What is the latest decision form to establish a commune-level tax advisory council in Vietnam?

What is the latest decision form to establish a commune-level tax advisory council in Vietnam?

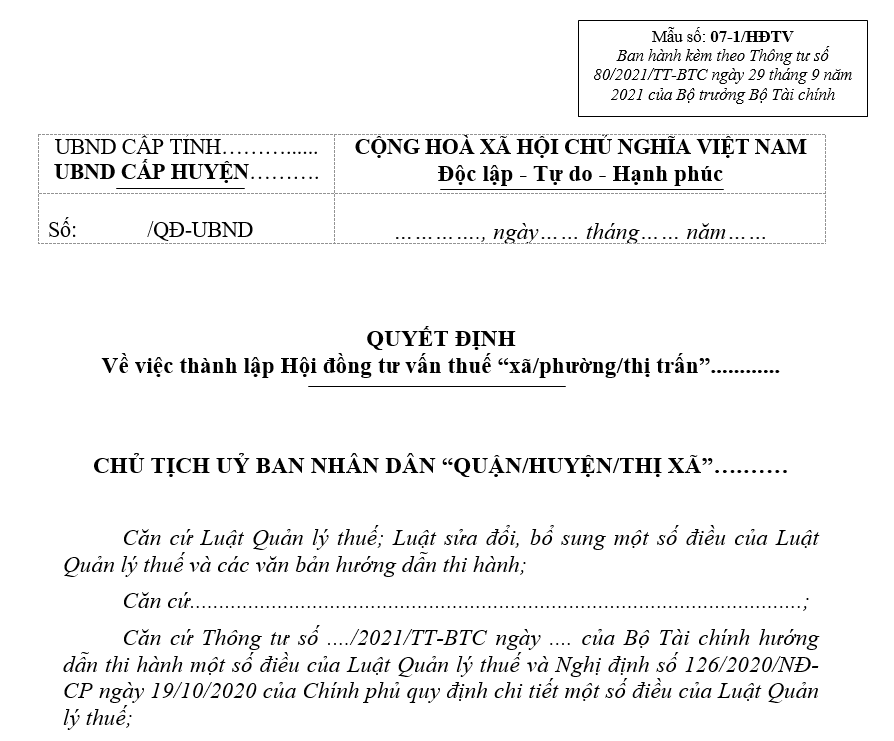

The current Form for the decision to establish a tax advisory council at the commune, ward, or commune-level town level is using Form No. 07-1/HDTV issued under Appendix I Circular 80/2021/TT-BTC as follows:

Form for the decision to establish a commune, ward, or commune-level town tax advisory council: Here

What is the latest decision form to establish a commune-level tax advisory council in Vietnam? (Image from Internet)

Who issues the decision to establish the tax advisory council in Vietnam?

Based on Article 7 of Circular 80/2021/TT-BTC, the regulations are as follows:

Establishment of the tax advisory council

- The Chairman of the District People's Committee, based on the quantity, scale of business, and individual business entities on the local area, shall decide to establish the commune, ward, or commune-level town tax advisory council upon the proposal of the Head of the Tax Department.

- The tax advisory council is established and operates for a maximum term of no more than 5 years.

- The tax advisory council may be re-established or have its members supplemented or replaced in specific cases as follows:

a) Re-establish the tax advisory council when the council's term expires as stipulated in Clause 2 of this Article.

b) Supplement or replace the members of the tax advisory council in the following cases:

b.1) Members no longer meet the specified composition requirements according to Clauses 1, 2 of Article 6 of this Circular;

b.2) Add business households, individual business entities to match the current number of operating business households, individual business entities, or replace business households, individual business entities that have ceased business activities in the commune, ward, or commune-level town area;

b.3) Other changes related to the composition of the tax advisory council as proposed by the Head of the Tax Department.

- Procedures for establishing the tax advisory council

a) The Commune, Ward, or Commune-level Town Fatherland Front proposes and sends the list of business households, individual business entities participating in the tax advisory council to the Tax Department. The Tax Department is responsible for providing information about business households, individual business entities according to the list for the Commune, Ward, or Commune-level Town Fatherland Front to select.

b) The Head of the Tax Department, based on the composition and list of participants in the tax advisory council, proposes that the Chairman of the District People's Committee issue a decision to establish the tax advisory council as prescribed in this Article (according to Form No. 07-1/HDTV issued under Appendix I of this Circular).

The Chairman of the District People's Committee issues a decision to establish the tax advisory council upon the proposal of the Head of the Tax Department.

Who directs the tax advisory council in Vietnam?

Based on Article 8 of Circular 80/2021/TT-BTC, the regulations are as follows:

Principles and policies for the tax advisory council's operations

- The Chairman and members of the tax advisory council work on a concurrent basis. The tax advisory council is directly directed by the Chairman of the tax advisory council on the contents specified in this Circular.

- The tax advisory council convenes to gather opinions from its members on advisory contents as summoned by the Chairman of the tax advisory council. Meetings of the tax advisory council are conducted when presided over by the Chairman of the tax advisory council and attended by at least 2/3 of the total members (including the Chairman). The tax advisory council may collect member opinions on advisory contents through electronic means. In case the members' opinions are not unanimous, a vote must be taken to decide by majority; if the vote results are tied, the decision follows the content with the agreement of the Chairman of the tax advisory council as the basis for drafting the meeting minutes.

- Meetings of the tax advisory council must be recorded in minutes according to Form No. 07-2/HDTV issued under Appendix I of this Circular. The meeting minutes must have the signatures of the attending members of the tax advisory council. In case opinions are collected through electronic means, the standing members of the council compile and record in the minutes as if it were a direct meeting.

The tax advisory council is directly directed by the Chairman of the tax advisory council on the contents specified in Circular 80/2021/TT-BTC.