What is the latest tax declaration form for leasing a house in Vietnam?

What is the latest tax declaration form for leasing a house in Vietnam?

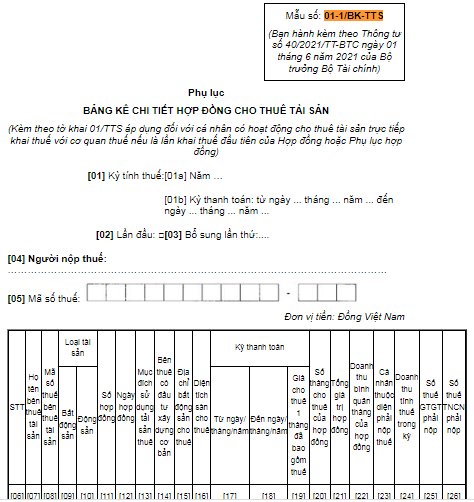

Under Section 7, Appendix 2 issued along with Circular 40/2021/TT-BTC, the tax declaration form for individuals leasing houses and directly declaring taxes with the tax authority is Form 01/TTS as follows:

>>> Download the latest tax declaration form for leasing a house in Vietnam in 2024.

Note: The above tax declaration form applies only when an individual leases a house and directly declares taxes with the tax authority.

What is the latest tax declaration form for leasing a house in Vietnam? (Image from the Internet)

What does the tax declaration dossier of a lessor being an individual directly declaring taxes with the tax authority in Vietnam include?

According to Clause 1, Article 14 of Circular 40/2021/TT-BTC, the tax declaration dossier of a lessor be an individual directly declaring taxes with the tax authority in Vietnam includes:

[1] Tax declaration form for house rental activities

[2] Appendix detailing the rental contract (if it is the first tax declaration of the Contract or Contract Appendix) according to form 01-1/BK-TTS issued with Circular 40/2021/TT-BTC; Download.

[3] Copy of the lease contract and its appendices (for the first declaration);

[4] The copy of the authorization letter as prescribed by law (in case the lessor authorizes the legal representative to declare and pay tax).

The tax authority is entitled to request the taxpayer to present original copies for comparison with the copies.

>> See more details about the tax declaration form for individuals leasing houses here. Download <<

What is the tax calculation method for individuals leasing houses in Vietnam?

According to Clause 1, Article 9 of Circular 40/2021/TT-BTC amended by Clause 3, Article 1 of Circular 100/2021/TT-BTC regarding the tax calculation method for individuals leasing assets as follows:

Tax calculation in some special cases

1. Individuals leasing out their property (hereinafter referred to as “lessors”)

a) Lessors are individuals who earn revenue from leasing out: housing, premises, stores, factories, storage without lodging services; vehicles, equipment without operator; other property without associated services. Lodging services that are not considered property lease include: provision of short-term lodging for tourists and other visitors; provision of long-term lodging other than apartments for students, workers and similar persons; provision of lodging together with food and beverage services or entertainment.

b) Lessors shall declare tax separately on each rent payment (according to the beginning date of the lease period) or by calendar year. The lessor shall declare tax on each contract separately, or declare tax on multiple contracts on the same declaration if the pieces of property are under the management of the same tax authority.

c) In case an individual's only business operation is property lease, the lease duration is shorter than 1 year, and the revenue from property lease does not exceed VND 100 million per year, he/she is not required to pay VAT and PIT. In case the lessees pay the rent in advance for many years, the revenue as the basic to determine whether individuals must pay tax or not is the lump sum payment according to the calendar year.

d) In case the lessee pays the rent in advance for multiple years, the lessor shall declare and pay tax in a lump sum for the rent paid in advance. The lump sum tax shall be the sum of tax payable in each calendar year as per regulations. In case of change in the content of the lease contract that leads to change to the taxable revenue, payment period or lease period, the individual shall make revisions for the tax period in which the change occurs in accordance with the Law on Tax Administration.

...

Thus, according to the above regulations, individuals leasing houses calculate tax using one of the following methods:

Method {1}: Declare tax separately on each rent payment (each payment period is determined by the start date of the lease period for each payment period)

Method {2}: Declare taxes according to the calendar year.

The lessor shall declare tax on each contract separately, or declare tax on multiple contracts on the same declaration if the pieces of property are under the management of the same tax authority.

In case an individual's only business operation is property lease, the lease duration is shorter than 1 year, and the revenue from property lease does not exceed VND 100 million per year, he/she is not required to pay VAT and PIT.

In case the lessees pay the rent in advance for many years, the revenue as the basic to determine whether individuals must pay tax or not is the lump sum payment according to the calendar year.