What is the latest form for achievement report of individuals in Vietnam? How to write the latest achievement report? Are the bonuses for the emulation titles above subject to personal income tax in Vietnam?

What is the latest form for achievement report of individuals in Vietnam?

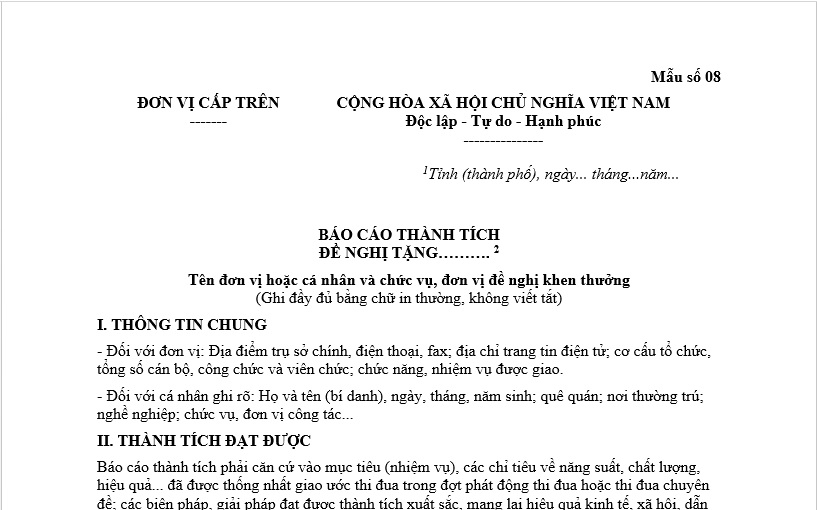

The latest form for an achievement report of individuals (for the request for commendation according to specialized emulation movements) is form 08 as stipulated in Appendix 1 issued together with Decree 98/2023/ND-CP.

The latest achievement report of individuals form for 2024 is as follows:

Download the latest achievement report of individuals form for 2024...Download

How to write the latest achievement report of individuals form for 2024 in Vietnam?

Specifically, in the appendix of form 08 as stipulated in Appendix 1 issued together with Decree 98/2023/ND-CP, there are detailed instructions on how to write each specific section as follows:

(1) Geographical location

(2) Indicate the form of commendation requested. Only apply the forms of commendation under the authority of ministries, central authorities, and local authorities;

In outstanding and exemplary cases, the Prime Minister of the Government of Vietnam may be requested to award the Government of Vietnam Emulation Flag, Certificate of Merit of the Prime Minister of the Government of Vietnam, and in particularly outstanding cases, recommend to the Prime Minister of the Government of Vietnam to propose the President to award a Medal.

(3) For collectives or heads of production and business units, it is necessary to state the fulfillment of obligations to pay the state budget; ensuring the environment, occupational safety, and hygiene, food safety.

(4) For individuals: Indicate "Person reporting the achievement" and sign, clearly stating full name and obtaining confirmation from the head of the agency.

What is the latest form for achievement report of individuals in Vietnam? (Image from the Internet)

How many forms of commendation are there according to regulations in Vietnam?

Based on Article 8 of the Law on Emulation and Commendation 2022, 06 forms of commendation are specified as follows:

(1) Commendation for meritorious services is for individuals and collectives regularly achieving outstanding results in building and defending the Fatherland.

(2) Sudden commendation is promptly awarded to individuals, collectives, and households achieving sudden outstanding results.

(3) Emulation movement commendation is for individuals, collectives, and households with outstanding achievements in emulation movements launched and directed by competent authorities for a specific period or thematic emulation serving the political tasks of the Communist Party and the State.

(4) Lifetime contribution commendation is for individuals with long-term involvement in revolutionary periods or in building and defending the Fatherland, holding leadership or management positions in state agencies, public service providers, political organizations, socio-political organizations, socio-political-professional, social organizations, social-professional organizations assigned by the Communist Party and the State, contributing to the revolutionary cause of the Communist Party and the nation.

(5) Seniority commendation is for individuals in the People's Army and People's Public Security with achievements, having served in the armed forces.

(6) Foreign relations commendation is for Vietnamese individuals and collectives residing abroad; foreign individuals and collectives contributing to the construction and defense of the Vietnamese Fatherland.

Are the bonuses for the emulation titles above subject to personal income tax in Vietnam?

According to point e clause 2 Article 2 of Circular 111/2013/TT-BTC, taxable incomes are defined as follows:

Taxable Incomes

According to Article 3 of the Personal Income Tax Law and Article 3 of Decree No. 65/2013/ND-CP, taxable personal income includes:

...

- Income from salaries and wages

...

e) Bonuses in cash or non-cash form in any manner, including bonuses in securities, except for the following bonuses:

e.1) Bonuses attached to titles awarded by the State, including bonuses attached to emulation titles, commendation forms according to the law on emulation and commendation, specifically:

e.1.1) Bonuses attached to emulation titles such as National Emulation Fighter; Emulation Fighter at the ministerial, sector, central organization, provincial, and city levels directly under the Central Government; Basic Emulation Fighter, Advanced Worker, Advanced Soldier.

e.1.2) Bonuses attached to commendation forms.

e.1.3) Bonuses attached to titles awarded by the State.

e.1.4) Bonuses attached to awards by Associations, Organizations affiliated with Central and Local Political Organizations, Socio-Political Organizations, Social Organizations, Socio-Professional Organizations in accordance with their regulations and consistent with the Law on Emulation and Commendation.

e.1.5) Bonuses attached to Ho Chi Minh Prize, State Prize.

e.1.6) Bonuses attached to Commemorative Medals, Badges.

e.1.7) Bonuses attached to Certificates of Merit and Commendation Letters.

The authority to make commendation decisions and bonus levels attached to the emulation titles, commendation forms mentioned above must comply with the provisions of the Law on Emulation and Commendation.

e.2) Bonuses attached to national and international awards recognized by the State of Vietnam.

e.3) Bonuses for technical improvements, inventions, and discoveries recognized by competent state agencies.

e.4) Bonuses for detecting and reporting law violations to competent state agencies.

...

Thus, bonuses attached to emulation titles in accordance with the law are not subject to personal income tax (PIT).