What is the price for calculating resource royalty for natural bird's nests in Quang Nam province for the year 2025?

What is the price for calculating resource royalty for natural bird's nests in Quang Nam province for the year 2025?

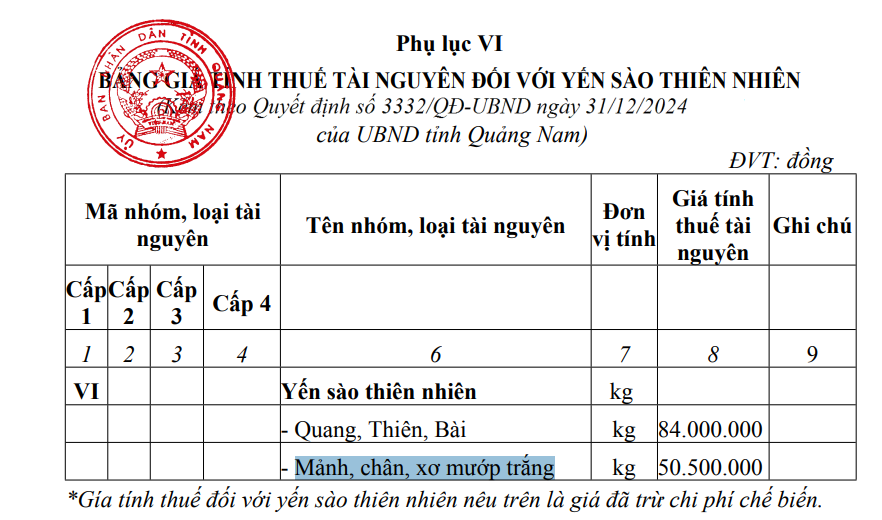

Based on Appendix VI issued with Decision 3332/QD-UBND in 2024 of Quang Nam province, which regulates the issuance of the list of price for calculating resource royaltys for 2025 in the province of Quang Nam, the price for calculating resource royalty for natural bird's nests is as follows:

Thus, the price for calculating resource royalty for natural bird's nests is 84,000,000 VND/kg for Quang, Thien, Bai, and 50,500,000 VND/kg for Manh, Chan, and white loofah parts.

Note: The above price for calculating resource royalty for natural bird’s nests is the price excluding processing costs.

Download the 2025 price for calculating resource royalty list in Quang Nam province

Download the price for calculating resource royalty list for natural bird's nests: Appendix VI

What is the price for calculating resource royalty for natural bird's nests in Quang Nam province for the year 2025? (Image from the Internet)

When shall organizations and individuals be exempted or reduced from resource royalty in Vietnam?

Pursuant to Articles 10 and 11 of Circular 152/2015/TT-BTC which stipulates cases for exemption and reduction of resource royalty as follows:

(1) Cases eligible for resource royalty exemption include:

- resource royalty exemption for organizations and individuals exploiting natural aquatic resources.

- resource royalty exemption for organizations and individuals exploiting branches, tops, firewood, bamboo, truc, nua, mai, giang, thatch, pole bamboo, and lolo which individuals are allowed to exploit for living purposes.

- resource royalty exemption for organizations and individuals exploiting natural water used for hydropower production serving the living activities of households and individuals.

- resource royalty exemption for natural water exploited by households and individuals for living purposes.

- resource royalty exemption for land assigned or leased to organizations and individuals for exploitation and use on the assigned or leased land area; land extracted for leveling and building security, military, dike works.

Land exploited and used on site is tax exempt, including sand, stone, gravel mixed in the land where specific components cannot be identified and are used in their raw form for leveling and construction works; in cases of transportation elsewhere for use or sale, resource royalty must be paid according to regulations.

- Other cases eligible for resource royalty exemption, the Ministry of Finance presides and cooperates with relevant ministries and sectors to report to the Government of Vietnam for submission to the Standing Committee of the National Assembly for consideration and decision.

(2) Cases eligible for resource royalty reduction include:

- resource royaltypayers suffering from natural disasters, fires, or unexpected accidents causing losses to already declared resources and submitted taxes will be considered for tax exemption or reduction for the lost resources; in cases where taxes have already been paid, the paid taxes will be refunded or deducted from the following period's payable resource royalty.

- Other cases eligible for resource royalty reduction, the Ministry of Finance presides and cooperates with relevant ministries and sectors to report to the Government of Vietnam for submission to the Standing Committee of the National Assembly for consideration and decision.

How to determine the taxable resource output in Vietnam?

According to Article 5 of the Law on resource royalty 2009, the taxable resource output is determined as follows:

- For exploitable resources with determined quantity, weight, or volume, the taxable resource output is the actual quantity, weight, or volume of the resources extracted in the tax period.

- For resources extracted without determined quantity, weight, or volume due to the presence of different components and impurities, the taxable resource output is determined by the quantity, weight, or volume of each component obtained after screening and classification.

- For resources extracted but not sold and used to produce other products without direct determination of actual extraction quantity, weight, or volume, the taxable resource output is determined based on the production output of products during the taxable period and the standard resource use per product unit.

- For natural water used for hydropower production, the taxable resource output is the electricity output of the hydropower production facility sold to the electricity buyer under the electricity purchase agreement or the delivered electricity output in the absence of a purchase agreement, determined according to the measuring system meeting Vietnamese quality measurement standards, with verification from the buyer, seller, or the delivering and receiving parties.

- For natural mineral water, natural hot water, and natural water used for industrial purposes, the taxable resource output is determined in cubic meters (m³) or liters (l) according to the measurement system meeting Vietnamese quality measurement standards.

- For resources exploited manually, dispersedly, or in a mobile, irregular manner, and expected annual extraction value under 200,000,000 VND, the extracted resource output may be allocated seasonally or periodically to calculate tax. The tax authority cooperates with relevant local agencies to determine allocated exploitable resource output for tax calculation.