What is the monitoring sheet form for goods subject to export and import duty exemption - Form No. 07 in Vietnam?

What is the monitoring sheet form for goods subject to export and import duty exemption - Form No. 07 in Vietnam?

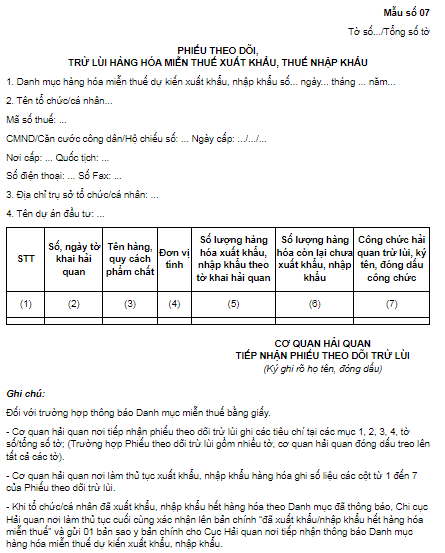

Under Appendix 7 of the forms/templates for tax exemption, tax reduction, tax refund, and non-taxation issued together with Decree 18/2021/ND-CP, the monitoring sheet for goods subject to export and import duty exemption is Form No. 07:

>>> Download Monitoring sheet form for goods subject to export and import duty exemption - Form No. 07.

What is the monitoring sheet form for goods subject to export and import duty exemption - Form No. 07 in Vietnam? (Image from the Internet)

What is the monitoring sheet for goods subject to export and import duty exemption made in Form No. 07 in Vietnam used for?

Under Clause 12, Article 1 of Decree 18/2021/ND-CP amending Decree 134/2016/ND-CP:

Exemption of duties on exports and imports under international treaties

...

4. Registration of duty-free list

Before registering the first customs declaration of duty-free exports/imports, the exporter/importer shall send register the duty-free list with the customs authority.

a) The application for registration of the duty-free list consists of:

- The registration form No. 05 in Appendix VII hereof: 01 original copy;

- The duty-free list sent via the electronic data processing system of customs authority. In case this system is not functional, the exporter/importer shall submit 02 original copies of the duty-free list (Form No. 06) and 01 original copy of Form No. 07 in Appendix VII hereof.

In case the equipment has to be divided into multiple export/import shipments and thus deduction is not possible at the time of export/import (hereinafter referred to as “combination or assembly line”), the exporter/importer shall submit 02 original copies of Form No. 06 in Appendix VII hereof.

The duty-free list that is conformable with the international treaty or the written confirmation of categories and quotas of duty-free goods issued by the proposing authority or line management authority;

- The international treaty if it specifies the categories and quotas of duty-free goods: 01 photocopy;

- The written confirmation of categories and quotas of duty-free goods mentioned in Point b Clause 3 of this Article: 01 photocopy with the original copy presented for comparison.

b) The locations where the duty-lists are registered or revised; responsibility of the customs authorities that receive duty-free lists; responsibility of submitting entities are specified in Clause 4, Clause 5, Clause 6 and Clause 7 Article 30 of this Decree.

c) In case the duty-free goods are exported/imported by the exporter/importer’s main contractor or subcontractor or a finance lease company, such contractor or finance lease company may use the duty-free list notified to the customs authority by the exporter/importer.

Hence, it can be seen that Form No. 07 Monitoring Sheet for goods subject to export and import duty exemption is a required document to prepare the notification files of the Tax-Exempt List.

What is the list of goods subject to export and import duty exemption in Vietnam?

Under Article 16 of the Law on Export and Import Duties 2016, the list of goods subject to export and import duty exemption is stipulated as follows:

- Exported or imported goods of foreign entities granted diplomatic immunity and privileges in Vietnam within the allowance under an international treaty to which Socialist Republic of Vietnam is a signatory; luggage within the tax-free allowance of inbound and outbound passengers; imports to be sold at duty-free shops.

- Personal belongings, gifts from foreign entities to Vietnamese entities and vice versa within the tax-free allowance.

Suppose the quantity or value of personal belongings or gifts exceeds the tax-free allowance. In that case, the excess amount or value shall be taxed, unless the recipient is an entity funded by state budget and permitted by a competent authority to receive them or they are meant to serve humanitarian or charitable purposes.

- Goods traded across the border of border residents on the List of goods and within the tax-free allowance serving the manufacturing or consumption by border residents.

Goods that are purchased or transported within the tax-free allowance but do not serve the manufacturing or consumption by border residents, exports and imports of foreign traders permitted to be sold at bordering markets shall be taxed.

- Goods exempt from export and import duties under international treaties to which Socialist Republic of Vietnam is a signatory.

- Goods whose value or tax payable is below the minimum level.

- Imported raw materials, supplies, components serving processing of exports; finished products imported to be fixed on processed products; outward processing products.

Regarding outward processing products derived from domestic raw materials that subject to export duties, the amount of domestic raw materials incorporated into the products shall be taxed.

Goods exported for processing and then imported are exempt from export duty and import duty on the value of exported raw materials incorporated into the processed products. Goods exported for processing and then imported that are natural resources, minerals, or products whose the total value of natural resources or minerals plus energy costs makes up at least 51% of the product price shall be taxed.

- Materials, supplies, components imported for manufacture of exports. products.

- Goods manufactured, processed, recycled, assembled in a free trade zone without using imported raw materials or components when they are imported into the domestic market.

- Goods temporarily imported for re-export or goods temporarily exported for re-import within a certain period of time, including:

+ Goods temporarily imported or exported to participate in fairs, exhibitions, product introduction, sports or art events, or other events; machinery and equipment temporarily imported for re-export for testing, research and development; machinery and equipment, tools temporarily imported or exported to be used for certain period of time or serve overseas processing, except for machinery, equipment, tools, vehicles permitted to be temporarily imported too serve investment projects, construction, installation, or manufacture;

+ Machinery, equipment, components, spare parts temporarily imported for replacement or repair of foreign ships or airplanes, or temporarily exported for replacement or repair of Vietnamese ships or airplanes overseas; goods temporarily imported to supply for foreign ships or airplanes in Vietnam's ports;

+ Goods temporarily imported or exported for warranty, repair, or replacement;

+ Vehicles temporarily imported or exported to carry exports or imports;

+ Goods that are temporarily imported and re-exported by the deadline or extended deadline and a credit institution provides a guarantee or a deposit equivalent to import duties on the temporarily imported goods has been paid.

- Non-commercial goods: samples, pictures, videos, models instead of samples; advertisement publications in small quantities.

- Imports as fixed assets of an entity eligible for investment incentives as prescribed by regulations of law on investment, including:

+ Machinery and equipment; components, parts, spare parts for assembly or operation of machinery and equipment; raw materials for manufacture of machinery and equipment, components, parts, or spare parts of machinery and equipment;

+ Special-use vehicles in a technological line directly used for a manufacture project;

+ Building materials that cannot be domestically produced.

Exemption of import duty on the imports specified in this Clause also applies to new investment projects and extension projects.

- Plant varieties; animal breeds, fertilizers, pesticides that cannot be domestically produced as prescribed by competent authority.

- Raw materials and components which cannot be domestically manufactured and are imported serving the manufacturing of investment projects eligible for investment incentives or in an extremely disadvantaged area prescribed by regulations of law on investment, high technology enterprises, science and technology enterprises, science and technology organizations are exempt from import duties for 05 years from the commencement of manufacture.

The exemption of import duties specified in this Clause does not apply to mineral extraction projects; projects for manufacture of products where total value of natural resources or minerals plus energy costs makes up at least 51% of the product price; projects for manufacture or sale of goods/services subject to special excise tax.

- Raw materials and components which cannot be domestically manufactured of investment projects for manufacture or assembly of medical equipment given priority shall be exempt from import duties for 05 years from the commencement of manufacture.

- Imports serving petroleum activities, including:

+ Machinery, equipment, components, means of transport necessary for petroleum activities, including those temporarily imported for re-export;

+ Components, parts, spare parts for assembly or operation of machinery and equipment; raw materials for manufacture of machinery and equipment, components, parts, or spare parts of machinery and equipment necessary for petroleum activities;

+ Supplies necessary for petroleum activities that cannot be domestically produced.

- Shipbuilding projects and shipyards eligible for incentives as prescribed by regulations of law on investment shall have tax exempted from:

+ Imports that constitute fixed assets of the shipyard, including: machinery and equipment; components, parts, spare parts for assembly or operation of machinery and equipment; raw materials for manufacture of machinery and equipment, components, parts, or spare parts of machinery and equipment; means of transport in the technological line directly serving shipbuilding; building materials that cannot be domestically produced;

+ Imported machinery, equipment, raw materials, supplies, components, semi-finished products serving shipbuilding that cannot be domestically produced;

+ Ships for export.

- Imported machinery, equipment, raw materials, supplies, components, parts, spare parts serving money printing and mincing.

- Imported raw materials, supplies, components serving that cannot be domestically produced serving manufacture of information technology products, digital contents, software.

- Exports and imports serving environmental protection, including:

+ Imported machinery, equipment, equipment, tools, supplies that cannot be domestically produced serving collection, transport, treatment wastewater, wastes, exhaust gases, environmental monitoring and analysis, production of renewable energy, treatment of environmental pollution, response to environmental emergencies;

+ Exports that are products of waste recycling and treatment.

- Imports directly serving education that cannot be domestically produced.

- Imported dedicated machinery, equipment, components, supplies that cannot be domestically produced, scientific materials serving scientific research, technological development, technological cultivation, cultivation of science and technology enterprises and technological innovation.

- Imported dedicated products directly serving national defense and security, the vehicles among which must be those that cannot be domestically produced.

- Exports and imports serving assurance of social security, recovery from disasters, epidemics, and other special situations.