What is the notice form on TIN and supervisory tax authorities of business locations to household businesses in Vietnam?

What is the notice form on TIN and supervisory tax authorities of business locations to household businesses used by the district-level business registration authority in Vietnam?

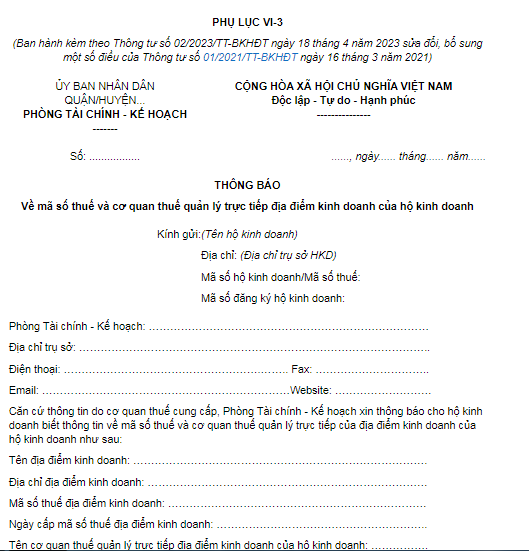

Under Circular 02/2023/TT-BKHDT amending and supplementing certain provisions of Circular 01/2021/TT-BKHDT dated March 16, 2021, of the Minister of Planning and Investment, guiding enterprise registration;

According to Appendix VI-3 List of forms used in household business registration, issued together with Circular 02/2023/TT-BKHDT, the district-level business registration authority will use the following form on TIN and supervisory tax authorities of business locations to household businesses:

Download the notice form on TIN and supervisory tax authorities of business locations to household businesses.

What is the relationship between the district-level business registration authority and the district-level tax authority in Vietnam?

Under the provisions of Article 16 of Decree 01/2021/ND-CP:

Tasks and powers of district-level business registration authorities

1. Directly receive applications for household business registration, examine their validity, issue or reject to issue certificates of household business registration.

2. Provide instructions for household businesses on necessary documents and procedures for household business registration.

3. Cooperate in developing, managing and operating the system of information about household businesses in the district; submit periodic reports on registration of household businesses in the district to the district-level People’s Committee, Business Registration Office, and district-level tax authority.

4. Provide information about household business registration within the district to the district-level People’s Committee, district-level Department of Taxation, and relevant agencies and entities as prescribed by law.

5. Directly carry out inspections or request competent authorities to carry out inspections at household businesses according to their applications for household business registration.

6. Request household businesses to submit reports on their observation of regulations herein where necessary.

7. Request household businesses to stop engaging in conditional business lines if they fail to satisfy all business conditions.

8. Revoke certificates of household business registration in accordance with regulations of law.

9. Grant business registration to other entities as prescribed by law.

Thus, according to the regulations above, the district-level business registration authority and the district-level tax authority will cooperate with each other in developing, managing, and operating the system of information about household businesses in the district.

At the same time, the district-level business registration authority provides information on household business registration within the district to the district-level tax authority upon request.

What is the notice form on TIN and supervisory tax authorities of business locations to household businesses used by the district-level business registration authority in Vietnam? (Image from the Internet)

Is the enterprise identification number in Vietnam TIN of an enterprise?

According to Article 8 of Decree 01/2021/ND-CP on enterprise ID number, ID numbers of affiliates and business locations of enterprises:

Enterprise ID number, ID numbers of affiliates and business locations of enterprises

1. Each enterprise is issued with a single enterprise ID number. This number is also the enterprise’s taxpayer identification number (TIN) and social insurance participant’s code.

2. The enterprise ID number exists throughout its operation and shall not be issued to any other entity. When an enterprise ceases to operate, the enterprise ID number will be invalidated.

3. Enterprise ID numbers are created, sent and received automatically by the National Enterprise Registration Information System, tax registration information system, and written on enterprise registration certificates.

4. Regulatory agencies shall uniformly use enterprise ID numbers to perform state management tasks and exchange information about enterprises.

5. ID numbers of an enterprise’s affiliates are issued to the enterprise’s branches and representative offices. These numbers are also TINs of branches and representative offices.

6. ID number of a business location is a series of 5 digits from 00001 to 99999. This number is not TIN of the business location.

7. In case the TIN of the enterprise, or its branch or representative office is invalidated as a result of its commission of tax offences, this TIN must not be used in business transactions from the day on which the TIN invalidation is announced by the tax authority.

8. With regard to branches and representative offices that are established before November 01, 2015 but have not had their own ID numbers, the enterprise shall directly contact the tax authority to be issued with a 13-digit TIN, and then follow procedures for change of the registration information at the business registration authority as prescribed.

9. Enterprise ID numbers of enterprises that are established and operating under the investment license or investment certificate (also the business registration certificate) or another document of equivalent validity, or securities trading license shall be their TINs issued by tax authorities.

Each enterprise is issued with a single enterprise ID number. This number is also the enterprise’s taxpayer identification number (TIN) and social insurance participant’s code.

Thus, according to the regulations, the enterprise identification number in Vietnam is the TIN of an enterprise.