What is the latest resource royalty declaration form for petroleum in Vietnam?

What is the latest resource royalty declaration form for petroleum in Vietnam?

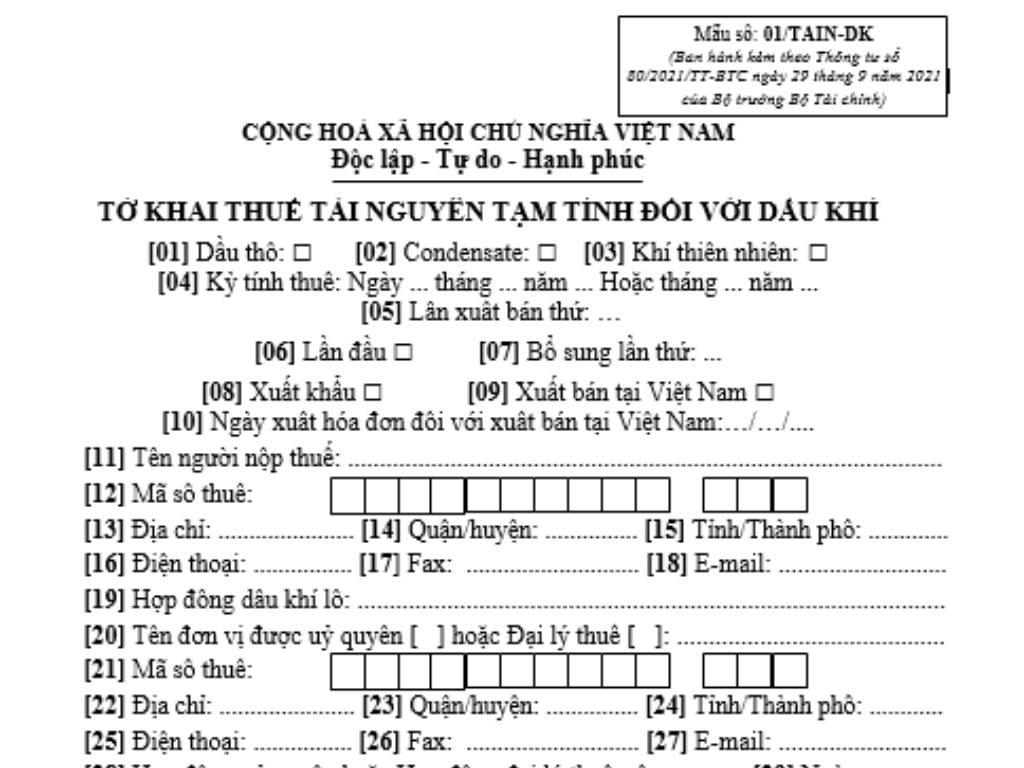

The resource royalty declaration form for petroleum is Form No. 01/TAIN-DK as stipulated in Section XII of Appendix II Catalogue of tax declaration forms issued under Circular 80/2021/TT-BTC as follows:

The latest resource royalty declaration form for petroleum Download

What is the latest resource royalty declaration form for petroleum in Vietnam? (Image from the Internet)

Where is the location to submit the resource royalty declaration dossier in Vietnam?

According to Article 45 of the Law on Tax Administration 2019, the location to submit the resource royalty declaration dossier is stipulated as follows:

- Taxpayers submit the tax declaration dossier at the directly managing tax authority.

- In case of submitting the tax declaration dossier under the one-stop-shop mechanism, the location for submitting the tax declaration dossier shall comply with the provisions of that mechanism.

- The location to submit the tax declaration dossier for export and import goods is in accordance with the provisions of the Customs Law.

- the Government of Vietnam prescribes the location to submit tax declaration dossiers for the following cases:

+ Taxpayers with multiple production and business activities;

+ Taxpayers conducting production and business activities in multiple locations; taxpayers with tax obligations arising from taxes declared and paid on a per-arising basis;

+ Taxpayers with tax obligations arising from revenues from land; licensing of water resource exploitation, mineral resources;

+ Taxpayers with personal income tax finalization obligations;

+ Taxpayers declaring taxes through electronic transactions and other necessary cases.

Which entities are the resource royalty payers in Vietnam?

Pursuant to Article 3 of Circular 152/2015/TT-BTC, the resource royaltypayer is an organization, individual exploiting the natural resources subject to the aforesaid resource royalty. Resource taxpayers in certain cases are specifically prescribed as follows:

- For mineral resources exploitation activities, the taxpayer is the organization or business household granted the Mineral Exploitation License by the competent state agency.

+ If the organization is granted the Mineral Exploitation License by the competent state agency, is permitted to cooperate with organizations, individuals in resource exploitation and has specific taxpayer provisions, the resource royaltypayer is determined according to that document.

+ If the organization is granted the Mineral Exploitation License by the competent state agency and thereafter assigns units under its control to carry out resource exploitation, each extracting unit is the resource royaltypayer.

- The resource-exploiting enterprise established on a joint-venture basis is the joint-venture enterprise which is the taxpayer;

+ If the Vietnamese party and the foreign party together execute a business cooperation contract for resource extraction, the tax obligation of each party must be specifically defined in the business cooperation contract;

+ If the business cooperation contract does not specifically define the party responsible for paying the resource royalty, all parties involved in the contract must declare and pay the resource royalty or appoint a representative to pay the resource royalty on behalf of the business cooperation contract.

- Organizations or individuals contracting the construction project during the execution may generate a resource yield permitted by the state authority or not in conflict with legal regulations on resource management and exploitation. If they exploit, use, or consume the resources, they must declare and pay resource royalty to the local tax authority where the resource exploitation occurs.

- Organizations, individuals using water from irrigation works to generate electricity are resource royaltypayers as per Circular 152/2015/TT-BTC, regardless of the investment source of the irrigation work. If the irrigation works management organization supplies water to other organizations or individuals for domestic water production or other purposes (except for electricity generation), the irrigation works management organization is the taxpayer.

- For prohibited or illegal exploitation of natural resources that have been seized, confiscated and are subject to the resource royalty and allowed for sale, the organization in charge of selling must declare and pay the resource royalty each time it arises at the directly managing tax authority before deducting related expenses for seizure activities, auction sales, and rewards according to the prescribed policies.