What is the PIT declaration authorization form in Vietnam in 2024?

What is the PIT declaration authorization form in Vietnam in 2024?

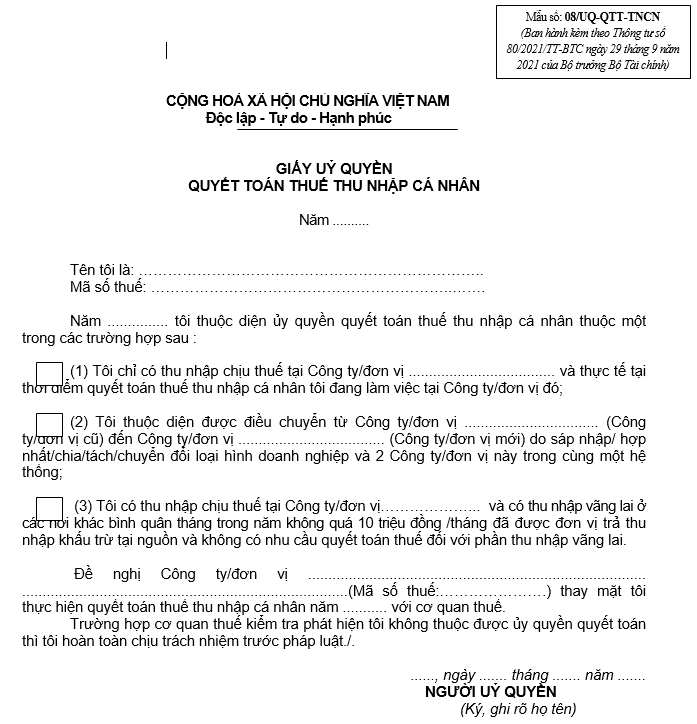

Currently, the PIT declaration authorization form 2024 is form 08/UQ-QTT-TNCN, Appendix II, issued with Circular 80/2021/TT-BTC. The form 08/UQ-QTT-TNCN is as follows:

Download form 08/UQ-QTT-TNCN here

What is the PIT declaration authorization form in Vietnam in 2024? (Image from Internet)

When can an individual be authorized to finalize personal income tax in Vietnam?

Based on points d.2 and d.3 paragraph 6 Article 8 of Decree 126/2020/ND-CP, the cases eligible for authorization of personal income tax finalization are as follows:

- Individuals earning income from salary, wage with a labor contract of three months or more at one place and actually working there at the time the organization or individual paying the income carries out tax finalization, even if they do not work for the full 12 months of the year.

- In cases where an individual is an employee transferred from an old organization to a new organization due to merger, consolidation, division, separation, change of business type, or both the old and new organizations are within the same system, the individual may authorize the new organization to finalize taxes for both the income paid by the old organization and for collecting any personal income tax withholding certificates issued by the old organization (if any).

- Individuals earning income from salary, wage with a labor contract of three months or more at one place, actually working there at the time the organization or individual paying the income issues tax finalization, even if they do not work for the full 12 months of the year; simultaneous income from temporary work at other places not exceeding 10 million VND/month on average per year, and tax has been withheld at 10%, with no request for tax finalization on this income.

- In cases where an individual is a foreigner concluding a labor contract in Vietnam who needs to finalize tax with the tax authority before departure but has not yet done so, they may authorize the income paying organization or another organization or individual to finalize the tax as per regulations concerning tax finalization for individuals. The authorized entity must take responsibility for any additional individual income tax payable or refund any overpaid tax.

If tax finalization has been authorized, does the enterprise need to issue personal income tax withholding certificates in Vietnam?

Based on paragraph 2 Article 25 of Circular 111/2013/TT-BTC, the regulations on tax withholding certificates are as follows:

Tax withholding and tax withholding certificates

...

- Withholding Certificates

a) Organizations or individuals paying income that has been withheld according to guidelines in paragraph 1 of this Article must issue tax withholding certificates upon the request of individuals whose income was withheld. In the case of individuals authorizing tax finalization, withholding certificates are not issued.

b) Issuing withholding certificates in specific cases as follows:

b.1) For individuals not signing a labor contract or signing a labor contract for less than three (03) months: the individual can request the organization or individual paying the income to issue a withholding certificate for each instance of tax withholding or a single certificate for multiple withholdings in a tax period.

Example 15: Mr. Q signs a service contract with enterprise X to care for plants in the enterprise's premises once monthly from September 2013 to April 2014. Mr. Q's income is paid monthly by the enterprise at 3 million VND. In this case, Mr. Q may request the enterprise issue a withholding certificate monthly or one certificate reflecting tax withheld from September to December 2013 and another for the period from January to April 2014.

b.2) For individuals signing a labor contract of three (03) months or more: the organization or individual paying the income only issues one withholding certificate to the individual during a tax period.

Example 16: Mr. R signs a long-term labor contract (from September 2013 to the end of August 2014) with enterprise Y. In this case, if Mr. R is required to finalize taxes directly with the tax authority and requests a withholding certificate, the enterprise will issue one certificate reflecting tax withheld from September to the end of December 2013 and another for the period from January to the end of August 2014.

Thus, in case the employee has authorized personal income tax finalization, the enterprise is not required to issue tax withholding certificates.