What is the latest form of corporate power of attorney granted to an individual in Vietnam in 2025? Which entity is authorized, guaranteed, and pays export duty on behalf of the taxpayer in Vietnam?

What is the latest form of corporate power of attorney granted to an individual in Vietnam in 2025?

In today's business environment, authorizing an individual to perform certain tasks on behalf of a company is very common and necessary. The corporate power of attorney for individuals is an important legal document that helps a company authorize an individual to represent it in specific activities such as contract signing, administrative work, or conducting other transactions. Properly drafting and utilizing a power of attorney not only helps the company operate efficiently but also ensures legal compliance in transactions.

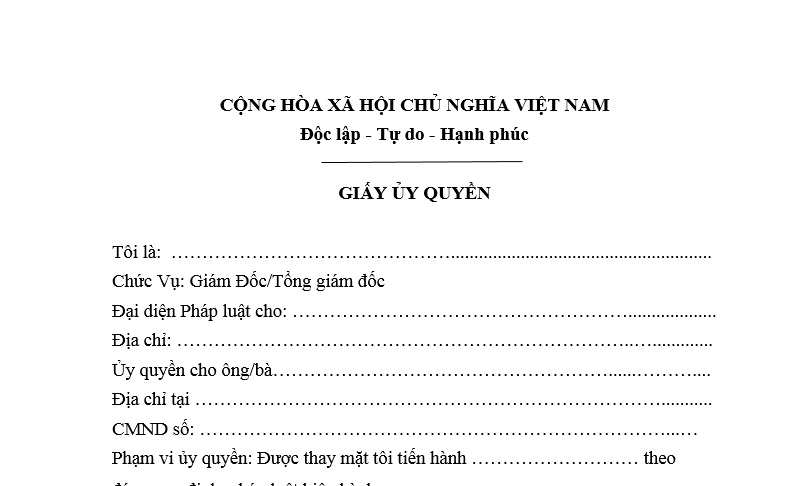

There is currently no specific regulation on the form of a corporate power of attorney for individuals. Below is the form of corporate power of attorney granted to an individual 2025 that you can refer to:

Latest form of corporate power of attorney granted to an individual 2025...Download

What is the latest form of corporate power of attorney granted to an individual in Vietnam in 2025? (Image from the Internet)

Which entity is authorized, guaranteed, and pays export duty on behalf of the taxpayer in Vietnam?

According to the provisions of Clause 4, Article 3 of the Law on Export and Import Tax 2016 on persons authorized, guaranteed, and paying export duty on behalf of the taxpayer, include:

- Customs procedure agent when authorized by the taxpayer to pay export duty;

- Enterprises providing postal services, international express delivery services when paying taxes on behalf of the taxpayer;

- Credit institutions or other organizations operating under the Law on Credit Institutions when guaranteeing and paying taxes on behalf of the taxpayer;

- The person authorized by the owner of the goods in case the goods are gifts, presents of individuals; luggage sent before or after the trip of people exiting or entering;

- Branch of the enterprise authorized to pay taxes on behalf of the enterprise;

- Others authorized to pay taxes on behalf of the taxpayer in accordance with the law.

Which cases are exempt from export-import duties in Vietnam?

According to Article 16 of the Law on Export and Import Tax 2016, the cases exempt from export-import duties are as follows:

- Export, import goods of foreign organizations or individuals enjoying privileges and immunities in Vietnam within the limit specified in international treaties to which the Socialist Republic of Vietnam is a member; goods within the duty-free allowance for exiting and entering passengers; import goods for sale at duty-free shops.

- Movable assets, gifts, presents within the limit from foreign organizations, individuals to Vietnamese organizations, individuals, or vice versa.

Movable assets, gifts, and presents exceeding the duty-free limit must pay taxes on the excess, except where the recipient unit is an agency or organization funded by the state budget and is authorized to receive or for humanitarian, charitable purposes.

- Goods traded or exchanged across borders by border residents belonging to the list and within the limit to serve the production and consumption needs of border residents.

In cases where goods are purchased, transported within the duty-free limit but not used for production, consumption of border residents, and export-import goods of foreign traders are allowed to trade at border markets, taxes must be paid.

- Goods exempt from export-import duties under international agreements to which the Socialist Republic of Vietnam is a member.

- Goods with value or tax due below the minimum threshold.

- Raw materials, supplies, components imported for processing export products; finished products imported for attachment to processed products; products exported after processing.

Export products processed from domestic raw materials and supplies subject to export duty are not exempt from tax on the value of domestic raw materials and supplies that constitute the export product.

Goods exported for processing and then imported are exempt from export and import duties on the value of raw materials constituting the processed product. As for goods exported for processing and then imported that are resources, minerals, or products with the total value of resources, minerals, and energy costs accounting for 51% or more of the product's cost, no tax exemption applies.

- Raw materials, supplies, and components imported to manufacture export goods.

- Goods produced, processed, recycled, assembled in non-tariff zones without using imported materials and parts from abroad when imported into the domestic market.

- Goods temporarily imported for re-export or temporarily exported for re-import within a specified period, including:

+ Goods temporarily imported, re-exported, temporarily exported, re-imported to organize or attend fairs, exhibitions, product introductions, sports, cultural, artistic events, or other events; machinery and equipment temporarily imported, re-exported for testing, research, and development of products; professional equipment temporarily imported, re-exported, temporarily exported, re-imported for a specific period or serving as processing for foreign merchants, except where machinery, equipment, tools, and means of transport of organizations and individuals are allowed to temporarily import, re-export to perform investment projects, construction works, installations, serving production;

+ Machinery and equipment, components, spare parts temporarily imported for replacement, repair of foreign ships and aircraft, or temporarily exported for replacement, repair of Vietnamese ships and aircraft abroad; goods temporarily imported, re-exported for supply to foreign ships and aircraft docked at Vietnamese ports;

+ Goods temporarily imported, re-exported or temporarily exported, re-imported for warranty, repair, replacement;

+ Round-trip transport means temporarily imported, re-exported or temporarily exported, re-imported to contain export-import goods;

+ Goods temporarily imported for re-export trading within the temporary import, re-export period (including extensions) are guaranteed by credit organizations or have deposited an amount equivalent to the import tax of temporarily imported goods for re-export.

- Non-commercial goods in the following cases: samples; pictures, films, models replacing samples; small quantities of promotional publications.

- Imported goods to create fixed assets of entities enjoying investment incentives according to the law on investment, including:

+ Machinery and equipment; components, details, detachable parts, spare parts for assembly or use with machinery and equipment; raw materials and supplies for manufacturing machinery and equipment or for manufacturing components, details, detachable parts, spare parts of machinery and equipment;

+ Specialized transportation means in the technology chain directly used for production activities of the project;

+ Construction materials not yet produced domestically.

Import duty exemption for imported goods specified in this clause applies to both new investment projects and expansion investment projects.

- Varieties of plants; animal breeds; fertilizers, plant protection drugs not produced domestically, necessary for import according to the authorized state management agency.

- Raw materials, supplies, components not yet produced domestically imported for production of investment projects in special preferential investment sectors or in areas with extremely difficult socio-economic conditions according to investment law, high-tech enterprises, scientific and technological enterprises, scientific and technological organizations are exempt from import tax for a period of 5 years, starting from production commencement.

Import duty exemption specified in this clause does not apply to mining projects; projects producing products with a total value of resources and minerals combined with energy costs accounting for 51% or more of the cost; projects producing, trading goods, and services subject to special consumption tax.

- Raw materials, supplies, components not yet produced domestically of investment projects for manufacturing, assembling medical equipment prioritized for research, manufacturing are exempt from import tax for a period of 5 years, starting from production commencement.

- Imported goods serving oil and gas activities, including:

+ Machinery, equipment, spare parts, specialized transportation means necessary for oil and gas activities, including temporary import and re-export cases;

+ Components, details, detachable parts, spare parts for assembly or use with machinery and equipment; raw materials and supplies for manufacturing machinery and equipment or manufacturing components, details, detachable parts, spare parts of machinery and equipment necessary for oil and gas activities;

+ Supplies necessary for oil and gas activities not yet produced domestically.

- Projects, shipbuilding facilities listed in the priority sectors by the investment law, granted tax exemptions for:

+ Imported goods to create fixed assets of shipbuilding facilities, including: machinery, equipment; components, details, detachable parts, spare parts for assembly or use with machinery and equipment; raw materials and supplies for manufacturing machinery and equipment or for manufacturing components, details, detachable parts, spare parts of machinery and equipment; transportation means in the technology chain directly serving shipbuilding activities; construction materials not yet produced domestically;

+ Imported goods are machinery, equipment, raw materials, supplies, components, semi-finished products not produced domestically for shipbuilding;

+ Exported ships.

- Machinery, equipment, raw materials, supplies, components, parts, and accessories imported serving printing and coin minting activities.

- Imported goods are raw materials, supplies, components not yet produced domestically serving directly for manufacturing IT products, digital content, software.

- Export-import goods for environmental protection, including:

+ Machinery, equipment, transportation means, tools, specialized supplies not yet produced domestically for collection, transportation, treatment, processing wastewater, waste, exhaust gas, environmental observation and analysis, renewable energy production; environmental pollution treatment and incident response, handling;

+ Export products manufactured from recycling or waste treatment.

- Imported goods are specialized in serving directly for education not produced domestically.

- Imported goods are machinery, equipment, spare parts, specialized materials not yet produced domestically, scientific materials, and specialized scientific journals directly used for scientific research, technology development, innovation incubation activities, fostering technology enterprises, and science and technology enterprises.

- Imported goods specialized in serving directly for security, national defense, in which specialized transportation means must not be produced domestically.

- Export-import goods serving social welfare assurance, natural disaster, disaster, epidemic recovery, and other special cases.