What is the notification form of business suspension No. 23/DK-TCT according to Circular 105 in Vietnam?

What is the notification form of business suspension No. 23/DK-TCT according to Circular 105 in Vietnam?

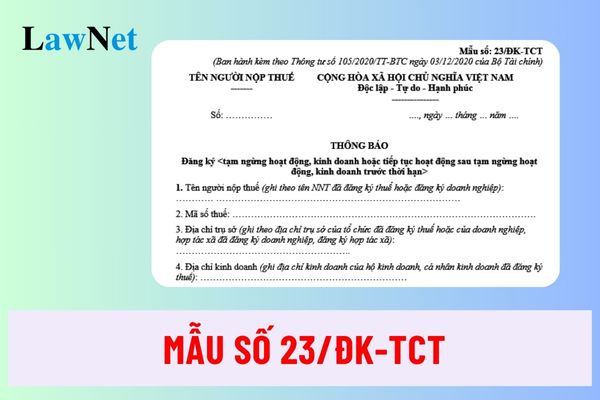

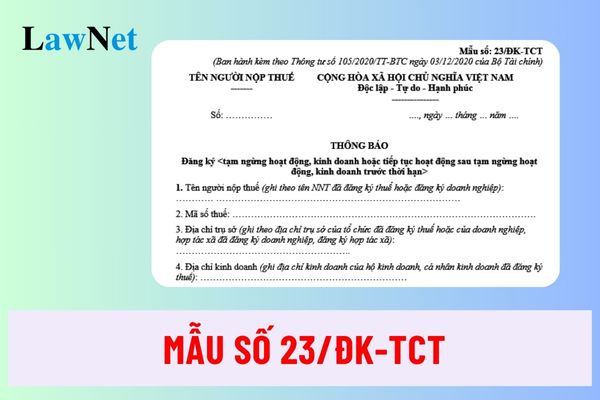

Notification form of business suspension No. 23/DK-TCT issued attached to Circular 105/2020/TT-BTC as follows:

>> Download Notice of Temporary Business Suspension issued attached to Circular 105/2020/TT-BTC

What is the notification form of business suspension No. 23/DK-TCT according to Circular 105 in Vietnam? (Image from the Internet)

What are regulations on taxpayer registration receipt procedures by tax authorities in case of business/operation suspension in Vietnam?

According to sub-section 20, Section 2, Part 2 of Administrative Procedures issued with Decision 2589/QD-BTC in 2021, tax authorities handle the receipt of taxpayer registration dossiers in cases of temporary cessation of business or operations as follows:

- For paper-based taxpayer registration information change applications:

+ In case the application is submitted directly at the tax authority: The tax officer receives and stamps the dossier with the receipt date, clearly noting the date, number of documents according to the list. The tax officer issues an appointment slip notifying the result delivery date and the processing time of the received dossier.

+++ In case the taxpayer registration dossier is sent by post: The tax officer stamps the receipt date on the dossier and records the tax authority’s reference number.

The tax officer checks the taxpayer registration dossier. If the dossier is incomplete and requires additional information or documents, the tax authority will notify the taxpayer using Form No. 01/TB-BSTT-NNT in Appendix 2 issued with Decree 126/2020/ND-CP within 02 (two) working days from the date of receiving the dossier.

- For electronic taxpayer registration dossiers:

The tax authority receives the dossier through the General Department of Taxation's electronic portal and processes it through the electronic data processing system.

+ Receiving dossiers: The General Department of Taxation's electronic portal sends a receipt confirmation to the taxpayer through the chosen electronic portal (e.g., the General Department of Taxation’s portal, the government authority’s portal, or a T-VAN service provider’s portal) within 15 minutes of receiving the electronic taxpayer registration dossier.

+ Checking and processing dossiers: The tax authority checks and processes the taxpayer’s dossier following the legal regulations on taxpayer registration and returns the result via the electronic portal selected by the taxpayer.

++ If the dossier is complete and proper according to regulations and requires a result: The tax authority sends the result to the electronic portal selected by the taxpayer within the timeframe specified in Circular 105/2020/TT-BTC.

++ If the dossier is incomplete or improper according to regulations, the tax authority sends a notice of dossier rejection to the electronic portal selected by the taxpayer within 02 (two) working days from the date stated on the dossier receipt confirmation.

What are criteria for determining the period of business suspension for taxpayers in Vietnam?

According to Clause 1, Article 4 of Decree 126/2020/ND-CP, the criteria for determining the period of temporary business or operation suspension for taxpayers are as follows:

- For taxpayers who register with business registration, cooperative registration, or business operation registration under Clause 1, Article 37 of the Tax Administration Law 2019, the period of business suspension is recorded by the business registration authority, cooperative registration authority on the National Business Registration System.

The business registration authority, cooperative registration authority sends the business suspension registration information to the tax authority electronically through the information exchange system within 01 working day or no later than the next working day from the date of recording on the National Business Registration System.

- For taxpayers approved, notified, or required by a competent State agency to suspend operations or business activities under Clause 1, Article 37 of the Tax Administration Law 2019, the period is stated in the document issued by the competent State agency. The competent State agency sends the document to the direct managing tax authority within 03 working days from the date of issuance.

- For taxpayers who are organizations, business households, or individuals not required to register business under Clause 2, Article 37 of the Tax Administration Law 2019, they must notify the direct managing tax authority at least 01 working day before the business suspension.

The tax authority sends a confirmation notice to the taxpayer about the registration time for temporary business suspension within 02 working days from the receipt of the taxpayer’s notice. The taxpayer is allowed to suspend operations or business for no more than 1 year per registration. In case the taxpayer is an organization, the total suspension period cannot exceed 2 years for 2 consecutive registrations.

- Shall enterprises be entitled for VAT deferral in Vietnam for October 2024 according to Decree 64?

- What are specialized measures during processing of tax refund applications in Vietnam?

- Do tax authorities of Vietnam have the right to publish tax-related regulatory violations on mass media?

- Is the amount received under public service housing policies considered taxable personal income in Vietnam?

- Are invoices issued for internally used goods in Vietnam?

- What principles and basis are used to determine the maximum road user charge in Vietnam?

- Is healthcare service providers for the elderly subject to VAT in Vietnam?

- Is the therapeutic service provides for persons with disabilities subject to VAT in Vietnam?

- What is the currency unit used in tax accounting in Vietnam?

- Which enterprise groups will the General Department of Taxation of Vietnam focus on inspecting and auditing in 2025?