What is the minute form on asset inventory related to tax inspection in Vietnam?

What is the minute form on asset inventory related to tax inspection in Vietnam?

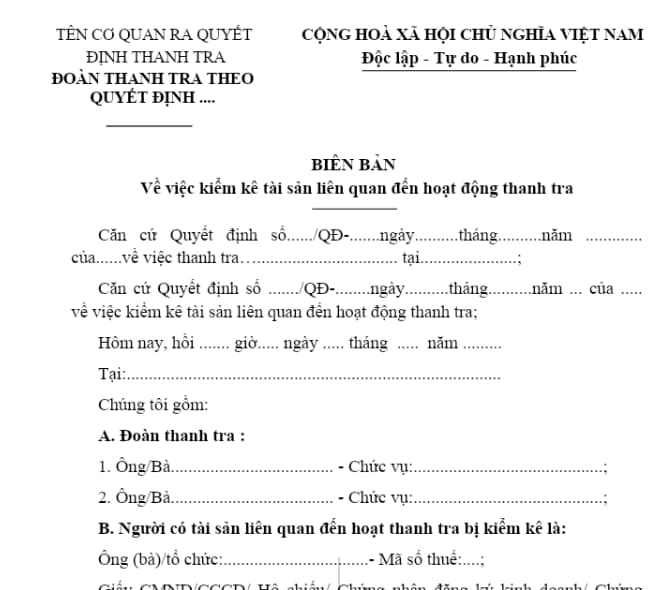

The minutes on asset inventory related to tax inspection are stipulated in form 14/TTrT in Appendix I issued together with Circular 80/2021/TT-BTC.

Download the minutes on asset inventory related to tax inspection

What is the minute form on asset inventory related to tax inspection in Vietnam?

What are the rights of the tax inspected entities in Vietnam?

According to Article 118 of Law on Tax Administration 2019:

Rights and obligations of the inspected entities

1. The inspected entities has the following rights:

a) Explain issues related to the content of tax inspection;

b) Appeal against decisions, actions of the decision-maker of the inspection, the head of the inspection team, and members of the inspection team during the inspection process; appeal against inspection conclusions, post-inspection handling decisions in accordance with the law on appeals; while awaiting resolution of the appeal, the complainant must still comply with those decisions;

c) Receive the minutes of tax inspection and request an explanation of the contents of the tax inspection minutes;

d) Refuse to provide information and documents not related to the content of tax inspection, information, and documents classified as State secrets, unless otherwise stipulated by law;

dd) Request compensation for damage according to legal regulations;

e) Denounce violations of law by the head of the tax administration agency, head of the tax inspection team, and members of the tax inspection team according to the law.

2. The inspected entities has the following obligations:

a) Comply with the tax inspection decision;

b) Promptly, fully, and accurately provide information and documents as requested by the decision-maker of the inspection, the head of the inspection team, and members of the inspection team and shall be legally responsible for the accuracy, truthfulness of the provided information and documents;

c) Implement the requirements, recommendations, conclusions of the tax inspection, handling decisions of the decision-maker of the inspection, the head of the inspection team, members of the inspection team, and competent state agencies;

d) Sign the tax inspection minutes.

Hence, the inspected entities has the following rights:

- Explain issues related to the content of the tax inspection;

- Appeal against decisions, actions of the decision-maker of the inspection, the head of the inspection team, and members of the inspection team during the inspection process; appeal against inspection conclusions, post-inspection handling decisions in accordance with the law on appeals; while awaiting resolution of the appeal, the complainant must still comply with those decisions;

- Receive the minutes of tax inspection and request an explanation of the contents of the tax inspection minutes;

- Refuse to provide information and documents not related to the content of the tax inspection, information, and documents classified as State secrets, unless otherwise stipulated by law;

- Request compensation for damage according to legal regulations;

- Denounce violations of law by the head of the tax administration agency, head of the tax inspection team, and members of the tax inspection team according to the law.

What are the 05 principles of tax audits and tax inspections in Vietnam?

According to Article 107 of Law on Tax Administration 2019, there are 5 principles of tax audits and tax inspections, including:

- Apply risk management in tax administration and utilize information technology in tax audits and tax inspections.

- Comply with the provisions of the Law on Tax Administration 2019, other related legal regulations, and inspection forms, procedures, tax audit documentation as stipulated by the Minister of Finance.

- Do not obstruct the normal activities of the taxpayer.

- When conducting tax auditing, inspection at the taxpayer's headquarters, the head of the tax administration agency must issue an audit, inspection decision.

- Tax auditing, inspection aims to assess the completeness, accuracy, truthfulness of the contents of documents, information, and dossiers that the taxpayer has declared, submitted, presented to the tax administration agency, and assess the compliance with tax law and other related legal provisions by the taxpayer to process tax matters according to law.