having practice licenses or practice certificates as prescribed by law.

Income from business as specified in this clause does not include income of business individuals with revenue of 100 million VND/year or less.

...

Additionally, based on Official Dispatch 5747/NHNN-PC 2017 from the State Bank of Vietnam provides guidance as follows:

Based on the aforementioned regulations, virtual currency in general, and Bitcoin and Litecoin in particular, are not considered currency and are not recognized as legal means of payment under the laws of Vietnam. The issuance, provision, and use of virtual currency in general, and Bitcoin and Litecoin in particular (illegal payment methods) as currency or means of payment, is behavior that is prohibited. The sanctions for this behavior have been specified in Decree 96/2014/ND-CP of the Government of Vietnam on administrative penalties in the field of currency and banking, and the Criminal Code 2015 (amended and supplemented). Moreover, the State Bank of Vietnam has repeatedly warned that investing in virtual currency carries very significant risks for investors.

Simultaneously, based on Clause 6, Article 26 of Decree 88/2019/ND-CP, as revised by Point d, Clause 15, Article 1 of Decree 143/2021/ND-CP, stipulates violations relating to payment activities as follows:

Violations Regarding Payment Activities

...

- A fine from 50,000,000 VND to 100,000,000 VND applies to one of the following violations:

...

d) Issuing, providing, or using illegal payment means below criminal liability threshold;

...

Thus, it can be seen that Pi Network is not considered currency or a legal means of payment under the laws of Vietnam; therefore, trading Pi Network is illegal. Consequently, income from trading Pi Network is not subject to personal income tax (PIT).

Additionally, if involved in trading Pi Network but not to the extent of criminal liability, a fine from 50,000,000 VND to 100,000,000 VND may be imposed.

Note: The above fine is the penalty for individuals; the penalty for organizations is twice the penalty for individuals (Point b, Clause 3, Article 3 of Decree 88/2019/ND-CP).

What income is exempt from personal income tax in Vietnam?

Based on Article 4 of the Law on Personal Income Tax 2007, supplemented by Clause 3, Article 2 of the Law Amending Various Laws on Tax 2014 and revised by Clause 2, Article 1 of the Law on Amendments to the Personal Income Tax Law 2012, stipulating which personal income types are exempt from personal income tax as follows:

- Income from the transfer of real estate between spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; grandparents and grandchildren; and between siblings.

- Income from the transfer of housing, land use rights and assets attached to land use rights of an individual in cases where the individual only has one house, land use right.

- Income from the value of land use rights of individuals allocated land by the state.

- Income from inheritances or gifts which are real estate between spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; grandparents and grandchildren; and between siblings.

- Income from households or individuals directly involved in agricultural, forestry, salt production, aquaculture activities without processing into other products or only undergoing primary processing.

- Income from converting agricultural land of households or individuals allocated for production by the state.

- Income from interest on deposits at credit institutions or interest from life insurance contracts.

- Income from remittances.

- Overtime wages and night shift wages higher than those for daytime or regular hours as prescribed by law.

- Retirement pensions paid by the Social Insurance Fund; regular voluntary pension paid monthly.

- Income from scholarships, including:

+ Scholarships received from the state budget;

+ Scholarships received from domestic and foreign organizations under their scholarship support programs.

- Income from life insurance and non-life insurance contract indemnities, work injury compensation, and other compensation as prescribed by law.

- Income received from charitable funds authorized or recognized by competent state agencies, operating for charitable, humanitarian purposes, not for profit.

- Income received from foreign aid for charitable, humanitarian purposes in governmental and non-governmental forms approved by competent state agencies.

- Income from wages, salaries of Vietnamese sailors working for foreign shipping companies or Vietnamese shipping companies engaging in international transport.

- Income of individuals owning, renting boats and working on boats from providing materials, services directly for off-shore fishing activities.