What is the personal income tax declaration form for Quarter 4, 2024? What's the deadline for submitting the Quarter 4, 2024 personal income tax declaration in Vietnam?

Vietnam: What is the personal income tax declaration form for Quarter 4, 2024?

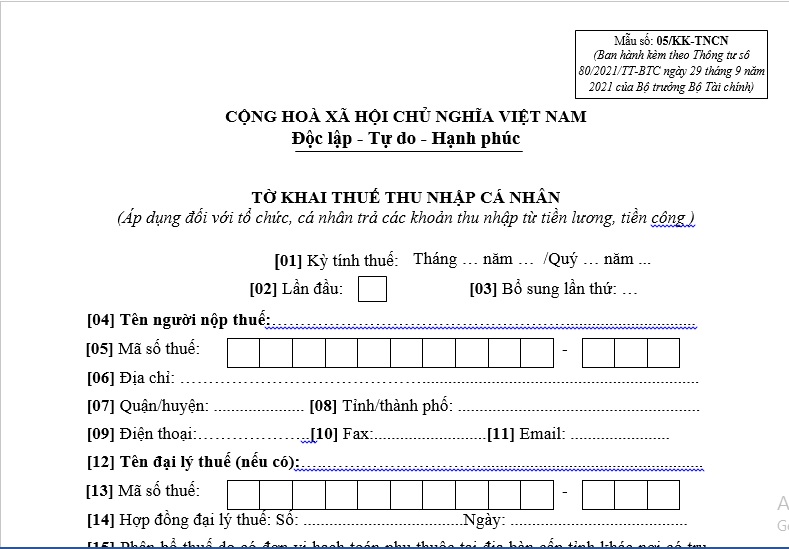

The personal income tax declaration form for Quarter 4 is form 05/KK-TNCN issued together with Circular 80/2021/TT-BTC, formatted as follows:

The personal income tax declaration form for Quarter 4, 2024...Download

What is the deadline for submitting the personal income tax declaration for Quarter 4, 2024 in Vietnam?

According to the provisions at point b, clause 1, Article 44 of the Law on Tax Administration 2019 regarding the timeline for tax declaration submission as follows:

Tax Declaration Submission Deadline

- The timeline for submitting tax declarations for taxes declared monthly or quarterly are as follows:

a) No later than the 20th day of the month following the tax obligation accrual month for monthly declarations and submissions;

b) No later than the last day of the first month of the quarter following the tax obligation accrual quarter for quarterly declarations and submissions.

...

Therefore, the deadline for submitting taxes for Quarter 4, 2024 will be no later than the last day of the first month of Quarter 1, 2025, which is January 31, 2025 (third day of Tet).

Based on Article 86 of Circular 80/2021/TT-BTC the provisions are as follows:

Tax Declaration and Tax Payment Submission Deadlines

The timeframe for submitting tax declarations follows provisions in clauses 1, 2, 3, 4, 5, Article 44 of the Law on Tax Administration and Article 10 of Decree 126/2020/ND-CP. The tax payment deadline is implemented according to clauses 1, 2, 3 of Article 55 of the Law on Tax Administration and Article 18 of Decree 126/2020/ND-CP. If the deadline coincides with recognized holidays, it is deferred to the next working day per the Civil Code.

Under these regulations, if the tax declaration submission and payment coincide with public holidays, they will be deferred to the next working day following these lunar New Year holidays.

Thus, the deadline for submitting the personal income tax declaration for Quarter 4, 2024 will be moved to the next working day following the Lunar New Year holidays in 2025, which is February 3, 2025.

Note: Electronic tax filing and payment can be done 24 hours a day and 7 days a week, including holidays, as stated in Article 8 of Circular 19/2021/TT-BTC

What is the personal income tax declaration form for Quarter 4, 2024? What's the deadline for submitting the Quarter 4, 2024 personal income tax declaration in Vietnam? (Image from the Internet)

When is the deadline for submitting the Quarter 4, 2024 personal income tax declaration extended?

According to clause 1, Article 46 of the Law on Tax Administration 2019, taxpayers may receive an extension for tax submission if unable to submit tax declarations by the deadline due to natural disasters, calamities, epidemic diseases, fires, or unexpected accidents. The head of the directly managing tax authority grants the extension.

Moreover, the extension period for tax submission is defined as follows:

- Not exceeding 30 days for monthly, quarterly, annual tax declarations, or declarations for each arising tax obligation, starting from the end of the deadline.

- Not exceeding 60 days for tax settlement declarations starting from the end of the prescribed deadline.

Note: Taxpayers must submit a written request for extension to the tax authority before the end of the deadline, specifying reasons, with confirmation from the commune-level People's Committee or Police at the place where the extension case occurs.

What are the administrative fines for late submission of the Quarter 4, 2024 tax declaration in Vietnam?

Based on Article 13 of Decree 125/2020/ND-CP, penalties for late tax declaration submission are as follows:

- A warning for declarations submitted 1 to 5 days late with mitigating circumstances.

- Fines ranging from 2,000,000 to 5,000,000 VND for declarations submitted 1 to 30 days late.

- Fines ranging from 5,000,000 to 8,000,000 VND for submissions 31 to 60 days late.

- Fines ranging from 8,000,000 to 15,000,000 VND for the following:

+ Late submission from 61 to 90 days;

+ Late submission over 91 days without tax payable;

+ Failure to submit tax declaration without tax payable;

+ Failure to provide annexes according to tax management regulations for related-party transactions with corporate income tax finalization documentation.

- Fines ranging from 15,000,000 to 25,000,000 VND for declarations over 90 days late with tax payable, provided the taxpayer has paid the full tax amount and late fees before the tax authority announces an audit or investigation decision, or before the authority issues a record of late submission according to clause 11, Article 143 of the Law on Tax Administration 2019.

If the fine according to this clause exceeds the tax amount on the declaration, the maximum fine equals the tax payable on the declaration, but not less than the median fine in clause 4, Article 13 of Decree 125/2020/ND-CP.

Note: The above fines apply to organizations. Fines for individuals with the same violations are 1/2 of those for organizations per clause 5, Article 5 of Decree 125/2020/ND-CP.