What is the latest notice form on the extension of exit suspension for failing to fulfill tax liability in Vietnam?

What is the latest notice form on the extension of exit suspension for failing to fulfill tax liability in Vietnam?

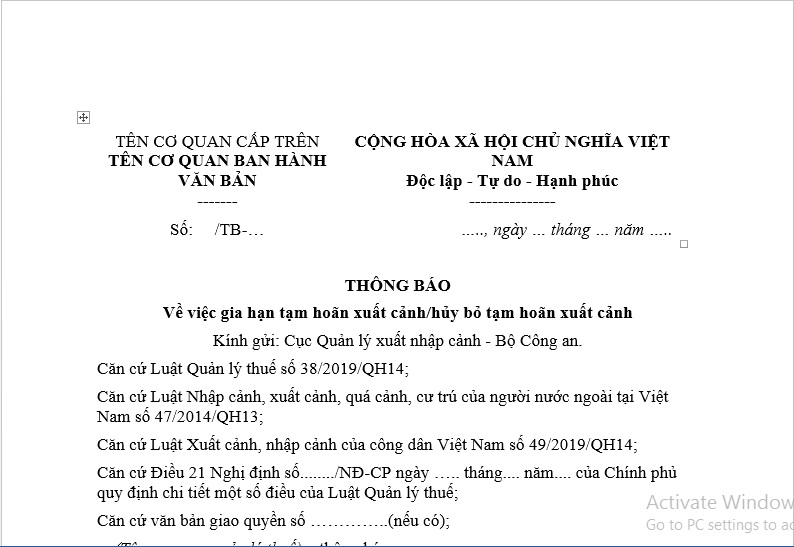

The latest 2024 notice form on the extension of exit suspension for failing to fulfill tax liability is Template No. 02/XC in Appendix 3 issued together with Decree 126/2020/ND-CP.

The latest 2024 notice form on the extension of exit suspension for failing to fulfill tax liability is as follows:

notice form on the extension of exit suspension for failing to fulfill tax liability... Download

What are the procedures for implementing the extension of exit suspension in Vietnam?

According to Clause 3, Article 21 of Decree 126/2020/ND-CP, the procedures for implementing the extension of exit suspension are as follows:

- After reviewing, cross-checking, and accurately identifying the taxpayer's tax obligations, the tax authority directly managing the taxpayer prepares a list of individuals, including the legal representative of an enterprise falling under the category of exit suspension, and drafts documents according to Template No. 01/XC in Appendix 3 issued with Decree 126/2020/ND-CP to send to the immigration management authority. A copy is also sent to the taxpayer to complete their tax obligations before departure.

- On the day of receiving the exit suspension document from the tax authority, the immigration management authority must carry out the exit suspension as prescribed and publish it on their electronic information portal.

- If the taxpayer has completed their tax obligations, within 24 working hours, the tax authority must issue a document canceling the exit suspension using Template No. 02/XC in Appendix 3 issued with Decree 126/2020/ND-CP and send it to the immigration management authority to execute the cancellation of the exit suspension as prescribed.

Thirty days before the expiration of the exit suspension period, if the taxpayer has not fulfilled their tax obligations, the tax authority must send a document extending the exit suspension using Template No. 02/XC in Appendix 3 issued with Decree 126/2020/ND-CP to the immigration management authority, simultaneously notifying the taxpayer.

- Documents on exit suspension, extension of exit suspension, cancellation of exit suspension can be sent by postal service or electronically if electronic transactions are feasible and published on the tax authority's electronic information portal.

Documents sent to taxpayers by postal service that are returned but have been published on the tax authority's electronic information portal are considered as sent.

What are the cases of exit suspension in Vietnam?

Based on Article 36 of the Law on Exit and Entry of Vietnamese Citizens 2019, the cases of exit suspension are regulated as follows:

(1) Defendants, suspects; persons reported or petitioned for prosecution who, upon inspection and verification, have reasonable grounds to suspect the commission of a crime and need immediate prevention from fleeing or destroying evidence as regulated by the Criminal Procedure Code.

(2) Persons whose prison sentence execution is postponed, temporarily suspended, conditionally released early, suspended sentences during probation, and those serving non-custodial reform sentences during the execution of the sentence as regulated by the Law on Execution of Criminal Judgments.

(3) Persons with obligations according to civil procedure law if there are grounds indicating the linkage of their obligations to the state, agencies, organizations, individuals or their departure affects the resolution of the case, the interests of the state, or the legitimate rights and interests of agencies, organizations, or individuals, or to ensure the enforcement of judgments.

(4) Persons required to enforce civil judgments, legal representatives of agencies, organizations with the obligation to execute judgments, as prescribed by the law on civil judgment enforcement, if their departure affects state interests or the legitimate rights and interests of agencies, organizations, or individuals or to ensure judgment enforcement.

(5) Taxpayers, legal representatives of businesses under enforced execution of administrative decisions on tax management obligations, Vietnamese citizens emigrating or residing abroad before departing who have not fulfilled tax obligations as prescribed by tax management laws.

(6) Persons under enforcement, representative of organizations under enforcement of administrative penalty decisions when deemed necessary to immediately prevent escape.

(7) Persons undergoing inspection, examination, verification with sufficient grounds to determine a serious violation and deemed necessary to immediately prevent escape.

(8) Persons with dangerous communicable diseases when deemed necessary to immediately control, preventing community transmission unless entry is permitted by the foreign side.

(9) Persons whose departure, as determined by competent authorities, affects national defense, security.

What is the duration of exit suspension and extension of exit suspension in Vietnam?

According to Article 38 of the Law on Exit and Entry of Vietnamese Citizens 2019, the duration of exit suspension and its extension are regulated as follows:

- In the case mentioned in (1) above, the duration of exit suspension is executed according to the Criminal Procedure Code 2015;

- In the cases mentioned in (2), (3), (4), (5), and (6) above, exit suspension ends when the violator, or obligated person, completes the judgment or decision of a competent body, or as stipulated by the Law on Exit and Entry of Vietnamese Citizens 2019;

- In the case mentioned in (7) above, the exit suspension duration does not exceed 01 year and may be extended, each extension being no more than 01 year;

- In the case mentioned in (8) above, the exit suspension does not exceed 06 months and may be extended, each extension being no more than 06 months;

Label d) In the case mentioned in (9) above, the duration of exit suspension is calculated until it no longer affects national defense or security as decided by the Minister of National Defense and the Minister of Public Security.