What is the latest supplementary declaration form for exports and imports in Vietnam? What are cases where customs declaration for exports and imports is supplemented in Vietnam?

What is the latest supplementary declaration form for exports and imports in Vietnam?

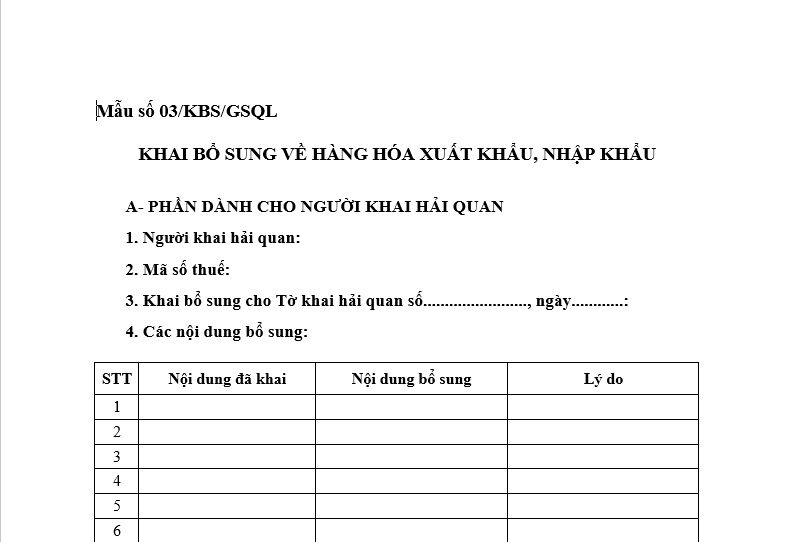

The latest supplementary declaration form for exports and imports is Form No. 03/KBS/GSQ as stipulated in Appendix 5 issued together with Circular 39/2018/TT-BTC.

The latest supplementary declaration form for exports and imports is as follows:

The 2024 supplementary declaration form for exports and imports...Download

What is the latest supplementary declaration form for exports and imports in Vietnam? (Image from the Internet)

What are cases where customs declaration for exports and imports is supplemented in Vietnam?

According to Clause 1, Article 20 of Circular 38/2015/TT-BTC (amended by Clause 9, Article 1 of Circular 39/2018/TT-BTC) regarding cases where customs declarants can supplement customs declarations for exports and imports:

(1) Cases for Supplementary Declaration

Except for certain information criteria on the customs declaration that are not permitted for supplementary declaration as specified in section 3, Appendix 2 issued with Circular 39/2018/TT-BTC, customs declarants are permitted to supplement information criteria on customs declarations in the following cases:

- Supplementary declaration during customs clearance:

+ Customs declarants and taxpayers are allowed to supplement customs declaration records before the customs authority announces the results of customs declaration channeling to the customs declarant;

+ Customs declarants and taxpayers recognize errors in customs declarations after the customs authority announces the results of customs declaration channeling but before customs clearance, they are allowed to supplement customs declaration records and are penalized according to legal regulations;

+ Customs declarants and taxpayers are required to supplement customs declaration records upon the customs authority's request when the customs authority detects discrepancies between the actual goods, customs records, and declared information during document verification or actual goods inspection and are penalized according to legal regulations.

- Supplementary declaration after goods have been cleared:

Except for supplementary declaration contents related to import/export licenses; specialized inspections on goods quality, health, culture, animal quarantine, animal and plant products, food safety, customs declarants perform supplementary declaration after clearance in the following cases:

+ Customs declarants and taxpayers identify errors in customs declarations and are permitted to supplement customs declaration records within 60 days from the customs clearance date but before the customs authority decides to inspect or audit after clearance;

+ After the 60-day period from the customs clearance date and before the customs authority decides to inspect or audit after clearance, if customs declarants and taxpayers newly recognize errors in customs declarations, they must perform supplementary declaration and are penalized according to legal regulations;

+ Customs declarants perform supplementary declaration according to the customs authority's request during file inspection or actual goods inspection and are penalized according to legal regulations on taxes and administrative violations.

Note: Supplementary declaration contents related to import/export licenses; specialized inspections on goods quality, health, culture, animal quarantine, animal and plant products, food safety are not allowed after goods have been cleared.

Which entites are customs declarants in Vietnam?

According to Article 5 of Decree 08/2015/ND-CP (amended by Clause 3, Article 1 of Decree 59/2018/ND-CP), customs declarants include:

- Owners of exported, imported goods. In cases where the owner is a foreign trader not present in Vietnam, customs must be processed via a customs procedure agency.

- Transport vehicle owners, operators of entry, exit, transit transport vehicles, or persons authorized by such transport vehicle owners.

- Persons authorized by the goods owner for gifts, personal presents, luggage sent before or after the trip of travelers; imported goods for tax-free investment projects.

- Persons performing goods transit services, goods transshipment.

- Customs procedure agencies.

- Enterprises providing international postal services, international express delivery services unless otherwise requested by the goods owner.

What are the rights of customs declarants in Vietnam?

Based on Clause 1, Article 18 of the Customs Law 2014, the rights of customs declarants are specified as follows:

- To be provided by the customs authority with information related to customs declarations for goods, transport vehicles, guidance on customs procedures, dissemination of customs law;

- To request customs authorities to pre-determine codes, origins, and customs values for goods when they have provided complete and accurate information to customs authorities;

- To preview goods, take samples of goods under the supervision of customs officials before making customs declarations to ensure accuracy;

- To request customs authorities to re-check the actual inspected goods if disagreeing with the customs authority’s decision in cases where goods have not been cleared;

- To use customs documents to clear goods, transport goods, and perform related procedures with other agencies as prescribed by law;

- To complain, denounce illegal acts of customs authorities, customs officials;

- To claim compensation for damages caused by customs authorities, customs officials according to the law on state liability for compensation.