What is the latest licensing fee declaration in Vietnam in 2025? When is the deadline for paying the licensing fee in Vietnam for 2025?

What is the latest licensing fee declaration in Vietnam in 2025?

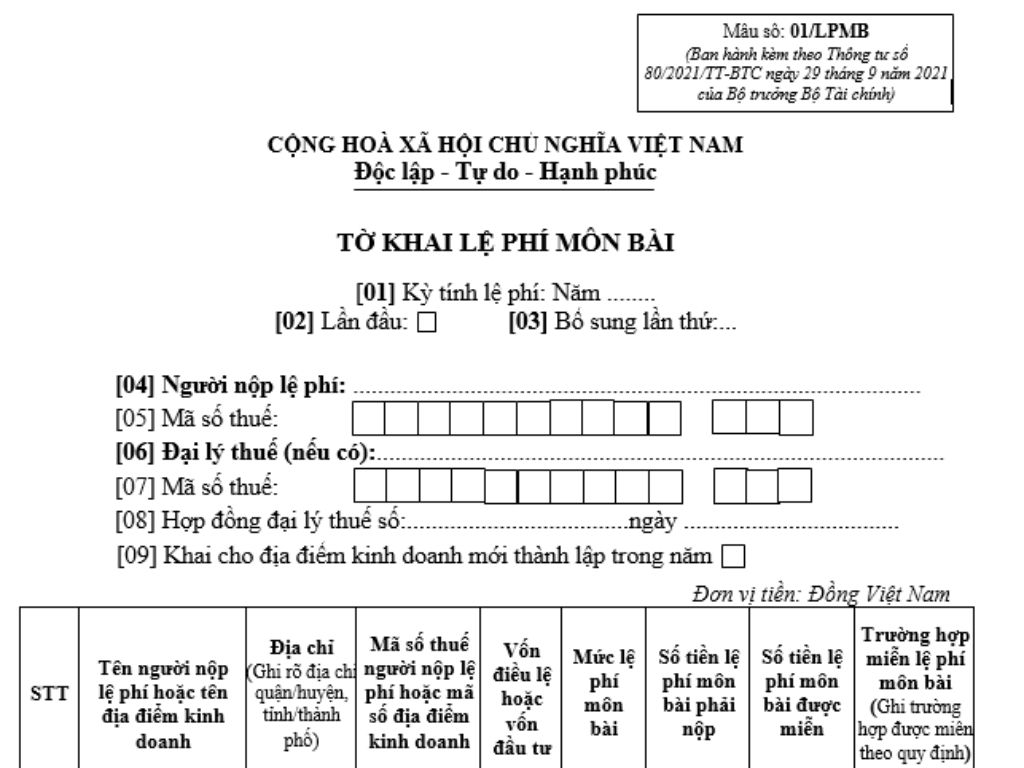

The latest licensing fee declaration 2025 is Form 01/LPMB stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC.

To be specific, the latest licensing fee declaration 2025 is as follows:

The latest licensing fee declaration 2025 Download Here

What is the latest licensing fee declaration in Vietnam in 2025? When is the deadline for paying the licensing fee in Vietnam for 2025? (Image from internet)

When is the deadline for paying the licensing fee in Vietnam for 2025?

According to Clause 9, Article 18 of Decree 126/2020/ND-CP, the deadline for paying the licensing fee for 2025 is stipulated as follows:

Deadline for paying taxes to the state budget from land, water resource exploitation rights, mineral resources, sea area use fees, registration fees, licensing fees

…

9. licensing fee:

a) The deadline for paying the licensing fee is no later than January 30 each year.

b) For small and medium-sized enterprises converted from business households (including dependent units and business locations of the enterprise) when the period of exemption from licensing fees ends (the fourth year since the establishment of the enterprise), the deadline for paying the licensing fee is as follows:

b.1) In the case the period of exemption ends in the first 6 months of the year, the deadline for paying the licensing fee is no later than July 30 of the year the exemption period ends.

b.2) In the case the period of exemption ends in the last 6 months of the year, the deadline for paying the licensing fee is no later than January 30 of the year following the year the exemption period ends.

c) For business households and individuals who ceased business operations and resumed thereafter, the deadline for paying the licensing fee is as follows:

c.1) In the case of resuming operations in the first 6 months of the year: No later than July 30 of the year resuming operations.

c.2) In the case of resuming operations in the last 6 months of the year: No later than January 30 of the year following the year resuming operations.

Thus, according to the above regulation, the latest deadline for licensing fee payment is January 30 each year.

However, January 30, 2025, falls on the second day of the Lunar New Year, so the latest submission date for the licensing fee is February 3, 2025 (Monday).

Note: For cases of small and medium-sized enterprises converted from business households when the period of exemption from licensing fees ends and business households, individual businesses that ceased operations and resumed later, the deadline for paying the licensing fee in 2025 is according to Points b and c, Clause 9, Article 18 of Decree 126/2020/ND-CP.

What is the late payment interest for licensing fee in Vietnam in 2025?

According to Clause 2, Article 59 of the Law on Tax Administration 2019, amended by Clause 7, Article 6 of the Law amending the Law on Securities, Law on Accounting, Law on Independent Audit, Law on State Budget, Law on Management and Use of Public Assets, Law on Tax Administration, Law on Personal Income Tax, Law on National Reserve, Law on Handling Administrative Violations 2024, the late payment fee and the timeline for calculating the late fee for the licensing fee 2025 are regulated as follows:

Handling of Late Tax Payment

1. Cases required to pay late tax payment include:

a) Taxpayers who pay taxes late compared to the stipulated deadlines, extended tax deadlines, deadlines specified in tax administration notices, or deadlines in imposed tax or administrative handling decisions of the tax management authority;

b) Taxpayers supplementing tax declaration dossiers increasing the payable tax amount or detected by tax authorities, competent state agencies inspecting, auditing underdeclared payable tax amounts must pay late tax payment for the increased payable tax amount from the day following the last date for the deadline of filing taxes with incorrect or missing calculations or since the tax declaration in the original customs declaration;

c) Taxpayers supplementing tax declaration dossiers reducing the refunded tax amount or detected by tax authorities, competent state agencies inspecting, auditing less tax refunded than the refunded tax amount must pay late tax payment on the refunded tax amount to be recovered from the date when receiving the refund from the state budget;

d) In cases permitted to gradually pay tax debts as prescribed in Clause 5, Article 124 of this Law;

đ) Cases not subject to administrative penalties for tax administration violations due to statute of limitations but still subject to tax recovery for underpaid taxes as prescribed in Clause 3, Article 137 of this Law;

e) Cases not subject to administrative penalties for tax administration violations for the acts specified in Clause 3 and Clause 4, Article 142 of this Law;

g) Agencies, organizations authorized by the tax administration agency to collect taxes who delay in transferring tax money, late payment money, and penalties of taxpayers to the state budget must pay late tax payment for late transfer money as stipulated.

2. Calculation of late payment and time of late payment calculation is regulated as follows:

a) The late payment calculation rate is 0.03%/day calculated on the delayed tax payment amount;

b) The time of calculating the late payment money is continuous from the day following the last day of the tax payment deadline, extended tax payment deadline, deadline in announcement or imposed tax decision, administrative decisions of the tax authority up to the day proceeding the day when the tax debt money, retrieved refund money, additional tax, imposed tax, delayed transfer tax is paid into the state budget

....

Thus, according to the above regulation, the late payment rate for the licensing fee 2025 is 0.03%/day calculated on the delayed tax payment amount.