What is the latest appointment form for chief accountant in Vietnam in 2025?

What is the latest appointment form for chief accountant in Vietnam in 2025?

Based on Article 53 of the Law on Accounting 2015, the chief accountant is regulated as follows:

- The chief accountant is the head of the accounting apparatus of the unit responsible for organizing and executing accounting tasks in the accounting unit.

- The chief accountant of a state agency, organization, public service provider utilizing state budget, and enterprise where the State holds more than 50% of the charter capital, beside the aforementioned tasks, also assists the legal representative of the accounting unit in supervising finance within the accounting unit.

- The chief accountant is subject to the leadership of the legal representative of the accounting unit. If there is a superior accounting unit, the chief accountant is also subject to the direction and supervision of the chief accountant of the superior accounting unit concerning expertise and operations.

In addition, the chief accountant must meet the standards and conditions as stipulated in Article 54 of the Law on Accounting 2015, specifically:

- Possess professional ethical qualities, integrity, honesty, and a sense of law compliance;

- Have qualifications and expertise in accounting from an intermediate level onwards;

- Have a chief accountant training certificate;

- Have at least 2 years of practical experience in accounting for those with an accounting qualification at a university level or higher, and at least 3 years of practical accounting experience for those with intermediate or college-level accounting expertise.

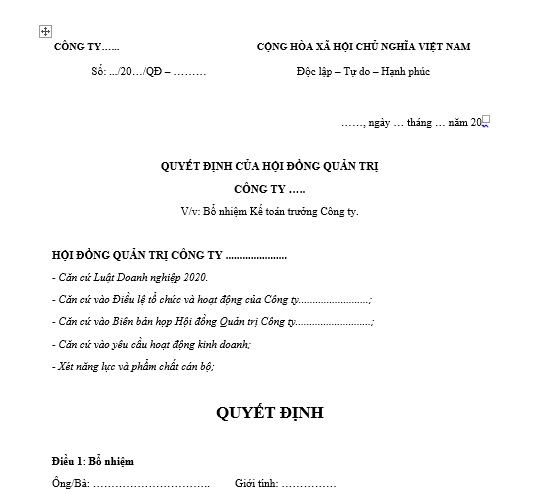

Currently, the law does not specifically regulate the format of the chief accountant appointment decision, so units can refer to commonly used chief accountant appointment forms in enterprises below:

2025 Chief Accountant Appointment Form - Form No. 1...Download

2025 Chief Accountant Appointment Form - Form No. 2...Download

2025 Chief Accountant Appointment Form - Form No. 3...Download

What is the latest appointment form for chief accountant in Vietnam in 2025? (Image from Internet)

When is the data cutoff time for the chief accountant to prepare the tax accounting report in Vietnam?

According to Article 30 of Circular 111/2021/TT-BTC, the regulations are as follows:

data cutoff time for Preparing the Tax Accounting Report

1. The data cutoff time for preparing the tax accounting report is at the time of closing the tax accounting quarter, as prescribed in Article 8 of this Circular.

- In case errors are found after the closing time of the tax accounting quarter before submitting the tax accounting report to the competent state authority, the adjustments to the tax accounting report are made as follows:

a) For adjustments based on a written request from the competent authority, adjust the figures of the previous year's report as requested and provide a detailed explanation.

b) For adjustments due to errors discovered by the tax authority, the adjustment of previous year's report figures must be approved in writing by the General Director of the Tax Administration and accompanied by a detailed explanation.

- After the tax accounting report has been approved by the competent state authority, if there are any adjustments, the previous year's data is adjusted into the current year's report.

Thus, the data cutoff time for the chief accountant to prepare the tax accounting report is at the time of closing the tax accounting quarter.

Does the enterprise notify the tax authority when changing the chief accountant in Vietnam?

According to Article 59 of Decree 01/2021/ND-CP regarding notification of changes in taxpayer registration content:

Notification of Changes in Taxpayer Registration Content

1. If an enterprise changes the content of taxpayer registration without changing the content of business registration, except for changing the tax calculation method, the enterprise sends a notification of changes in business registration content signed by the legal representative of the enterprise to the Business Registration Office where the enterprise's head office is located.

- After receiving the notification, the Business Registration Office issues a receipt, checks the validity of the dossier, inputs data into the National Business Registration Information System, and transfers information to the Taxpayer Registration Information System. If the enterprise requests, the Business Registration Office issues a Certificate of Changes in Business Registration Content to the enterprise.

Moreover, according to Article 31 of the Enterprise Law 2020 regarding notification of changes in business registration content:

Notification of Changes in Business Registration Content

- An enterprise must notify the Business Registration Authority when changing one of the following contents:

a) Business industries and professions;

b) Founding shareholders and foreign investor shareholders for joint stock companies, except for listed companies;

c) Other contents in the business registration dossier.

- The enterprise is responsible for notifying changes in business registration content within 10 days from the date of change.

.....

Therefore, changing the chief accountant is a change in other contents of the business registration dossier.

Hence, when a enterprise changes its chief accountant, it must notify the change in taxpayer registration information to the Business Registration Office - Department of Planning and Investment where the enterprise is headquartered, without notifying the tax authority. The business registration agency is responsible for updating the change in business registration content and transferring the information to the database of the General Department of Taxation.

Therefore, when a enterprise changes its chief accountant, there's no need to notify the tax authority.