What is the newest tax procedure service practice certificate template in Vietnam?

What is the newest tax procedure service practice certificate template in Vietnam?

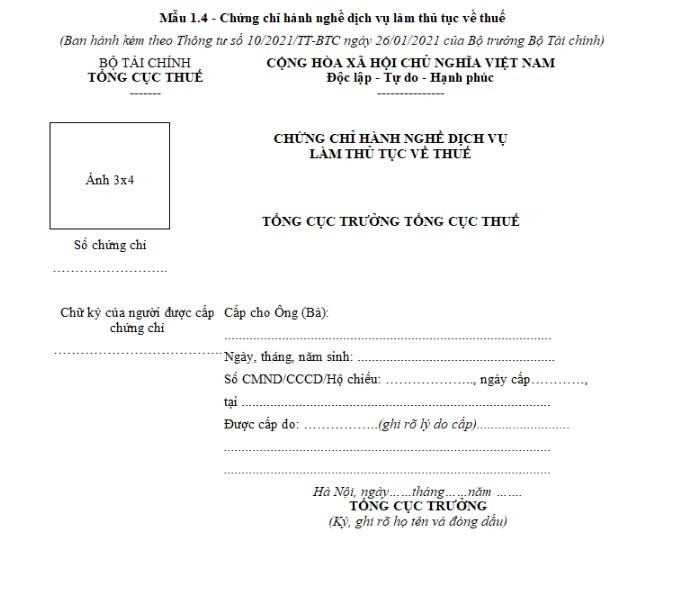

The newest tax procedure service practice certificate in Vietnam follows Template 1.4 in the Annex issued together with Circular 10/2021/TT-BTC guiding the management of the provision of tax services:

The newest tax procedure service practice certificate in Vietnam: DOWNLOAD

What is the newest tax procedure service practice certificate template in Vietnam?

What are the conditions for issuing a tax procedure service practice certificate in Vietnam?

Under Article 105 of the Law on Tax Administration 2019, the conditions are as follows:

Tax agent certifications

1. In order to be granted the tax agent certification, a person shall:

a) have full legal capacity;

b) have at least a bachelor’s degree in economics, finance, accounting, audit or another major specified by the Minister of Finance;

c) have at least 36 months’ experience of work in finance, accounting or audit after graduation;

d) pass the examination for the practising certificate for tax services, which consists of two tests: tax and accounting.

2. Holders of the auditor certification or accountant certification issued by competent authorities will be granted the tax agent certification without having to pass the exam.

3. The person who has the tax agent certification and works for a tax agent is called a tax agent employee. Tax agent employees must fully participate in refresher training programs.

4. The following persons must not work as tax agent employees:

a) Officials and public employees; commissioned and non-commissioned officers, career military personnel, military workers, military public employees, non-commissioned police officers and police workers.

b) Any person who is being banned from providing tax, accounting or audit services under an effective court judgment or court decision; people who are facing criminal prosecution;

c) Any person who has been convicted of any of the crimes related to tax, finance or accounting and has not have his/her criminal record expunged; any person who is put under supervision by commune authority or put into a correctional institution or rehabilitation center;

d) Any person who incurs an administrative penalty for accounting- or audit-related offence over the last 06 months (for warnings) or 12 months (for other penalties).

5. The Minister of Finance shall promulgate regulations on organization of examinations, conditions for exemption from examinations; procedures for issuance and revocation of the tax agent certification; provision of refresher training for tax agent employees.

Additionally, Article 12 of Circular 10/2021/TT-BTC guiding the management of the provision of tax services provides further guidance on the issuance of the tax procedure service practice certificate (practicing certificate) as follows:

Issuance, revocation of practicing certificates

1. Issuance of practicing certificates to examinees who pass two subject exams.

a) According to the approved exam results, General Department of Taxation shall issue practicing certificates to examinees that pass two subject exams.

b) The examinee is not required to apply for issuance of a practicing certificate if he/she has passed two subject exams.

...

Thus, individuals are granted the tax procedure service practice certificate when they meet the standards of academic qualifications, civil act capacity, work experience, and pass the exam for issuance of the certificate as prescribed.

What are the cases of revocation of a tax procedure service practice certificate in Vietnam?

Under Article 13 of Circular 10/2021/TT-BTC guiding the management of the provision of tax services, an individual will have their tax procedure service practice certificate revoked if they fall into one of the following cases:

- Untruthfully declaring the working time in the registration documents for exam or application for issuance of the practicing certificate;

- Correcting, falsifying, or cheating on the academic credentials, confirmation of exam score in the registration documents or application for issuance of the practicing certificate;

- Engaging in impersonation for someone else or allowing someone to impersonate you to take an exam for obtaining a practicing certificate;

- Using fake or invalid auditor's certificate, accountant's certificate in the application for issuance of the practicing certificate;

- The auditor's certificate, accountant's certificate was revoked in a case of issuance of practicing certificate as prescribed in point a clause 3 Article 11 hereof;

- Allowing someone else to use the practicing certificate.