What is the latest application form for use of electronic receipt in Vietnam?

What is the latest application form for use of electronic receipt in Vietnam?

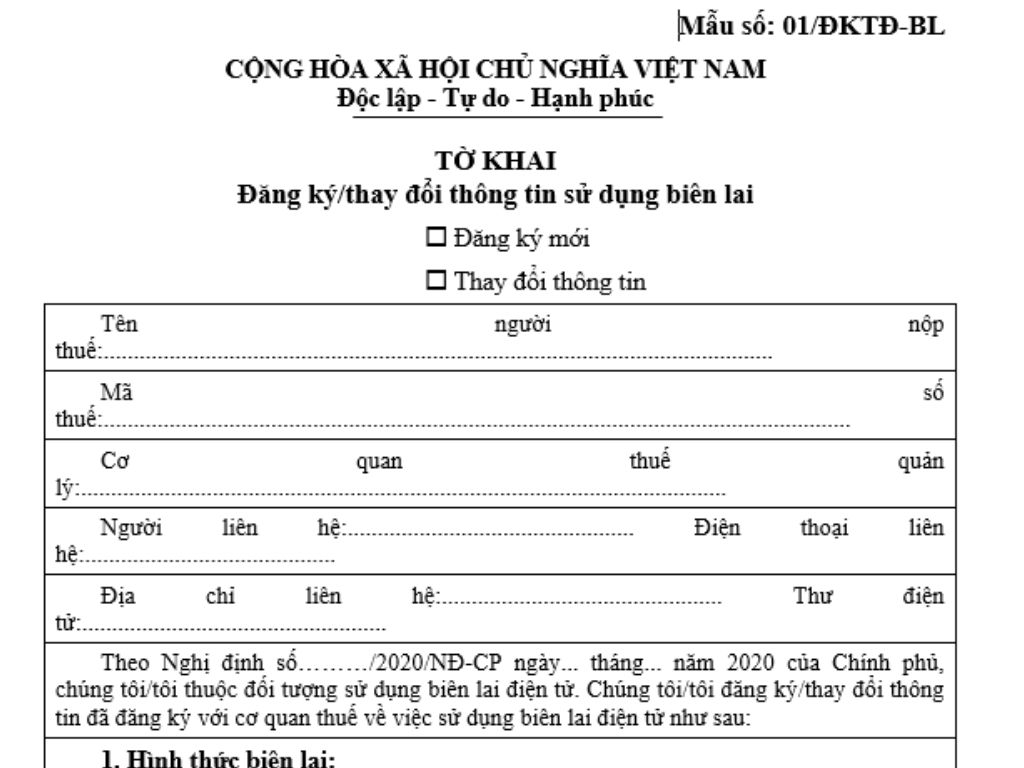

The form for the application for use of electronic receipt is Form No. 01/DK-BL, prescribed in Appendix IA issued together with Decree 123/2020/ND-CP. Below is the form for the application for use of electronic receipt:

>>Download the latest form for the application for use of electronic receipt Download

What is the latest form for the application for use of electronic receipt in Vietnam? (Image from Internet)

What is the format of electronic receipts in Vietnam?

Based on Article 33 of Decree 123/2020/ND-CP, the format of electronic receipts is stipulated as follows:

Format of Electronic Documents

1. Format of electronic receipts:

Receipts specified at Point b, Clause 1, Article 30 of this Decree must comply with the following format:

a) The format of an electronic receipt uses the XML format language (XML is the abbreviation of the English phrase "eXtensible Markup Language" created to share electronic data between IT systems);

b) The format of an electronic receipt consists of two components: the component containing the transaction data of the electronic receipt and the component containing the digital signature data;

c) The General Department of Taxation builds and publishes the component containing the transaction data of electronic receipts, the component containing the digital signature data, and provides tools to display the contents of the electronic receipts as regulated by this Decree.

- Format of electronic documents for personal income tax deduction:

Organizations deducting personal income tax using documents under point a, clause 1, Article 30 of this Decree in electronic form shall self-build software systems to use electronic documents ensuring mandatory contents specified in clause 1, Article 32 of this Decree.

- Electronic documents, electronic receipts must fully and accurately display the contents of the documents to ensure no misleading interpretation so users can read them electronically.

According to the above regulations, electronic receipts are formatted as follows:

- The format of an electronic receipt uses the XML format language (XML is the abbreviation of the English phrase "eXtensible Markup Language" created to share electronic data between IT systems);

- The format of an electronic receipt consists of two components: the component containing the transaction data of the electronic receipt and the component containing the digital signature data;

- The General Department of Taxation builds and publishes the component containing the transaction data of electronic receipts, the component containing the digital signature data, and provides tools to display the contents of the electronic receipts according to Decree 123/2020/ND-CP.

Note: Electronic receipts must fully and accurately display the contents of the documents to ensure no misleading interpretation so users can read them electronically.

What are regulations on the registration for the use of electronic receipts in Vietnam?

Based on Article 34 of Decree 123/2020/ND-CP, the registration for the use of electronic receipts is regulated as follows:

- Organizations collecting fees and charges, before using electronic receipts according to point b, clause 1, Article 30 of Decree 123/2020/ND-CP, must register for usage via the electronic portal of the General Department of Taxation.

+ The registration information content is according to Form No. 01/DK-BL, Appendix IA, issued together with Decree 123/2020/ND-CP.

+ The electronic portal of the General Department of Taxation receives registrations for the use of electronic receipts from organizations collecting fees and charges and sends notifications according to Form No. 01/TB-TNDK, Appendix IB, issued together with Decree 123/2020/ND-CP upon receipt of registration for the use of electronic receipts to confirm the submission of the registration dossier for the use of electronic receipts.

- Within 1 working day from receiving the registration for the use of electronic receipts, the Tax Authority is responsible for sending an Electronic Notice according to Form No. 01/TB-DKDT, Appendix IB, issued together with Decree 123/2020/ND-CP to the subjects specified in clause 1, Article 34 of Decree 123/2020/ND-CP regarding acceptance in case of valid registration for the use of electronic receipts, without errors or rejection due to unqualified or erroneous registrations.

- From the time of using electronic receipts as regulated in Decree 123/2020/ND-CP, organizations collecting fees and charges before using electronic receipts must cancel any unused paper receipts or documents remaining (if any) according to regulations.

- If there are changes in the information registered for the use of electronic receipts, organizations collecting fees and charges under the state's budget must update the information and resend it to the tax authority according to Form No. 01/DK-BL, Appendix IA, issued together with Decree 123/2020/ND-CP via the electronic portal of the General Department of Taxation.