What is the latest dependant registration declaration form for personal exemption in Vietnam?

What is the latest dependant registration declaration form for personal exemption in Vietnam?

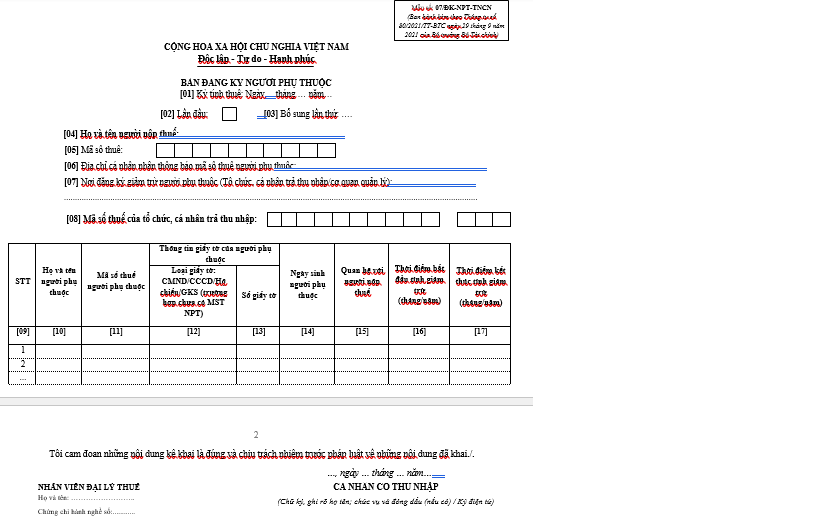

Currently, the latest dependant registration declaration form for personal exemption is Form No. 07/DK-NPT-TNCN issued along with Circular 80/2021/TT-BTC.

Form 07/DK-NPT-TNCN contains the following content:

Download the form 07/DK-NPT-TNCN: registration declaration form for dependant personal exemption

Some notes when filling out Form 07/DK-NPT-TNCN:

- Criterion [16]: is the start time to calculate the dependant deduction. In cases where the taxpayer changes the income payer to calculate the dependant deduction or changes the taxpayer for the dependant deduction, criterion [16] is declared as the start time of the dependant deduction at that organization or the taxpayer. In cases where taxpayers register for dependant deductions for periods before the current year due to settling for previous years, criterion [16] is declared as the start time for the corresponding year’s deduction before the current settlement year.

- Criterion [17]: is the end time for calculating the dependant deduction. If the taxpayer cannot determine the end time for the dependant deduction, this should be left blank. In cases where the taxpayer changes the end time for calculating the dependant deduction (including where criterion [17] had been declared or left blank), the taxpayer should submit a supplementary dependant Registration Form to update criterion [17] to reflect the actual end time for the dependant deduction.

What is the latest dependant registration declaration form for personal exemption in Vietnam? (Image from the Internet)

Who are considered dependants in Vietnam?

According to the provisions at Clause 1, Article 9 of Circular 111/2013/TT-BTC (Provisions related to personal income tax on business individuals in this Article are annulled by Clause 6, Article 25 of Circular 92/2015/TT-BTC), dependants include:

- Children: biological children, legally adopted children, illegitimate children, stepchildren of the spouse. Specific criteria include:

+ Children under 18 years old (calculated in complete months).

+ Children 18 years or older with disabilities, unable to work.

+ Children studying in Vietnam or abroad at the university level, college, professional secondary level, vocational training, including children 18 years or older studying at high school level (including the waiting period for university exam results from June to September of grade 12) with no income or an average monthly income of not more than 1,000,000 VND from all income sources.

- The taxpayer's spouse meeting the conditions:

+ Disabled, unable to work.

+ No income or an average monthly income of not more than 1,000,000 VND from all income sources.

- Biological parents; in-laws (or spouse's parents); stepparents; legally adoptive parents of the taxpayer meeting the conditions:

+ Disabled, unable to work.

+ No income or an average monthly income of not more than 1,000,000 VND from all income sources.

- Other individuals with no support who are directly nurtured by the taxpayer and meet the conditions of (i) Disability, unable to work and (ii) No income or an average monthly income of not more than 1,000,000 VND from all income sources, specifically including:

+ Siblings of the taxpayer.

+ Paternal grandparents, maternal grandparents; uncles, aunts, etc., of the taxpayer.

+ Nephews or nieces of the taxpayer, including children of the taxpayer's siblings.

+ Other directly nurtured persons as prescribed by law.

Moreover, persons beyond working age must have no income or an average monthly income of not more than 1,000,000 VND from all income sources.

How to register a dependant for the first time for income from wages and salaries in Vietnam?

As stipulated at Point h, Clause 1, Article 9 of Circular 111/2013/TT-BTC, the first-time registration of dependants for income from wages and salaries is carried out as follows:

- The taxpayer with income from wages and salaries must register dependants according to the form issued with the tax administration guidance document and submit two (02) copies to the income payer or individual to use as a basis for deducting dependants.

- The income payer or individual retains one (01) registered copy and submits one (01) copy to the directly managing tax agency at the time of submitting the personal income tax declaration for that tax period.

- For individuals filing directly with the tax agency, they must submit one (01) dependant registration form in accordance with the form issued with the tax administration guidance document to the managing tax authority of the income payer at the time of submitting the personal income tax declaration for that tax period.