What is the Official Dispatch form on tax exemption for imported goods serving national defense and security in Vietnam?

What is the Official Dispatch form on tax exemption for imported goods serving national defense and security in Vietnam?

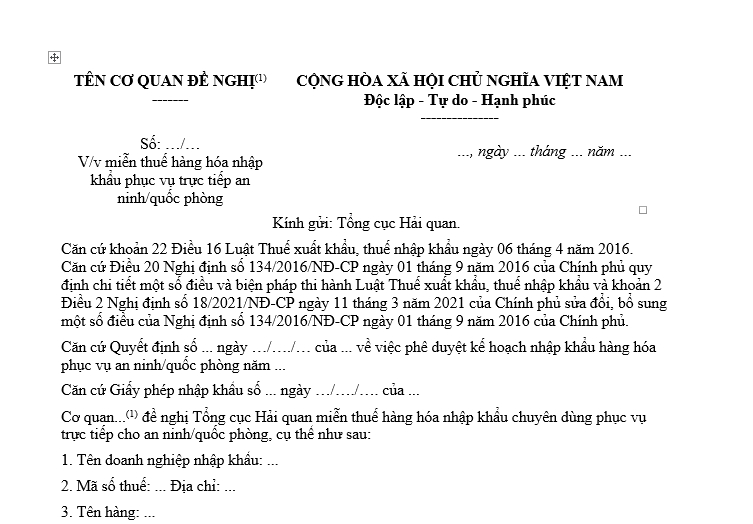

The Official Dispatch form requesting tax exemption for imported goods serving national defense and security is Form No. 03a issued together with Decree 18/2021/ND-CP.

Download the Official Dispatch form requesting tax exemption for imported goods serving national defense and security here: Here

What is the Official Dispatch form on tax exemption for imported goods serving national defense and security in Vietnam? (Image from the Internet)

Bases for tax exemption for imported goods serving national defense and security in Vietnam

Based on Clause 2, Article 20 of Decree 134/2016/ND-CP, the basis to determine tax exemption for imported goods serving national defense and security is as follows:

- Goods included in the annual plan for importing specialized goods directly serving national defense and security, approved by the Prime Minister or by the Minister of Public Security, Minister of National Defense authorized by the Prime Minister.

- Specialized transportation means that are not locally produced, as stipulated by the Ministry of Planning and Investment.

Documentation and procedures for tax exemption for imported goods serving national defense and security in Vietnam

According to Article 20 of Decree 134/2016/ND-CP, as amended and supplemented by Point a, Clause 2, Article 2 and Point d, Clause 20, Article 1 of Decree 18/2021/ND-CP, the documentation and procedures for tax exemption for imported goods serving national defense and security are as follows:

* Documentation:

- Official Dispatch from the Ministry of National Defense, Ministry of Public Security, or an authorized unit under the Ministry of National Defense, Ministry of Public Security according to Form No. 03a in Appendix 7 issued together with Decree 18/2021/ND-CP: 01 original.- Sales contract for goods: 01 copy.- Entrustment import contract or goods supply contract according to the bidding document or contractor appointment document, specifying that the supply price does not include import tax in the case of entrusted import, bidding: 01 copy.

* Tax Exemption Procedures:

The Ministry of National Defense, Ministry of Public Security, or an authorized unit under the Ministry of National Defense, Ministry of Public Security should submit the tax exemption application to the General Department of Customs no later than 05 working days before the customs declaration registration.

Within 03 working days from the date of receiving the application, the General Department of Customs must notify in writing whether the goods are tax-exempt, not eligible for tax exemption, or request additional documents.

The Customs Department at the processing location will base on the tax exemption notice from the General Department of Customs to carry out the customs clearance of goods according to regulations.

What are other cases eligible for export-import tax exemption besides imported goods serving national defense and security in Vietnam?

Based on Article 16 of the Law on Export and Import Taxes 2016, in addition to goods serving directly national defense and security, the following cases will be exempt from export-import tax:

(1). Exported, imported goods of foreign organizations and individuals entitled to privileges, immunities in Vietnam within the limits in accordance with international treaties of which the Socialist Republic of Vietnam is a member; goods in the duty-free baggage standards of passengers exiting, entering; goods imported for sale at duty-free shops.

(2). Personal effects, gifts within the standard limits from foreign organizations and individuals to Vietnamese organizations and individuals or vice versa.Personal effects, gifts exceeding the duty-free limit must pay tax on the excess part, except for cases where the recipient is an agency or organization funded by the state budget and authorized to receive or for humanitarian and charity purposes.

(3). Goods traded, exchanged across borders by border residents within the list and within the limit to serve production and consumption of border residents.If collected and transported goods within the limit but not used for production and consumption of border residents and exported, imported goods of foreign traders permitted to do business at border markets must pay tax.

(4). Goods exempted from export and import taxes under international treaties of which the Socialist Republic of Vietnam is a member.

(5). Goods with a value or tax amount payable below the minimum level.

(6). Materials, supplies, components imported for processing export products; complete products imported to install into processed products; processed products for export.Processed products for export produced from domestic materials are subject to export tax; the export value of domestic materials in processed products is not tax-exempt.

Goods processed for export and then imported are exempt from export and import taxes calculated on the value of exported materials constituting processed products. For goods processed for export and then imported, including resources, minerals, and products with the total value of resources, minerals plus energy costs accounting for 51% of the product cost or more, they are not tax-exempt.

(7). Materials, supplies, components imported to produce export goods.

(8). Goods produced, processed, recycled, assembled in the tax-free zone without using imported materials from abroad when imported into the domestic market.

(9). Goods temporarily imported, re-exported or temporarily exported, re-imported within a specific period, including:- Goods temporarily imported, re-exported, temporarily exported, re-imported to organize or participate in fairs, exhibitions, product displays, sports, cultural, artistic events or other events; machinery, equipment temporarily imported, re-exported for testing, product development research; machinery, equipment, professional tools temporarily imported, re-exported, temporarily exported, re-imported to serve work within a certain period or to perform processing for foreign traders, except for machinery, equipment, tools, vehicles of organizations and individuals allowed to temporarily import, re-export to implement investment projects, construct, install works, serve production;- Machinery, equipment, components, spare parts temporarily imported for replacement, repair of foreign ships, aircraft or temporarily exported for replacement, repair of Vietnamese ships, aircraft abroad; goods temporarily imported, re-exported to supply foreign ships, aircraft anchored at Vietnamese ports;- Goods temporarily imported, re-exported or temporarily exported, re-imported for warranty, repair, replacement;- Rotating means under temporary import, re-export or temporary export, re-import for containing import-export goods;- Temporarily imported, re-exported goods, re-imported within the temporary import, re-export period (including extension time) guaranteed by credit institutions or deposited with an amount equivalent to the import tax of temporarily imported, re-exported goods.

(10). Non-commercial goods in the following cases: samples; pictures, films, models replacing samples; advertising publications in small quantities.

(11). Imported goods to form fixed assets of entities entitled to investment incentives as stipulated by investment law, including:- Machinery, equipment; components, parts, accessories, spare parts for assembling or using with machinery, equipment; materials, supplies used for manufacturing machinery, equipment or for manufacturing components, parts, accessories, spare parts of machinery, equipment;- Specialized transportation means in the technological line used directly for production activities of the project;- Construction materials that are not locally produced.

Import tax exemption for goods specified in this clause applies to both new investment projects and expanded investment projects.

(12). Plant varieties; animal breeds; fertilizers, pesticides not locally produced, necessary to import as regulated by competent state authorities.

(13). Materials, supplies, components not locally produced imported for production projects in special investment incentive sectors or in areas with specially difficult socio-economic conditions, high-tech enterprises, science and technology enterprises, science and technology organizations are exempt from import tax for 05 years from the start of production.

Import tax exemption specified in this clause does not apply to investment projects exploiting minerals; projects producing products with total value of resources, minerals plus energy costs accounting for 51% or more of the product cost; projects producing goods, services subject to special consumption tax.

(14). Materials, supplies, components not locally produced imported for manufacturing, assembling priority medical equipment research and production under regulation.

(15). Imported goods for petroleum activities, including:- Machinery, equipment, spare parts, specialized transportation means essential for petroleum activities, including temporary import, re-export cases;- Components, parts, accessories for assembling or using with machinery, equipment; materials, supplies used for manufacturing machinery, equipment or for manufacturing components, parts, accessories, spare parts of machinery, equipment essential for petroleum activities;- Materials necessary for petroleum activities not locally produced.

(16). Shipbuilding projects, shipbuilding establishments in the list of investment incentive sectors specified by investment law are exempt from tax for:- Imported goods to form fixed assets of shipbuilding establishments, including: machinery, equipment; components, parts, accessories, spare parts for assembling or using with machinery, equipment; materials, supplies used for manufacturing machinery, equipment or for manufacturing components, parts, accessories, spare parts of machinery, equipment; transportation means in the technological line directly serving shipbuilding activities; construction materials not locally produced;- Imported goods are machinery, equipment, materials, supplies, components, semi-finished products not locally produced serving shipbuilding;- Export ships.

(17). Imported machinery, equipment, materials, supplies, components, parts, accessories for printing and minting activities.

(18). Imported goods are materials, supplies, components not locally produced serving directly information technology product manufacturing, digital content, software.

(19). Exported, imported goods to protect the environment, including:- Imported machinery, equipment, transportation means, tools, materials specialized and not locally produced for collecting, transporting, processing, treating, collecting water waste, waste gas, analyzing and monitoring environment, renewable energy production; environmental pollution treatment, environmental incident response, handling;- Export products produced from recycling, waste treatment activities.

(20). Imported goods specialized not locally produced serving directly for education.

(21). Imported goods are machinery, equipment, spare parts, materials specialized not locally produced, documents, scientific books specialized directly used for scientific research, technology development, technology incubation activities, science and technology enterprise incubation, technology renovation.

(22). Exported, imported goods to ensure social security, disaster, catastrophe, epidemic recovery and other special cases.