What is the latest state budget payment form in Vietnam in 2025?

What is the latest state budget payment form in Vietnam in 2025?

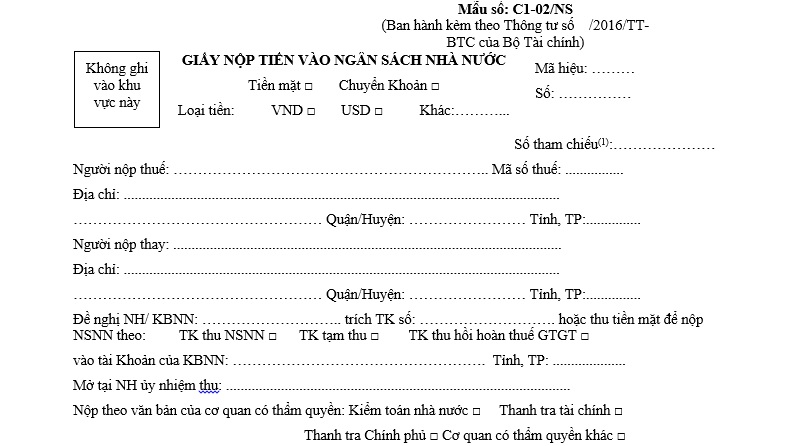

The State Budget Payment Form 2025 is Form No. C1-02/NS issued together with Circular 84/2016/TT-BTC.

The latest State Budget Payment Form 2025 is as follows:

Download the latest State Budget Payment Form 2025 here...Download

What is the latest state budget payment form in Vietnam in 2025? (Image from the Internet)

How to prepare tax payment documents on the General Department of Taxation of Vietnam’s electronic portal?

According to Article 6 of Circular 84/2016/TT-BTC, the procedure for preparing tax payment documents on the General Department of Taxation of Vietnam’s electronic portal is as follows:

- The taxpayer logs into the electronic tax payment system on the General Department of Taxation of Vietnam’s electronic portal using the electronic tax transaction account provided by the tax authority (as per Circular 19/2021/TT-BTC of the Ministry of Finance regarding electronic transactions in the field of taxation) to prepare tax payment documents.

- The taxpayer chooses one of two options:

+ Prepare a money payment slip

+ Prepare a money payment slip for payment on behalf of another

In addition, the taxpayer must declare specific information on the state budget payment form according to Form No. C1-02/NS issued together with Circular 84/2016/TT-BTC (the form in the section above) as follows:

(1) Information on the type of tax payment currency:

- Select the “VND” option on the payment document if the taxpayer is required to pay in Vietnamese Dong to the state budget.

- Select the “USD” option or specify another foreign currency on the payment document if the taxpayer is required to pay in US Dollars or another foreign currency as per legal regulations.

(2) Information about the taxpayer and the person paying on behalf:

- If choosing “Prepare a money payment slip”, the system automatically displays the taxpayer's information, including name, tax code, and address according to the login account.

- If choosing “Prepare a money payment slip for payment on behalf of another”, the system automatically displays the information of the person paying on behalf, including name and address according to the login account. Payment on behalf requires declaring the taxpayer's information, including name, tax code, and address.

(3) Information on the bank/State Treasury and account for tax payment:

Select the bank and account from the registered list for electronic tax payment.

(4) Information on state budget payment:

The taxpayer selects the “TK thu NSNN” or “TK thu hồi hoàn thuế GTGT” option as follows:

- Choose “TK thu NSNN” when paying tax amounts, late payment fees, fines, or other amounts into the state budget.

- Choose “TK thu hồi hoàn thuế GTGT” when repaying the state budget for VAT amounts that have been refunded by the competent authorities' decision or if the taxpayer self-discovers an incorrect refund; excluding repayment of VAT amounts refunded due to erroneous or excess payment.

(5) Information on State Treasury account:

Choose the name of the receiving state treasury agency from the list provided, as well as the designated collection agent bank corresponding to the selected state treasury agency in the system.

The receiving state treasury agency for budget collection is at the same administrative level as the tax management agency. If not, the tax management agency must inform the taxpayer to choose a suitable state treasury agency.

(6) Information on payments according to documents from competent authorities (if any)

Select one of the options corresponding to the issuing authority: “State Audit”, “Government Inspectorate of Vietnam”, “Financial Inspectorate”, “Other competent authority”.

If paying taxes as per decisions from tax agencies, select “Other competent authority”.

(7) Information on the name of the tax management agency

The system will automatically display the name of the tax agency directly managing the taxpayer. If the collected amount belongs to another tax agency, the taxpayer must choose another tax management agency from the list.

(8) Information on budget contributions

The taxpayer queries the amount payable in the electronic tax payment system and selects one or multiple amounts from the list displayed. The taxpayer can amend the payment amount information.

+ If an amount arises that is not in the list of amounts shown, the taxpayer enters the “State budget contributions” category to choose the suitable payment amount and enter payment information.

+ When paying taxes, land levy, registration fees, or other contributions related to asset registration, include additional information in the budget contribution description box such as: house address, land lot; vehicle type, brand, model, color, chassis number, engine number for aircraft, ships, cars, motorcycles.

+ When paying according to a document from a competent authority, include additional information on the issuing authority's name.

(9) Completing the tax payment document

The taxpayer performs electronic signing in at least one of the three positions of payer/chief accountant/head of the unit and sends the payment slip to the state budget in the electronic tax payment system.

What are responsibilities of the tax authority in collecting the state budget in Vietnam?

According to Article 5 of Circular 84/2016/TT-BTC, the responsibilities of the tax authority in collecting and remitting to the state budget include:

- Promptly updating information regarding shared categories, taxpayer data, and tax data on the General Department of Taxation of Vietnam’s electronic portal.

- Collaborating with banks to sign and implement agreements to coordinate the collection of the state budget.

- Providing business and technical support to banks/State Treasury during the implementation of the state budget collection coordination.

- Issuing electronic tax transaction accounts to taxpayers as per the regulations of the Ministry of Finance regarding electronic transactions in the field of taxation; guiding taxpayers in preparing tax payment slips or state budget payment documents; providing taxpayers with tax data to facilitate the preparation of payment documents in a complete and accurate manner; confirming paid taxes upon the taxpayer's request.

- Receiving information about paid taxes from the State Treasury and banks to aid in tax management; reviewing collections with the State Treasury, banks, and taxpayers; addressing errors related to contributions to the state budget.

- Coordinating with the State Treasury to reconcile figures, ensuring the alignment of amounts paid to the state budget before closing the tax accounting records.

- Considering suspending or terminating budget collection coordination with banks if the bank fails to meet the budget collection coordination agreement or violates legal regulations regarding tax management.