What is the name of sub-item 4931? What is the late payment interest for value-added tax in Vietnam?

What is the name of sub-item 4931?

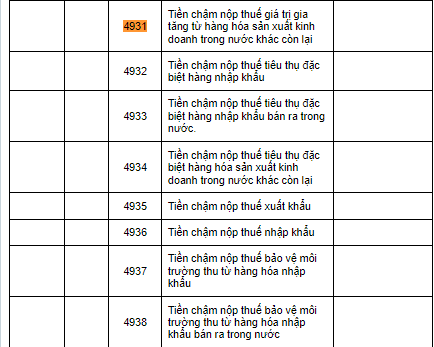

Based on Appendix 3 of the Catalogue, sub-item issued with Circular 324/2016/TT-BTC, supplemented by Clause 5, Article 1 of Circular 93/2019/TT-BTC, sub-item 4931 is defined as follows:

Thus, according to the regulation, the name of sub-item 4931 is late payment of value-added tax from other domestic business-manufactured goods.

What is the name of sub-item 4931? What is the late payment interest for value-added tax in Vietnam? (Image from the Internet)

What is the late payment interest of VAT in Vietnam?

According to Point a, Clause 2, Article 59 of the Tax Administration Law 2019, it is stipulated as follows:

Handling of late tax payment

...

- The late payment interest and the calculation time for late payment are regulated as follows:

a) The late payment interest is 0.03% per day based on the unpaid tax amount;

b) The calculation time for late payment is continuous from the day following the day the late payment arises as stipulated in Clause 1 of this Article to the day immediately preceding the day the tax debt, tax refund recovery, increased tax amount, determined tax amount, and delayed transferred tax is paid into the state budget.

...

Thus, it can be seen that the late payment interest of value-added tax is 0.03% per day calculated on the amount of unpaid tax.

When shall VAT late payment fees be paid in Vietnam?

* Cases where late payment fees must be paid:

According to Clause 1, Article 59 of the Tax Administration Law 2019, cases where late payment fees must be paid include:

- The taxpayer delays paying taxes compared to the prescribed deadline, the tax payment extension, the deadline stated in the tax administration agency's notice, the deadline in the tax determination decision or the handling decision of the tax administration agency;

- The taxpayer supplements the tax return files causing an increase in the tax payable amount, or the tax administration agency or competent state agency discovers under-declared taxes resulting in added tax payable, then the late payment fee must be paid on the additionally payable amount from the day following the last tax deadline of the erroneous or missing tax period or since the end of the initial customs declaration deadline;

- The taxpayer supplements the tax return files causing a decrease in the refundable tax amount or the tax administration agency or competent state agency discovers that the refundable tax amount is less than the refunded amount, then the late payment fee must be paid on the refunded amount to be recovered since receiving the refund from the state budget;

- Cases where tax debt installments are allowed as stipulated in Clause 5, Article 124 of the Tax Administration Law 2019;

- Cases where no administrative penalty for tax administration violations is applied due to the expiration of the penalty time limit but the tax shortfall is collected as stipulated in Clause 3, Article 137 of the Tax Administration Law 2019;

- Cases where no administrative penalty for tax administration violations is applied for acts specified in Clauses 3 and 4, Article 142 of the Tax Administration Law 2019.

* Cases where late payment fees are not payable:

According to Clause 5, Article 59 of the Tax Administration Law 2019, late payment fees are not payable in the following cases:

- Taxpayers providing goods and services paid from state budget sources, including sub-contractors regulated in contracts with the investor and directly paid by the investor but unpaid, do not have to pay late payment fees.

The tax debt not subject to late payment calculation is the total unpaid tax amount to the state budget by the taxpayer but not exceeding the unpaid amount from the state budget;

- Cases specified at point b, Clause 4, Article 55 of the Tax Administration Law 2019, where late payment is not calculated during the waiting period for analysis results, appraisal; during the time official pricing is not determined; while the actual payment amount, adjustments added to customs value, are not ascertained.

In addition, the procedure for handling late payment of tax is executed according to Clause 2, Article 9 of Circular 06/2021/TT-BTC, where the procedure for handling late payment of tax is as follows:

- The responsibility of taxpayers:

Taxpayers self-determine the late payment amount as stipulated in Clause 1, Article 9 of Circular 06/2021/TT-BTC and pay into the state budget.

- The responsibility of customs agencies:

Customs agencies check and handle late payment amounts as follows:

+ In case more than 30 days have passed since the tax payment deadline, and the taxpayer has not paid taxes, late payment fees, or fines, or has paid but still owes taxes, late payment fees, or fines, the customs agency notifies the taxpayer of the owed tax amount, fine amount, number of late-payment days through the System using Form 1 in Appendix 2 or a paper version using Form 01/TXNK in Appendix 1 issued with Circular 06/2021/TT-BTC.

In case the overpaid late payment amount exceeds the required late payment amount, the customs agency processes the overpaid late payment amount according to Article 10 of Circular 06/2021/TT-BTC.

+ In case the taxpayer supplements tax return files reducing the payable tax amount, or the tax administration agency or competent state agency discovers a reduced tax amount payable, the customs agency adjusts the calculated late payment amount corresponding to the reduced amount difference.