What is the newest announcement template of issue of internally- or externally-printed receipts in Vietnam?

What is the newest announcement template of issue of internally- or externally-printed receipts in Vietnam?

Under Clause 3, Article 36 of Decree 123/2020/ND-CP:

Announcement of issue of internally- or externally-printed receipts

...

3. An announcement of issue of receipts includes the following information:

a) The legislative document defining the functions, duties and powers to perform state management tasks with fee/charge collection;

b) Name, TIN and address of the collector or of the agency authorized to collect fees/charges or issue fee/charge receipts;

c) Types of receipts (enclosed with sample receipts). The sample receipt is a printed receipt that accurately and adequately reflects all items of a receipt given to a payer, and bears the number which is a series of "0" and the printed or stamped word “Mẫu” (“sample”);

d) Date of commencement of use of receipts;

dd) Name, TIN and address of printing service provider (for externally-printed receipts); name and TIN (if any) of printing software supplier (for internally-printed receipts);

e) Date of the announcement of receipt issue; name and signature of legal representative and seal of the collector.

In case the format or contents of a receipt (either compulsory or additional contents) is/are partially or entirely changed, the collector is required to provide a new announcement of receipt issue according to the provisions in this Clause, except the case resulting in Point d Clause 3 of this Article.

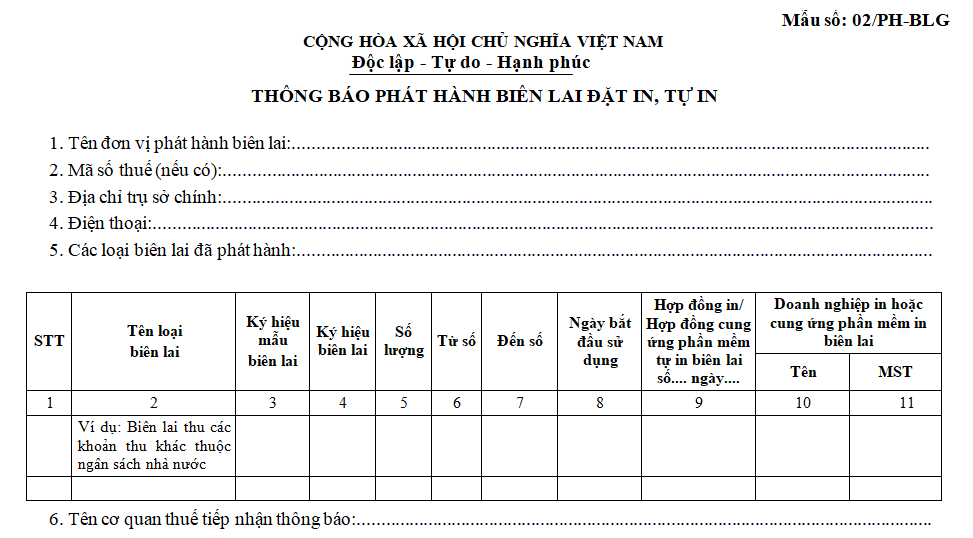

An announcement of receipt issue is made using Form No. 02/PH-BLG in Appendix IA enclosed herewith.

...

Currently, the announcement of issue of receipts is made in Form No. 02/PH-BLG Appendix IA issued with Decree 123/2020/ND-CP as follows:

*Download the newest announcement template of issue of internally- or externally-printed receipts: Here

What is the newest announcement template of issue of internally- or externally-printed receipts in Vietnam? (Image from the Internet)

What is the deadline for sending the announcement of issue of receipts in Vietnam?

Under Clause 4, Article 36 of Decree 123/2020/ND-CP:

Announcement of issue of internally- or externally-printed receipts

...

4. Procedures for issue of receipts:

a) The announcement of issue of receipts and sample receipt must be sent to the supervisory tax authority at least 05 days before such receipts are used. The announcement of issue of receipts and sample receipt must be posted at a noticeable place at the premises of the collector and the entity authorized or delegated to collect fees/charges throughout the use of such receipt type;

b) If the tax authority shall give a notification to the collector within 03 working days from receipt of the announcement if finding that the received announcement of issue of receipts does not contain adequate contents as prescribed. The collector shall make necessary modifications to make its new announcement of receipt issue satisfactory;

c) If the contents and format of the receipt whose issue has been announced are kept unchanged, the collector is not required to provide the sample receipt from the second and subsequent issues of receipts.

..

The announcement of issue of receipts and sample receipt must be sent to the supervisory tax authority at least 05 days before such receipts are use.

What are the requirements for the selling price of receipts printed under orders of the Provincial Department of Taxation in Vietnam?

Under Article 35 of Decree 123/2020/ND-CP:

Rules for creation of receipts

1. Each Provincial Department of Taxation shall place orders for printing of receipts (without pre-printed face value) which shall be then sold to collectors at prices sufficient to cover printing/issue costs.

2. If ordering the printing of receipts, collectors shall select and enter into printing service contracts with qualified printing service providers.

3. In case of internally-printed receipts, a collector is required to meet the following requirements:

a) It must have an equipment system (computers and printers) serving the printing and issuance of receipts when collecting fees/charges.

b) It must be an accounting unit as defined in the Law on accounting and have receipt printing software programs to ensure the transmission of receipt data to accounting software (or database) for declaration as prescribed.

The receipt printing system must comply with the following rules:

b.1) Receipts must be automatically numbered. Each copy of a receipt shall be printed out once. If a copy is printed out two times or more, it must be expressed as a copy.

b.2) The receipt printing software must ensure security by classifying users so that unauthorized persons cannot change date of the software application.

In case of purchase of receipt printing software, the collector must buy a printing software program from a qualified software supplier as prescribed.

b.3) Internally-printed receipts which are not yet issued shall be stored in the computer system according to regulations on information security.

b.4) Issued internally-printed receipts shall be stored in the computer system according to regulations on information security and in a manner that they may be accessed, extracted and printed out for reference when necessary.

TThus, each Provincial Department of Taxation shall place orders for printing of receipts (without pre-printed face value) which shall be then sold to collectors at prices sufficient to cover printing/issue costs.