What is the list of VAT refund documents for outbound passengers in Vietnam in 2025?

What documents are required in the application for VAT refunds regarding commercial banks acting as tax refund agents for outbound passengers in Vietnam?

Based on the provisions in Clause 1 and Point g, Clause 2, Article 28 of Circular 80/2021/TT-BTC concerning the application for VAT refund as follows:

Application for VAT refund

The application for VAT refund according to the legal provisions on value-added tax (except for cases of value-added tax refunds according to international treaties; input value-added tax refunds not fully deducted when ownership is transferred, enterprises are converted, merged, unified, split, dissolved, bankrupt, or cease operations as regulated in Article 30, Article 31 of this Circular) includes:

1. Application for refund of a payment to the state budget, form No. 01/HT issued with Appendix I of this Circular.

2. Related documents based on the refund case. Specifically:

...

g) Tax refund for commercial banks acting as value-added tax refund agents for outbound passengers:

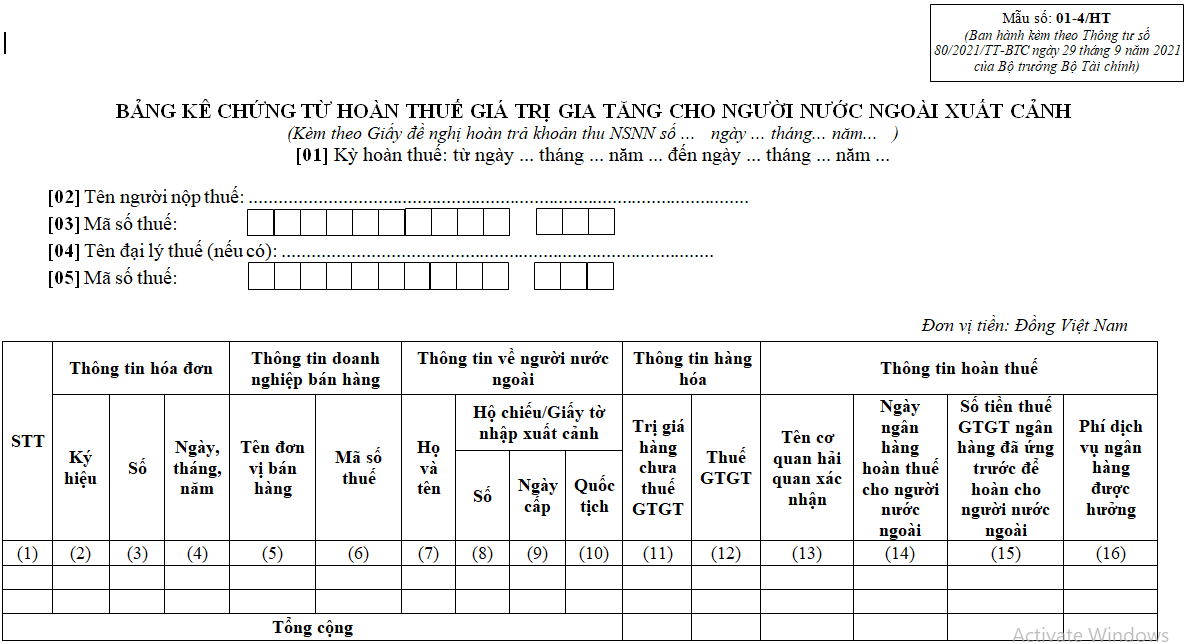

Detailed table of value-added tax refund documents for outbound passengers according to form No. 01-4/HT issued with Appendix I of this Circular.

..."

Therefore, the application for VAT refund for commercial banks acting as value-added tax refund agents for outbound passengers includes:

- Application for refund of a payment to the state budget according to form No. 01/HT issued with Appendix I of Circular 80/2021/TT-BTC;

DOWNLOAD >>> Application for refund of a payment to the state budget (Form No. 01/HT)

- Detailed table of value-added tax refund documents for outbound passengers according to form No. 01-4/HT issued with Appendix I of Circular 80/2021/TT-BTC.

What is the list of VAT refund documents for outbound passengers in Vietnam in 2025?

The latest detailed list of VAT refund documents for outbound passengers in 2025 is executed according to Form No. 01-4/HT issued with Appendix I of Circular 80/2021/TT-BTC.

DOWNLOAD >>> Detailed list of VAT refund documents for outbound passengers (Form No. 01-4/HT)

What is the list of VAT refund documents for outbound passengers in Vietnam in 2025? (Image from Internet)

What are the responsibilities of tax authorities in receiving and processing VAT refund applications for outbound passengers in Vietnam?

According to the provisions in Clause 2, Article 27 of Circular 80/2021/TT-BTC regarding the responsibilities of tax authorities in receiving and processing refund applications according to tax law:

Responsibilities of Tax Authorities in Handling Refund Applications

..

2. Responsibilities for receiving and processing refund applications as stipulated by tax law

a) The Tax Department is responsible for receiving and processing refund applications mentioned in Clause 1 of this Article (except for cases specified in points b, c of this clause) for taxpayers managed directly by the Tax Department and taxpayers managed directly by the Tax Sub-Department.

For the Tax Departments of Hanoi City, Ho Chi Minh City, Binh Duong, and Dong Nai, the Director of the Tax Department may assign the Tax Sub-Department to receive VAT refund applications from taxpayers managed directly by the Tax Sub-Department and to process refund applications. This includes classifying refund applications as either prior refund or prior inspection; determining the refundable amount; identifying overdue taxes, fines, late payment interest to offset against the refundable amount; drafting the Tax Refund Decision or the Tax Refund Decision cum offset with the state budget or Notice of ineligibility for refund (if applicable); thereafter, the Tax Sub-Department transfers the entire application to the Tax Department to continue tax refund processing as stipulated in this Circular.

b) The Tax Department where the taxpayer declares VAT of investment projects according to point a, Clause 1, Article 11 of Decree No. 126/2020/ND-CP is responsible for receiving and processing refund applications for taxpayers' investment projects.

c) The directly managing tax authority is responsible for receiving and processing refund applications for input value-added tax not fully deducted when ownership is transferred, businesses are converted, merged, consolidated, split, dissolved, bankrupt, or cease operations.

Thus, the responsibilities of the tax authorities in receiving and processing VAT refund applications for outbound passengers are prescribed as follows:

- The Tax Department is responsible for receiving and processing refund applications for taxpayers managed directly by the Tax Department and taxpayers managed directly by the Tax Sub-Department.

- Specifically, for the Tax Departments of Hanoi City, Ho Chi Minh City, Binh Duong, and Dong Nai, the Director of the Tax Department can assign the Tax Sub-Department to receive VAT refund applications from taxpayers managed directly by the Tax Sub-Department, and to process these applications. This includes classifying refund applications as prior refund or prior inspection, determining the refundable amount, identifying overdue taxes, fines, and late payment interest to offset against the refundable amount; drafting the Tax Refund Decision or the Tax Refund Decision cum offset with the state budget or Notice of ineligibility for refund (if applicable); thereafter, the Tax Sub-Department transfers the entire application to the Tax Department for further processing in accordance with this Circular.