What is the newest Schedule of Export Tariffs under Nomenclature of Taxable Products in Vietnam

What is the newest Schedule of Export Tariffs under the Nomenclature of Taxable Products in Vietnam?

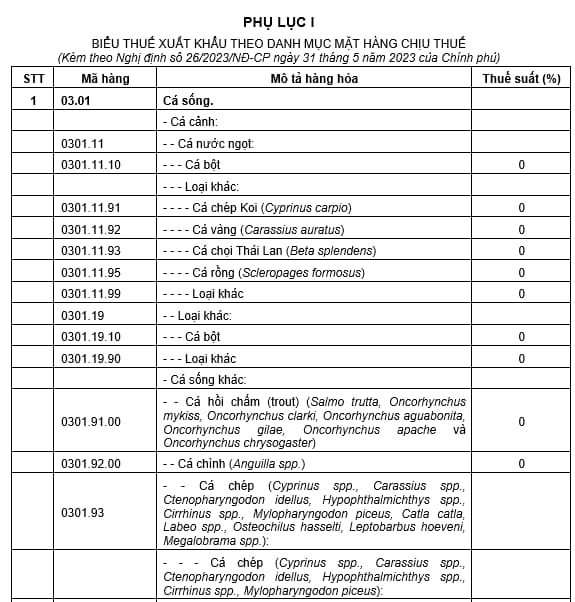

The Schedule of Export Tariffs under Nomenclature of Taxable Products in 2024 is stipulated in Appendix 1 issued together with Decree 26/2023/ND-CP as follows:

>> Download the Schedule of Export Tariffs under Nomenclature of Taxable Products in Vietnam.

What is the Schedule of Export Tariffs under Nomenclature of Taxable Products in Vietnam? (Image from the Internet)

What are the regulations on declaring the HS codes of exported goods not named in the Schedule of Export Tariffs by customs declarants in Vietnam?

According to Clause 1, Article 4 of Decree 26/2023/ND-CP, in case where any exported good is not named in the Schedule of Export Tariffs, the customs declarant shall enter HS code of the exported good corresponding to the 8-digit HS codes of commodities according to the Schedule of Preferential Import Tariffs specified in Section I of Appendix II of Decree 26/2023/ND-CP, and shall not need to enter duty rates in their export declaration.

Section 1, Appendix 2 issued together with Decree 26/2023/ND-CP on preferential import tariff rate on products in 97 chapters of the List of Vietnam’s exports and imports.

Contents include Parts, Chapters; Explanatory Notes; Explanatory Notes for subheadings; for Parts and Chapters; Import Tariff Schedule comprising the description of products, HS codes (8 digits) adopted according to the List of Vietnam’s exports and imports and preferential import duty rates applied to taxable products.

In case where the List of Vietnam’s exports and imports is amended or supplemented, customs declarants must use descriptions and HS codes according to the amended List of exports and imports, as well as duty rates on products with amended HS codes.

What are the requirements for commodities under the heading 211 in the Schedule of Export Tariffs in Vietnam?

According to Clause 2, Article 4 of Decree 26/2023/ND-CP, commodities under the heading 211 are commodities that satisfy both requirements below:

- 1st requirement: Supplies, raw or input materials, semi-finished products (collectively referred to as goods) do not belong to the headings from No. 01 to No. 210 in the Schedule of Export Tariffs.

- 2nd requirement: They are goods which are made directly from raw materials that are mainly natural resources or minerals and of which the aggregate value of such natural resources plus energy costs accounts for at least 51% of their production cost. The determination of the aggregate value of natural resources and minerals plus energy costs accounting for at least 51% of their production cost shall be subject to regulations laid down in the Decree 100/2016/ND-CP dated July 1, 2016, detailing and guiding the implementation of a number of articles of the Law on Amendments and Supplements to several Articles of the Law on Value-Added Tax 2008, Law on Special Consumption Tax 2008, and Law on Tax Administration 2019 and the Decree 146/2017/ND-CP dated December 15, 2017, amending and supplementing a number of articles of the Decree 100/2016/ND-CP and amendments (if any).

Exported goods that are exceptions specified in Clause 1, Article 1 of Decree 146/2017/ND-CP dated December 15, 2017 do not belong to the heading No. 211 of the Schedule of Export Tariffs issued together with Decree 26/2023/ND-CP.

Furthermore, codes and export duty rates of commodities in heading 211 are specified as follows:

The taxpayer shall declare export duty rates of commodities with 8-digit codes and descriptions of commodities in headings 25.23, 27.06, 27.07, 27.08, 68.01, 68.02, 68.03 in the headings numbered 211 that are corresponding with their HS codes of headings numbered 211. Otherwise, the taxpayer shall submit the statement of ratios of value of natural resources and minerals plus energy cost to production cost of the exports according to Form No. 14 of Appendix 2 issued together with Decree 26/2023/ND-CP while following customs procedures in order to prove that the aggregate value of natural resources and minerals plus energy costs is less than 51% of their production cost. In case the taxpayer is a trade enterprise that purchase goods form a manufacturer or from another trade enterprise for export but does not declare export duty rates of goods in the headings numbered 211, the taxpayer shall complete Form No. 14 in Appendix 2 issued together with Decree 26/2023/ND-CP according to information provided by the manufacturer in order to prove that the aggregate value of natural resources and minerals plus energy costs is less than 51% of their production cost.

The taxpayers shall be legally responsible for their declaration.

Regarding exports in headings numbered 211 that do not have 8-digit codes and satisfy the requirements specified in Clause 2, Article 4 of Decree 26/2023/ND-CP, the taxpayer shall declare the 8-digit codes in the Preferential Import Tariff Schedule in Section I Appendix 2 issued together with Decree 26/2023/ND-CP and declare the export duty rate of 5%.