What is the minute form of meetings of the Tax Advisory Council of a commune in Vietnam in 2024?

What is the minute form of meetings of the Tax Advisory Council of a commune in Vietnam in 2024?

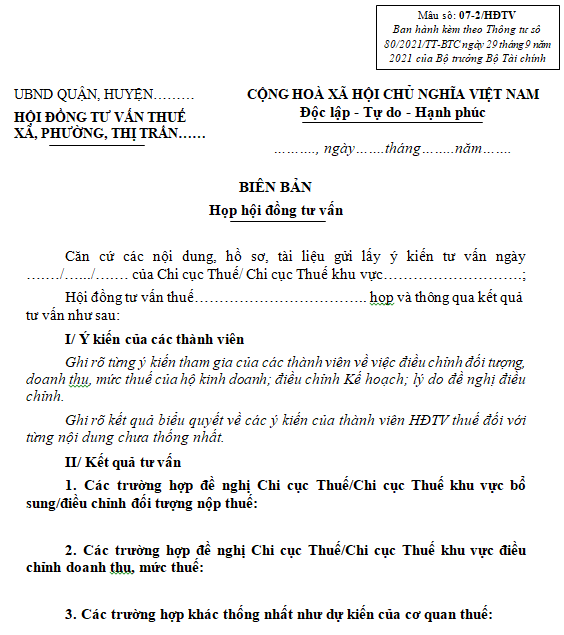

The minute form of meetings of the Tax Advisory Council of a commune for the Year 2024 is recorded according to Form No. 07-2/HDTV issued together with Appendix I attached to Circular 80/2021/TT-BTC.

DOWNLOAD >>> Form No. 07-2/HDTV - Minutes of Meetings of Tax Advisory Council of a commune for the Year 2024

Whose signature is required on the minutes of meetings of the Tax Advisory Council of a commune in Vietnam?

The principles and policies of the working procedures of the Tax Advisory Council of a commune are stipulated in Article 8 of Circular 80/2021/TT-BTC as follows:

Article 8. Principles and Policies of Working Procedures of the Tax Advisory Council

1. The Chairperson and members of the Tax Advisory Council operate under concurrent policies. The Tax Advisory Council is directly guided by the Chairperson of the Tax Advisory Council regarding the contents stipulated in this Circular.

2. The Tax Advisory Council convenes to gather opinions from members on advisory contents as summoned by the Chairperson of the Tax Advisory Council. Meetings of the Tax Advisory Council are conducted with the presence of the Chairperson of the Tax Advisory Council and at least two-thirds of the total member count (including the Chairperson) in attendance. The Tax Advisory Council may organize the collection of members’ opinions on advisory contents via electronic means. In case members’ opinions differ, voting must be conducted to decide by majority; if voting results tie, the decision is based on the content agreed upon by the Chairperson of the Tax Advisory Council to establish a basis for drafting the minutes of meetings of the Tax Advisory Council.

3. Meetings of the Tax Advisory Council must be recorded in minutes according to Form No. 07-2/HDTV attached to Appendix I of this Circular. The minutes of the meeting must have signature confirmation from attending members of the Tax Advisory Council. In cases where opinions are collected via electronic means, the standing member of the council compiles generally and records it in the minutes as if a direct meeting had taken place.

Thus, the minutes of meetings of the Tax Advisory Council of a commune must have signature confirmation from the members of the Tax Advisory Council present at the meeting.

Note:

+ Meetings of the Tax Advisory Council are conducted with the participation of the Chairperson of the Tax Advisory Council and at least two-thirds of the total member count (including the Chairperson).

+ The Tax Advisory Council may organize the collection of members’ opinions on advisory contents via electronic means.

In cases where opinions are collected via electronic means, the permanent member of the Tax Advisory Council consolidates them and records them in the minutes as if a direct meeting had taken place.

+ In case members' opinions are not consistent, voting must be conducted to decide by majority; if voting results tie, the decision is based on the content agreed upon by the Chairperson of the Tax Advisory Council to establish a basis for drafting the minutes of meetings of the Tax Advisory Council.

What is the minute form of meetings of the Tax Advisory Council of a commune in Vietnam in 2024? (Image from the Internet)

Who is the standing member of the Tax Advisory Council of a commune in Vietnam?

Based on the provisions of Clause 1, Article 6 of Circular 80/2021/TT-BTC, the composition of the Tax Advisory Council of a commune includes the following members:

Article 6. Composition of the Tax Advisory Council of a commune

1. The composition of the Tax Advisory Council includes:

a) The Chairman or Vice-Chairman of the People's Committee at the commune, ward, commune-level town - Chairperson of the Council;

b) The Head or Deputy Head of the Inter-commune, ward, commune-level town Tax Team or equivalent - Standing Member;

c) An official in charge of finance of the People's Committee at the commune, ward, commune-level town - Member;

d) Chairman of the Vietnam Fatherland Front Committee at the commune, ward, commune-level town - Member;

e) Head of the commune, ward, commune-level town Police - Member;

f) Head of the neighborhood group or equivalent level - Member;

g) Head of the market management board - Member;

h) Representative of household businesses, individual businesses in the locality - Member.

In cases where the administrative area at the district level has no administrative unit at the commune level, the Chairman of the District People's Committee decides on the establishment of the Tax Advisory Council with similar members as stipulated in this clause.

...

Thus, the Head or Deputy Head of the Inter-commune, ward, commune-level town Tax Team or equivalent is the Standing Member of the Tax Advisory Council of a commune.