What is the latest Form of declaration for connecting with the e-invoice information portal in Vietnam (Form No. 01/CCTT-KN)?

Who is responsible for developing and announcing the technical requirements for connecting to the e-invoice information portal in Vietnam?

Based on the provisions of Article 52 of Decree 123/2020/ND-CP regarding the responsibilities of the General Department of Taxation of Vietnam as follows:

Responsibilities of the General Department of Taxation of Vietnam

1. Develop, implement, and operate the electronic information portal, specifically:

a) Ensure that organizations and individuals have convenient access; provide tools to search information and data that are user-friendly and yield accurate search results;

b) Ensure information and data formats comply with defined standards and technical regulations for easy downloading, quick display, and printing using popular electronic means;

c) Ensure the system operates continuously and stably, guaranteeing information security;

d) Lead in providing usage guidance and operational support for the system.

2. Manage the registration for the use of e-invoice information and electronic documents by information users.

3. Deploy and announce email addresses and phone numbers for the provision of e-invoice and document information.

4. Develop and publish the technical requirements for connecting to the e-invoice information portal.

5. In case of temporarily suspending the provision of e-invoice information, the General Department of Taxation of Vietnam shall notify the information users. The notification must specify the estimated time for resuming information provision activities.

Thus, the General Department of Taxation of Vietnam is responsible for developing and announcing the technical requirements for connecting to the e-invoice information portal.

What is the Form of declaration for connecting with the e-invoice information portal (Form No. 01/CCTT-KN)?

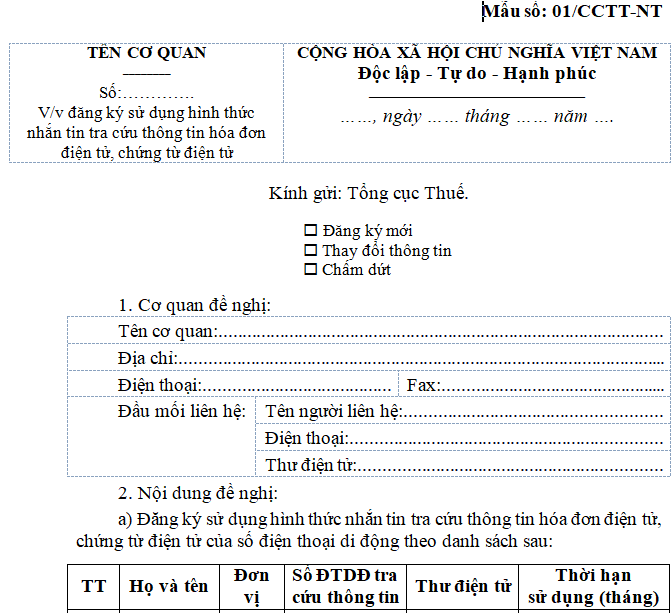

The Form of Declaration for Connecting with the e-invoice information portal is Form No. 01/CCTT-KN Appendix II issued together with Decree 123/2020/ND-CP.

DOWNLOAD >>> Form No. 01/CCTT-NT

What is the latest Form of declaration for connecting with the e-invoice information portal in Vietnam (Form No. 01/CCTT-KN)? (Image from Internet)

What is the procedure for registering to connect with the e-invoice information portal according to the guidance of the Ministry of Finance of Vietnam?

The procedure for registering to connect with the e-invoice information portal is specifically guided in Subsection 4, Section I of the newly issued, modified, replaced, or abolished administrative procedures in the field of Tax Management under the management function of the Ministry of Finance issued with Decision 1464/QD-BTC of 2022:

Step 01: The registration focal point of the information user sends 01 original document to the General Department of Taxation of Vietnam to request a connection to the e-invoice information portal using Form No. 01/CCTT-KN Appendix II issued with Decree 123/2020/ND-CP.

Step 02: Within no more than 03 working days from receiving the request document, the General Department of Taxation of Vietnam will notify the registration focal point of the information user in writing about whether it accepts or does not accept the request, citing reasons if it does not accept.

Step 03:

For cases accepting the system connection: Within no more than 10 working days from the date of sending the notification, the General Department of Taxation of Vietnam will send a survey team to the location and facilities where the information system of the user is implemented to check compliance with the requirements;

If the survey team's report confirms that the information system of the user meets the requirements, within no more than 10 working days, the General Department of Taxation of Vietnam will inform the user in writing about being eligible for connection and coordinate to connect the systems to provide e-invoice and document information;

If the survey team's report confirms that the information system of the user does not meet the requirements, within no more than 10 working days, the General Department of Taxation of Vietnam will inform the user in writing about not being eligible for connection and coordinate connecting the systems to provide e-invoice and document information.

What are procedures for connection with the e-invoice information portal executed according to the guidance of the Ministry of Finance of Vietnam?

The method of executing the registration for connection with the e-invoice information portal is specifically guided in Subsection 4, Section I of the newly issued, modified, replaced, or abolished administrative procedures in the field of Tax Management under the management function of the Ministry of Finance issued with Decision 1464/QD-BTC of 2022:

* Documentation Components:

Form No. 01/CCTT-KN: Connection, discontinuation of connection with the e-invoice, and Document information portal

DOWNLOAD >>> Form No. 01/CCTT-KN

* Number of documents: 01 (set)

* Method of submission:

Option 01: Directly

Within no more than 03 working days from receiving the request document, the General Department of Taxation of Vietnam will notify in writing about acceptance or rejection.

Option 02: Online

Within no more than 03 working days from receiving the request document, the General Department of Taxation of Vietnam will notify in writing about acceptance or rejection.

Option 03: Postal services

Within no more than 03 working days from receiving the request document, the General Department of Taxation of Vietnam will notify in writing about acceptance or rejection.

* Processing time: 03 working days

* Fees, charges: None