What is the latest explanation form for incorrect tax declaration in Vietnam?

What is the latest explanation form for incorrect tax declaration in Vietnam?

Currently, the law does not specifically prescribe a template for tax explanation documents.

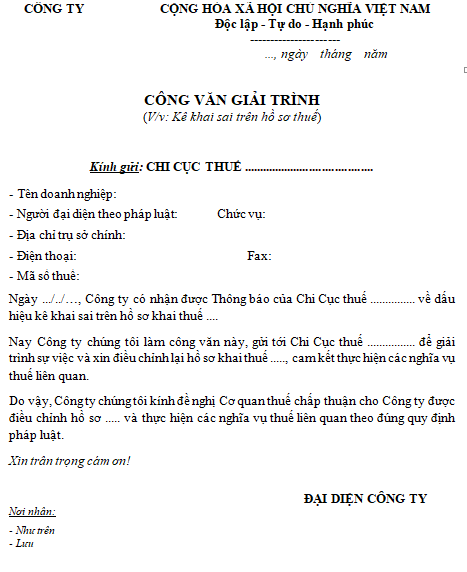

Below is the latest explanation form for incorrect tax declarations for businesses to refer to:

Download the explanation form explaining incorrect tax declaration here.

What is the latest explanation form for incorrect tax declaration in Vietnam? (Image from the Internet)

What are penalties for making false declarations leading to any deficiency or underpayment of taxes payable in Vietnam?

Based on Article 16 of Decree 125/2020/ND-CP, a penalty of 20% of the understated tax or the over-exempted, over-deducted, or over-refunded tax amount shall be imposed for one of the following acts:

(1) Incorrectly declaring the tax calculation basis or deductible tax amount or incorrectly determining cases of tax exemption, reduction, or refund leading to insufficient tax payable or increased tax exemption, reduction, or refund while all economic transactions have been fully recorded in accounting books, invoices, and legal documents;

(2) Incorrectly declaring to reduce payable tax or increase refundable tax or tax exemption/reduction not falling under point (a) of this clause, but the taxpayer has voluntarily filed supplementary declarations and paid the full amount of understated tax to the state budget before the tax authority completes the tax inspection or examination at the taxpayer's headquarters;

(3) Incorrectly declaring to reduce payable tax or increase refundable/exempted/reduced tax has been recorded by a competent authority in tax inspection minutes, administrative violation records confirming it as an act of tax evasion, but the taxpayer has committed an administrative violation of tax evasion for the first time, has filed an supplementary declaration, and has paid the full amount of tax to the state budget before the competent authority issues a penalty decision, and the tax authority has recorded the minutes confirming it as an act of incorrect declaration leading to insufficient tax;

(4) Incorrectly declaring leading to insufficient tax payable or increased tax exemption, reduction, or refund for related-party transactions, but the taxpayer has prepared a market price determination dossier or has prepared and submitted annexes to the tax authority as prescribed for tax management of enterprises with related-party transactions;

(5) Using illegal invoices or documents to account for the value of purchased goods and services to reduce tax payable or increase refundable/exempted/reduced tax, but when detected by the tax authority during inspection, the buyer proves that the violation of using illegal invoices or documents is the seller's fault, and the buyer has fully accounted for it according to regulations.

supplementaryly, individuals and organizations that incorrectly declare tax dossiers leading to insufficient tax payable are also subject to the following remedial measures:

- Must pay the full amount of understated tax, over-refunded, exempted, or reduced tax and late payment interest to the state budget.

In cases where the penalty time limit has expired, the taxpayer will not be penalized according to the above regulations but must pay the full amount of understated tax, over-refunded, exempted, or reduced tax, and late payment interest to the state budget within the period specified in Clause 6, Article 8 of Decree 125/2020/ND-CP;

- Must adjust the loss and deductible VAT for the next period (if any).

Note:

- Taxpayers who incorrectly declared like cases (1), (2), (4) mentioned above but do not lead to insufficient tax payable, increased tax exemption, reduction, or no tax refund yet will not be penalized as per the above regulations but will be penalized according to Clause 3, Article 12 of Decree 125/2020/ND-CP.

- The aforementioned penalty amounts apply to organizations. The penalty amounts for individuals are half the amounts for organizations.

For taxpayers who are households or business households, the penalty amount is applied as for individuals.

Vietnam: What is the guidance on submitting false supplementary tax declarations as per Decree 126?

Based on Clause 4, Article 7 of Decree 126/2020/ND-CP, taxpayers are allowed to file supplementary declarations for each tax dossier with errors, according to Article 47 of the Tax Administration Law 2019 and according to the template prescribed by the Minister of Finance.

Taxpayers shall file supplementary declarations as follows:

- In case of supplementary declarations that do not change tax obligations, only a Supplemental Explanation and related documents are required, not a Supplemental Declaration.

If the tax finalization dossier for the year has not been submitted, taxpayers shall file supplementary declarations for the erroneous month/quarter tax dossiers and cumulatively include the supplementary declared data in the annual tax finalization dossier.

If the annual tax finalization dossier has been submitted, only the annual tax finalization dossier shall be supplemented; supplementaryly, for individual income tax finalization declarations for organizations or individuals paying income from salaries and wages, supplementary monthly/quarterly declarations with errors shall also be submitted.

- If supplementary declarations result in increased tax payable or reduced tax refunded by the state budget, the taxpayer must fully pay the supplementary tax payable or the excess refunded tax and late payment interest to the state budget (if any).

In cases where supplementary declarations only increase or decrease VAT to be carried forward to the next period, they shall be declared in the current tax period. Taxpayers are only allowed to file supplementary declarations to increase the VAT refund claim when they have not submitted the tax declaration for the next tax period and have not submitted the tax refund claim dossier.