What is the policy on extension of payment deadline of taxes and land rents in Vietnam in 2024?

What is the policy on extension of payment deadline of taxes and land rents in Vietnam in 2024?

On June 17, 2024, the Government of Vietnam issued Decree 64/2024/ND-CP regarding the extension of the deadline for payment of value-added tax (VAT), corporate income tax, personal income tax, and land rent for 2024.

Article 4 of Decree 64/2024/ND-CP outlines the specifics of the extension of payment deadline of taxes and land rents s for 2024 as follows:

(1) For Value-Added Tax (excluding VAT at the import stage)

- Extension of the tax payment deadline for the VAT amount arising (including tax allocated to other provincial jurisdictions where the taxpayer's headquarters are located, and tax payable on each occurrence) of the tax periods from May to September 2024 (for monthly VAT declaration) and the tax periods of the second quarter of 2024 and the third quarter of 2024 (for quarterly VAT declaration) of enterprises and organizations mentioned in Article 3 of Decree 64/2024/ND-CP.

The extension is 5 months for the VAT payable in May 2024, June 2024, and the second quarter of 2024; 4 months for the VAT payable in July 2024; 3 months for the VAT payable in August 2024; and 2 months for the VAT payable in September 2024 and the third quarter of 2024. This extension period is counted from the end date of the VAT payment deadline as prescribed by the tax management laws.

Enterprises and organizations qualifying for the extension shall declare and submit the monthly and quarterly VAT declarations as per current legal regulations but are not required to pay the VAT amount that arises as declared. The VAT payment deadlines for the extended periods are as follows:

The VAT payment deadline for the May 2024 tax period is no later than November 20, 2024.

The VAT payment deadline for the June 2024 tax period is no later than December 20, 2024.

The VAT payment deadline for the July 2024 tax period is no later than December 20, 2024.

The VAT payment deadline for the August 2024 tax period is no later than December 20, 2024.

The VAT payment deadline for the September 2024 tax period is no later than December 20, 2024.

The VAT payment deadline for the second quarter of 2024 tax period is no later than December 31, 2024.

The VAT payment deadline for the third quarter of 2024 tax period is no later than December 31, 2024.

- In cases where enterprises and organizations as mentioned in Article 3 of Decree 64/2024/ND-CP have branches or affiliated units that declare VAT separately with the local tax authorities, such branches or units are also eligible for the VAT payment extension.

In cases where the branches or affiliated units of the enterprises or organizations mentioned in Clauses 1, 2, and 3 of Article 3 of Decree 64/2024/ND-CP do not carry out production or business activities in the sectors eligible for the extension, the branches or affiliated units are not entitled to the VAT payment extension.

(2) For Corporate Income Tax

- Extension of the tax payment deadline for the corporate income tax amount of the second quarter of 2024 arising from the quarterly estimated tax payments of enterprises and organizations, as specified in Article 3 of Decree 64/2024/ND-CP. The extension period is 3 months, starting from the end date of the corporate income tax payment deadline as stipulated by the tax management laws.

- In cases where enterprises and organizations as mentioned in Article 3 of Decree 64/2024/ND-CP have branches or affiliated units that declare corporate income tax separately with the local tax authorities, such branches or units are also eligible for the corporate income tax payment extension.

In cases where the branches or affiliated units of the enterprises or organizations mentioned in Clauses 1, 2, and 3 of Article 3 of Decree 64/2024/ND-CP do not carry out production or business activities in the sectors eligible for the extension, the branches or affiliated units are not entitled to the corporate income tax payment extension.

(3) For VAT and Personal Income Tax of Household Businesses and Individual Businesses

The extension of the payment deadline for VAT and personal income tax applies to the tax amounts arising in 2024 for household businesses and individual businesses operating in the sectors mentioned in Clauses 1, 2, and 3 of Article 3 of Decree 64/2024/ND-CP. Household businesses and individual businesses are required to settle the tax amount extended in (3) no later than December 30, 2024.

Note: In cases where enterprises, organizations, household businesses, and individual businesses engage in multiple economic sectors, including sectors eligible for the extension as specified in Clauses 1, 2, and 3 of Article 3 of Decree 64/2024/ND-CP, the following apply: enterprises and organizations are granted extensions for the entire amount of VAT and corporate income tax payable; household businesses and individual businesses are granted extensions for the entire VAT and personal income tax payable as guided in Decree 64/2024/ND-CP.

(4) For Land Rent

Extension of the payment deadline for 50% of the land rent arising in 2024 (the second installment of 2024) for enterprises, organizations, households, and individuals meeting the criteria specified in Article 3 of Decree 64/2024/ND-CP who are directly leasing land from the State under decisions or contracts of competent State agencies in the form of annual land rental payments. The extension period is 2 months starting from October 31, 2024.

This provision applies to cases where enterprises, organizations, households, and individuals have multiple land lease decisions or contracts with the State and have multiple production and business activities, including sectors eligible for the extension as specified in Clauses 1, 2, and 3 of Article 3 of Decree 64/2024/ND-CP.

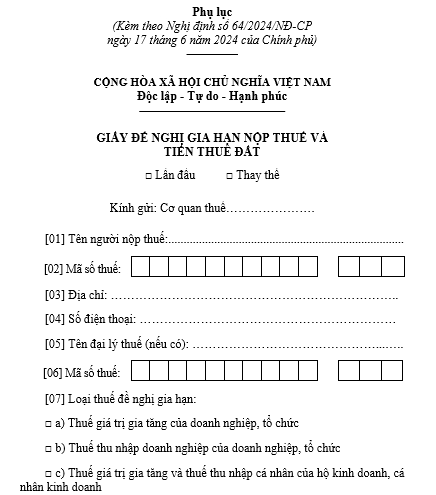

Download the application form for extension of payment deadline of taxes and land rents in Vietnam?

The Template for the application for extension of payment deadline of taxes and land rents for 2024 is found in the Appendix issued with Decree 64/2024/ND-CP:

>> Download Template for the application for extension of payment deadline of taxes and land rents for 2024: Download

Submitting the application for deadline extension to the tax authorities after which date will not be granted the tax extension under Decree 64?

According to Clause 2, Article 5 of Decree 64/2024/ND-CP, the taxpayer must identify and be responsible for the application for extension ensuring the right subject is granted the extension.

If the taxpayer submits the application for Extension form to the tax authorities after September 30, 2024, the extension of payment deadline of taxes and land rents as prescribed in Decree 64/2024/ND-CP will not be granted.

In cases where the taxpayer supplements the tax return of the extended tax period, causing an increase in the payable amount, and submits it to the tax authorities before the end of the extended tax payment deadline, the extended amount includes the increased amount due to the supplementary filing. If the taxpayer supplements the tax return of the extended tax period after the extended tax payment deadline, the increased amount is not eligible for the extension.