What is the latest 2025 taxpayer registration declaration form for diplomatic missions in Vietnam?

What is the latest 2025 taxpayer registration declaration form for diplomatic missions in Vietnam?

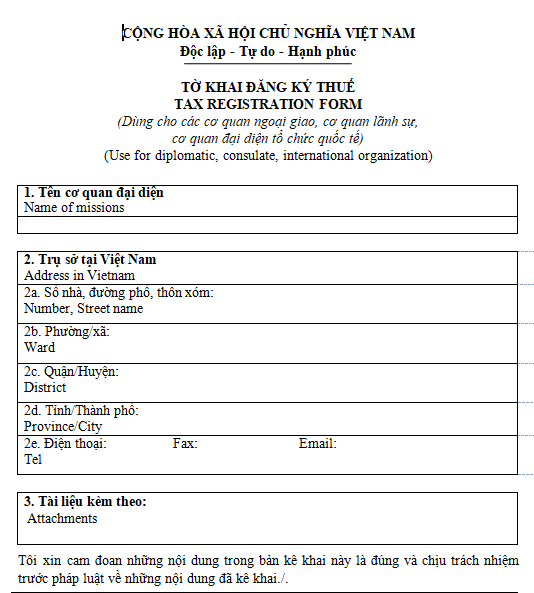

The taxpayer registration declaration form for diplomatic missions is implemented according to Form 06-DK-TCT issued with Circular 105/2020/TT-BTC.

DOWNLOAD >>> Form 06-DK-TCT

Where is the place to submit initial taxpayer registration application for taxpayers as diplomatic missions in Vietnam?

The place of submission and the initial taxpayer registration application are regulated in Clause 3 Article 7 of Circular 105/2020/TT-BTC as follows:

Place of submission and initial taxpayer registration application

The place of submission and initial taxpayer registration application are implemented according to the provisions at Clause 2, Clause 3 Article 31; Clause 2, Clause 3 Article 32 of the Law on Tax Administration and the following provisions:

...

3. For taxpayers who are diplomatic missions, consular agencies, and representative offices of international organizations in Vietnam as stipulated in Point d Clause 2 Article 4 of this Circular, initial taxpayer registration applications are submitted to the Tax Department where the entity is headquartered. The taxpayer registration application includes:

- Taxpayer registration declaration according to Form 06-DK-TCT issued with this Circular;

- Certification from the Department of State Protocol - Ministry of Foreign Affairs.

Referring to Point d Clause 2 Article 4 of Circular 105/2020/TT-BTC states:

2. Taxpayers subject to direct taxpayer registration with the tax authority include:

...

d) Foreign organizations, individuals, and organizations in Vietnam using humanitarian aid, non-refundable aid from abroad to purchase goods and services with value added tax (VAT) in Vietnam for non-refundable aid and humanitarian aid; diplomatic missions, consular agencies, and representative offices of international organizations in Vietnam subject to VAT refund for those enjoying diplomatic privileges and immunities; ODA project owners eligible for VAT refund, representative offices of ODA project sponsors, and organizations designated by foreign sponsors to manage non-refundable ODA programs and projects (hereinafter referred to as Other Organizations).

Thus, for taxpayers who are diplomatic missions eligible for VAT refund for those enjoying diplomatic privileges and immunities, initial taxpayer registration applications are submitted to the Tax Department where the entity is headquartered.

What is the latest 2025 taxpayer registration declaration form for diplomatic missions in Vietnam? (Image from the Internet)

What are guidelines for initial taxpayer registration for diplomatic missions eligible for VAT refund for those enjoying diplomatic privileges and immunities in Vietnam?

The steps for initial taxpayer registration for diplomatic missions eligible for VAT refunds for those enjoying diplomatic privileges and immunities are guided at Subsection 4 Section 2 Part 2 of the administrative procedures issued with Decision 2589/QD-BTC in 2021 as follows:

Step 01: Within 10 working days from the date of the request for a tax refund, the organization or individual eligible for VAT refund shall submit the dossier to the Tax Department where the entity is headquartered or where the individual has a permanent address in Vietnam.

- In the case of electronic taxpayer registration applications: Taxpayers (NNT) access the electronic portal chosen by the taxpayer (the electronic portal of the General Department of Taxation/Portal of the competent state agency, including the National Public Service Portal, Provincial-level Public Service Portal according to the provisions on implementing a one-stop-shop mechanism in administrative procedure resolution and connected with the electronic portal of the General Department of Taxation/T-VAN service provider's information portal) to fill out the form and submit accompanying dossiers in electronic form (if any), digitally sign and send to the tax authority via the chosen portal;

NNT submits the dossier (taxpayer registration application simultaneously with business registration dossier according to the interlinked single-window mechanism) to the competent state management authority. The competent state authority sends the information of the received dossier from NNT to the tax authority via the electronic portal of the General Department of Taxation.

Step 02: Tax authority reception:

- For paper-based taxpayer registration applications:

+ If the dossier is submitted directly at the tax authority: The tax official receives and stamps the receipt on the taxpayer registration application, clearly stating the date of receipt, number of documents according to the dossier list for the case of dossiers submitted directly at the tax authority. The tax official issues a receipt for the date of result delivery and the processing time of the received dossier;

+ If the taxpayer registration application is sent by post: The tax official stamps the receipt, records the date of receipt on the dossier, and records the correspondence number of the tax authority;

The tax official checks the taxpayer registration application. If the dossier is insufficient and requires clarification, additional information, or documentation, the tax authority notifies the taxpayer according to Form 01/TB-BSTT-NNT in Appendix II issued with Decree 126/2020/ND-CP within 02 (two) working days from the date of dossier receipt.

- For electronic taxpayer registration applications:

The tax authority receives the dossier via the electronic portal of the General Department of Taxation, processes, and resolves the dossier through the electronic data processing system of the tax authority:

+ Dossier reception: The electronic portal of the General Department of Taxation sends a receipt notification to the NNT who submitted the dossier via the selected electronic portal (the electronic portal of the General Department of Taxation/competent state agency's portal or T-VAN service provider's portal) no later than 15 minutes from receiving the taxpayer's electronic taxpayer registration application;

+ Dossier checking and processing: The tax authority checks and processes the taxpayer's dossier according to legal regulations on taxpayer registration and sends the resolution results via the electronic portal chosen by the taxpayer to draft and send the dossier:

++ If the dossier is complete, correct, and requires results to be returned: The tax authority sends the dossier resolution result to the electronic portal chosen by the taxpayer to draft and send the dossier within the time frame stipulated in Circular 105/2020/TT-BTC;

++ If the dossier is incomplete, incorrect as per regulations, the tax authority sends a notification of non-acceptance of the dossier, to the electronic portal chosen by the taxpayer to draft and send the dossier within 02 (two) working days from the date on the Dossier Receipt Notification.