What is the personal income tax declaration form for January 2025 in Vietnam? What are cases where individuals are eligible for personal income tax refunds in Vietnam?

What is the personal income tax declaration form for January 2025 in Vietnam?

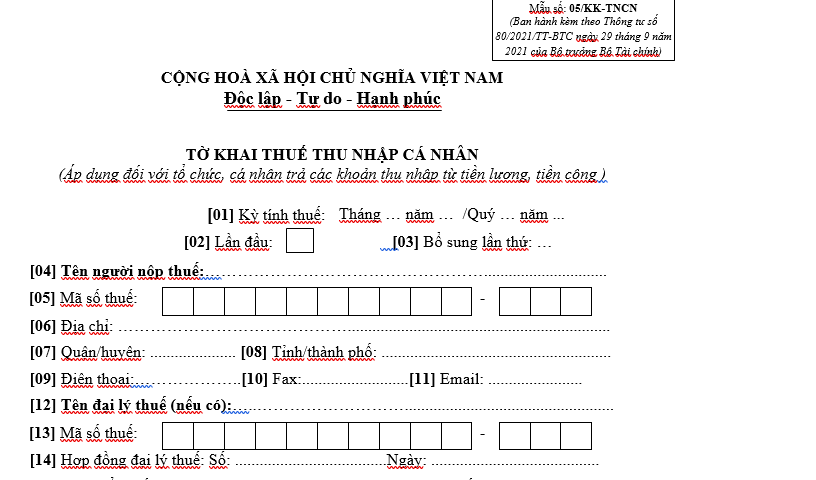

The Personal Income Tax Declaration Form for January 2025 is Form No. 05/KK-TNCN issued with Circular 80/2021/TT-BTC applicable to organizations and individuals paying salary or wage income.

The Form No. 05/KK-TNCN Personal Income Tax declaration is as follows:

Download Form No. 05/KK-TNCN Personal Income Tax declaration

Note:

- This declaration only applies to organizations or individuals paying income from salary or wages to individuals in a month/quarter, regardless of whether tax withholding arises or not.

- The monthly tax declaration period applies to organizations or individuals paying income with total revenue from the sale of goods and provision of services in the previous year exceeding 50 billion VND or when organizations or individuals paying income choose to declare taxes monthly.

- The quarterly tax declaration period applies to organizations or individuals paying income with total revenue from the sale of goods and provision of services in the previous year up to and including 50 billion VND, including organizations or individuals paying income without sales revenue from goods and services.

What is the personal income tax declaration form for January 2025 in Vietnam? What are cases where individuals are eligible for personal income tax refunds in Vietnam? (Image from the Internet)

What are instructions on how to fill out the personal income tax declaration form for January 2025 in Vietnam?

Below are the instructions on how to fill out the Personal Income Tax Declaration Form for January 2025 Form No. 05/KK-TNCN:

1. General Information Section:

[01] Tax period: Enter according to the month, year, or quarter, year of the tax declaration period. In case of monthly tax declaration, cross out quarterly; for quarterly tax declaration, cross out monthly. (The tax period is either a monthly or quarterly period. Check for overlap in the monthly/quarterly declaration.)

[02] First time: If declaring taxes for the first time, mark "x" in the square box.

[03] Supplementary time: If declaring after the first time, it is considered supplementary declaration and enter the number of supplementary declarations in the square box.

[04] Name of taxpayer: Clearly and fully enter the name of the organization or individual paying income according to the Establishment Decision or Business Registration Certificate or taxpayer registration Certificate.

[05] Tax code: Clearly and fully enter the tax code of the organization or individual paying income according to the taxpayer registration Certificate or Tax Code Notification or Tax Code Card issued by the tax authority.

[06], [07], [08] Address: Clearly and fully enter the address of the headquarters of the organization or individual paying income according to the Business Registration Certificate, or registered permanent address (for individuals) with the tax authority.

[09], [10], [11] Telephone, fax, email: Clearly and fully enter the phone number, fax number, and email address of the organization or individual paying income (leave blank if unavailable).

[12] Name of tax agent (if any): If the organization or individual paying income authorizes tax declaration to a Tax Agent, the full name of the Tax Agent must be clearly entered according to the Tax Agent's Establishment Decision or Business Registration Certificate.

[13] Tax code: Clearly and fully enter the tax code of the Tax Agent according to the taxpayer registration Certificate or Tax Code Notification or tax code card issued by the tax authority.

[14] Tax agency contract: Clearly and fully enter the number and date of the tax agency contract between the organization, individual paying income and the Tax Agent (contract being executed).

[15] Allocation of tax due to dependent accounting unit in another province different from where the headquarters is located: If applicable, mark "x" in the square box.

2. Declaration of the Table's Criteria:

[16] Total number of employees: Total number of individuals with income from salary and wages for whom the organization, individual pays income in the period.

[17] Resident individuals with labor contracts: Total number of resident individuals receiving income from salary and wages according to labor contracts of 03 months or more for whom the organization, individual pays income in the period.

[18] Total number of individuals with tax withheld: Indicator [18] = [19] + [20].

[19] Resident individuals: Number of resident individuals with income from salary and wages for whom the organization, individual pays income has withheld tax.

[20] Non-resident individuals: Number of non-resident individuals with income from salary and wages for whom the organization, individual pays income has withheld tax.

[21] Total taxable income (TTT) paid to individuals: Indicator [21] = [22] + [23].

[22] Resident individuals: Taxable income from salary, wages, and other taxable income of a wage nature that the organization, individual pays income has paid to resident individuals in the period.

[23] Non-resident individuals: Taxable income from salary, wages, and other taxable income of a wage nature that the organization, individual pays income has paid to non-resident individuals in the period.

[24] Total taxable income from insurance premiums for life insurance, other non-mandatory insurance by insurer not established in Vietnam for employees: The amount an organization, individual pays income for life insurance, other non-mandatory insurance with accumulation of insurance premiums by an insurer not established in Vietnam for employees.

[25] Total taxable income exempted according to Petroleum Contract regulations: Declare the total taxable income exempted according to Petroleum Contract regulations (if any arise).

[26] Total taxable income paid to individuals subject to tax withholding: Indicator [26] = [27] + [28].

[27] Resident individuals: Taxable income from salary, wages, and other taxable income of a wage nature that the organization, individual paying income has paid to resident individuals subject to tax withholding in the period.

[28] Non-resident individuals: Taxable income from salary, wages, and other taxable income of a wage nature that the organization, individual paying income has paid to non-resident individuals subject to tax withholding in the period.

[29] Total personal income tax withheld: Indicator [29] = [30] + [31].

[30] Resident individuals: Personal income tax that the organization, individual paying income has withheld from resident individuals in the period.

[31] Non-resident individuals: Personal income tax that the organization, individual paying income has withheld from non-resident individuals in the period.

[32] Total personal income tax withheld on insurance premiums for life insurance, other non-mandatory insurance by insurer not established in Vietnam for employees: Total personal income tax that the organization, individual paying income has withheld on insurance premiums for life insurance, other non-mandatory insurance with accumulation of insurance premiums by an insurer not established in Vietnam for employees. Indicator [32] = [24] x 10%.

What are cases where individuals are eligible for personal income tax refunds in Vietnam?

Based on Clause 2, Article 8 of the Personal Income Tax Law 2007 regulating cases eligible for a personal income tax refund as follows:

Tax administration and tax refund

- Taxpayer registration, tax declaration, tax withholding, tax payment, tax finalization, tax refund, handling of legal violations on tax, and other tax administration measures are carried out in accordance with tax administration laws.

- Individuals are eligible for a tax refund in the following cases:

a) The amount of tax paid is greater than the tax payable;

b) Individuals have paid taxes but have taxable income below the level required for tax payment;

c) Other cases as decided by competent state authorities.

Thus, individuals are eligible for personal income tax refunds in the following cases:

- The amount of tax paid is greater than the tax payable;

- Individuals have paid taxes but have taxable income below the level required for tax payment;

- Other cases as decided by competent state authorities.