What is the latest Form 07/DK-NPT-TNCN on dependant registratior application including in personal income tax return in Vietnam in 2025?

What is the latest Form 07/DK-NPT-TNCN on dependant registratior application including in personal income tax return in Vietnam in 2025?

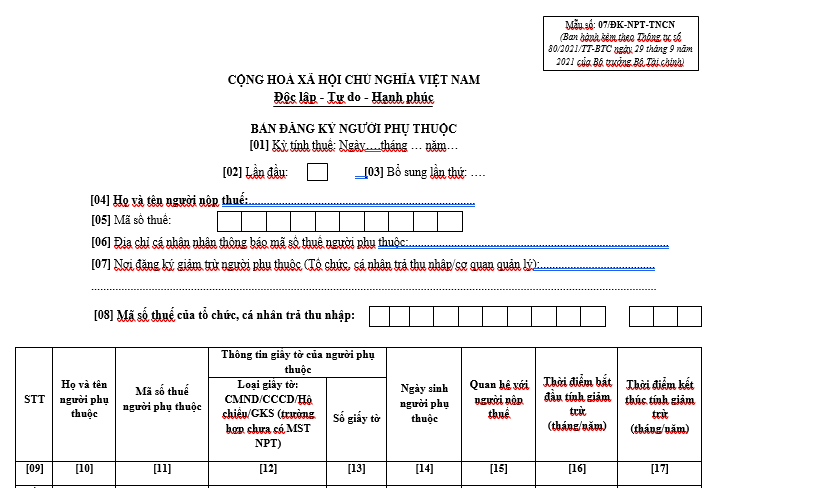

Currently, the latest form for registration of dependants for personal income tax return for the year 2025 is Form 07/DK-NPT-TNCN, issued with Circular 80/2021/TT-BTC as follows:

Download Form 07/DK-NPT-TNCN for registration of dependants for personal income tax return.

What is the latest Form 07/DK-NPT-TNCN on dependant registratior application including in personal income tax return in Vietnam in 2025? (Image from the Internet)

Who are dependants for personal exemption in Vietnam?

According to point d, clause 1, Article 9 of Circular 111/2013/TT-BTC, dependants for personal exemptions are specified as follows:

- Children: biological children, legally adopted children, illegitimate children, stepchildren of a wife or husband, specifically include:

+ Children under 18 years old (calculated by full months).

+ Children 18 years old or older with disabilities, unable to work.

+ Children studying in Vietnam or abroad at university, college, vocational secondary schools, including children 18 years old or older in high school without income or with average monthly income during the year from all sources not exceeding 1,000,000 VND.

- The spouse of the taxpayer meeting conditions at point d, clause 1, Article 9 of Circular 111/2013/TT-BTC.

- Biological father, mother; father-in-law, mother-in-law (or father-in-law, mother-in-law); stepfather, stepmother; legal adoptive father, adoptive mother of the taxpayer meeting conditions at point d, clause 1, Article 9 of Circular 111/2013/TT-BTC.

- Other individuals without support whom the taxpayer must directly nurture and who meet conditions at point d, clause 1, Article 9 of Circular 111/2013/TT-BTC include:

+ Siblings of the taxpayer.

+ Grandparents on both sides, uncles, aunts, maternal uncles, and aunts of the taxpayer.

+ Nephews of the taxpayer including children of siblings.

+ Others required to directly nurture under legal regulations.

Meanwhile, based on point d, clause 1, Article 9 of Circular 111/2013/TT-BTC, conditions for determining dependants of Personal Income Tax taxpayers in cases of spouse; biological parents; in-laws (or in-laws); stepparents; legal adoptive parents; others without support whom the taxpayer must directly support are as follows:

- For dependants of working age, the following conditions must be met:

+ Disabled, unable to work.

+ No income or average monthly income during the year from all sources not exceeding 1,000,000 VND.

- For dependants beyond working age, they must have no income or have average monthly income during the year from all sources not exceeding 1,000,000 VND.

Vietnam: What does the document proving dependant include?

According to point g, clause 1, Article 9 of Circular 111/2013/TT-BTC as amended by Article 1 Circular 79/2022/TT-BTC the document proving dependant includes:

(1) For children:

- Children under 18 years old: Proof documents include a photocopy of the birth certificate and a photocopy of the identity card or citizen identification card (if any).

- Children 18 years old or older with disabilities, unable to work, proof dossier includes:

+ A photocopy of the birth certificate and identity card or citizen identification card (if any).

+ A photocopy of the disability certification according to regulations on persons with disabilities.

+ Children studying at educational levels according to d.1.3, point d, clause 1, Article 9 of Circular 111/2013/TT-BTC, the proof dossier includes:

- A photocopy of the birth certificate.

- A photocopy of the student card or a letter verified by the school or other documents proving they are studying at universities, colleges, vocational schools, high schools, or apprenticing.

- In cases of adopted children, illegitimate children, or stepchildren, besides documents for each case stated, additional documents proving the relationship are needed, such as a photocopy of the governmental decision recognizing adoption, or recognizing parent, child by the competent state authority.

(2) For spouse, proof dossier includes:

- A photocopy of the identity card or citizen identification card.

- A photocopy of the residency information sheet or personal identification notification and information in the national population database or other documents issued by the police authority proving marital relationship or a marriage certificate.

In cases of spouse within working age, besides the above documents, additional proof documents for being unable to work such as a photocopy of the disability certificate according to the legal regulations for the disabled is required, for those unable to work due to disability, a photocopy of the medical records for those suffering from illnesses preventing work capacity (e.g., AIDS, cancer, chronic kidney failure, etc.).

(3) For biological parents, parents-in-law (or in-laws), stepparents, legal adoptive parents, proof dossier includes:

- A photocopy of the identity card or citizen identification card.

- Legal documents to ascertain the relationship with the taxpayer like a photocopy of a certificate.

In the case of being within working age, besides the aforementioned documents, additional proof documents of being disabled, unable to work are required, such as a photocopy of the disability certificate according to legal regulations for those who are disabled, a photocopy of medical records for those suffering from illnesses preventing work capacity (e.g., AIDS, cancer, chronic kidney failure, etc.).

(4) For other individuals as directed in d.4, point d, clause 1, clause 1, Article 9 of Circular 111/2013/TT-BTC, the proof dossier includes:

- A photocopy of the identity card or citizen identification card or birth certificate.

- Legal documents to define the nurturing responsibility according to legal regulations.

In the case of dependants within working age, aside from the aforementioned documents, additional proof documents of being unable to work are needed, such as a photocopy of the disability certificate according to legal regulations for those disabled unable to work, a photocopy of medical records for illnesses preventing work capacity (e.g., AIDS, cancer, chronic kidney failure, etc.).

The legal documents in g.4.2, point g, clause 1, clause 1, Article 9 of Circular 111/2013/TT-BTC include any legal papers identifying the relationship between the taxpayer and the dependant such as:

+ Photocopies of documents determining the legal obligation to provide for nurturance (if any).

+ A photocopy of the residency information sheet or a personal identification notification and information in the national population database or other documents issued by the police authority.

+ A self-declaration by the taxpayer as per the form issued together with Circular 80/2021/TT-BTC and Decree 126/2020/ND-CP verified by the commune-level People's Committee where the taxpayer resides concerning the dependant's cohabitation.

- A self-declaration by the taxpayer as per the form issued together with Circular 80/2021/TT-BTC and Decree 126/2020/ND-CP verified by the commune-level People's Committee where the dependant currently resides regarding the dependant currently living locally and having no one to provide nurturance (if not living together).

(5) For foreign resident individuals, if there are no dossiers according to guidelines for specific cases mentioned above, they must have similar legal documents to substantiate the dependant.

(6) For taxpayers working in economic organizations, administrative, and career bodies with parents, spouses, children, and others considered dependants already specified in the taxpayer's profile, proof dossiers are implemented as per guidelines in g.1, g.2, g.3, g.4, g.5, point g, clause 1, Article 9 Circular 111/2013/TT-BTC or only require a dependants Registration Form as per form issued with Circular 80/2021/TT-BTC and Decree 126/2020/ND-CP confirmed by the Head of the Unit at the left side of the form.

The Head of the Unit is only responsible for the following contents: name of the dependants, year of birth, and relationship to the taxpayer; other contents, the taxpayer is self-declared and takes responsibility.

(7) From the date the Tax Authority notifies the completion of data connection with the national population database, taxpayers do not need to submit the proof documents for dependants mentioned above if the information in these documents is already in the national population database.