What is the latest 2024 dependant declaration form in Vietnam?

What is the latest 2024 dependant declaration form in Vietnam?

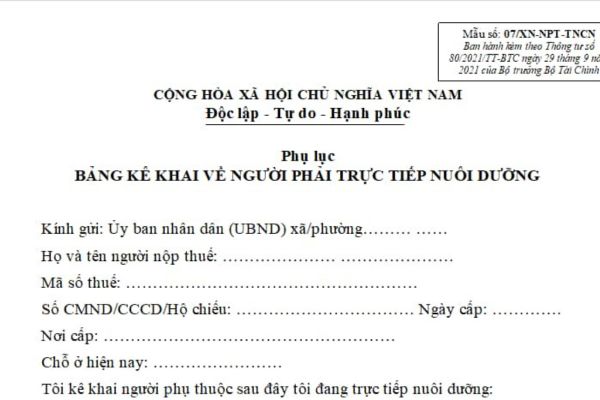

The latest dependant declaration form in 2024 is Form 07/XN-NPT-TNCN, stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC. To be specific:

Note: In the case where a taxpayer has multiple dependants residing in various communes/wards, the taxpayer must prepare a Declaration Form for confirmation by the People's Committee of the commune/ward where each dependant resides.

>>Details: Form 07/XN-NPT-TNCN, appendix of the latest 2024 declaration form for dependants Download

Who is considered a dependant for personal exemption in Vietnam?

According to point d.4, clause 1, Article 9 of Circular 111/2013/TT-BTC, contents related to personal income tax for individuals engaged in business in this Article are abolished by clause 6, Article 25 of Circular 92/2015/TT-BTC as follows:

Deductions as instructed in this Article are the amounts deducted from taxable income of an individual before determining taxable income from wages, salaries, and business. To be specific: as follows:

1. personal exemption

...

d) dependants include:

...

d.4) Other individuals without refuge whom the taxpayer is directly supporting and who meet the conditions at point đ, clause 1, of this Article, including:

d.4.1) The taxpayer's siblings.

d.4.2) The taxpayer's grandparents, aunts, uncles.

d.4.3) The taxpayer's nieces/nephews, including children of siblings.

d.4.4) Other dependants as provided by law.

...

According to point đ, clause 1, Article 9 of Circular 111/2013/TT-BTC, contents related to personal income tax for individuals engaged in business in this Article are abolished by clause 6, Article 25 of Circular 92/2015/TT-BTC as follows:

Deductions

Deductions as instructed in this Article are the amounts deducted from taxable income of an individual before determining taxable income from wages, salaries, and business. To be specific: as follows:

1. personal exemption

…

đ) Individuals considered dependants per instructions in clauses d.2, d.3, d.4, point d, clause 1, of this Article must meet the following conditions:

đ.1) For individuals of working age, the following conditions must be satisfied:

đ.1.1) Disabled and incapable of working.

đ.1.2) No income or average monthly income from all sources does not exceed 1,000,000 VND.

đ.2) For individuals outside working age, there must be no income or average monthly income from all sources does not exceed 1,000,000 VND.

...

Thus, those directly being supported and counted for personal exemption in personal income tax are other individuals without refuge who the taxpayer is directly supporting, including:

- The taxpayer's siblings.

- The taxpayer's grandparents, aunts, uncles.

- The taxpayer's nieces/nephews, including children of siblings.

- Other dependants as provided by law.

Additionally, these individuals must meet the following conditions:

- For individuals of working age, the following conditions must be satisfied:

+ Disabled and incapable of working.

Hence, disabled individuals, incapable of working, are those governed by law on persons with disabilities or those suffering from diseases rendering them unable to work (such as AIDS, cancer, chronic kidney failure, etc.).

+ No income or average monthly income from all sources does not exceed 1,000,000 VND.

- For individuals outside working age, there must be no income or average monthly income from all sources does not exceed 1,000,000 VND.

What are conditions for dependant recognization in Vietnam?

According to point c.2, point c, clause 1, Article 9 of Circular 111/2013/TT-BTC, to receive deductions for dependants, the taxpayer must register the dependant deduction according to regulations.

In case the taxpayer has not applied the dependant deduction for a dependant in the tax year, they can apply the deduction from the month the support obligation arises when the taxpayer processes their tax finalization and registers the personal exemption for the dependant.

The deadline for registering the personal exemption is December 31 of the tax year for other dependants as guided in point d.4, point d, clause 1, Article 9 of Circular 111/2013/TT-BTC.

In cases where the taxpayer is authorized to finalize but has not applied the personal exemption for a dependant in the tax year, they can also apply the deduction from the month the support obligation arises when the taxpayer processes authorized finalization and registers the personal exemption for the dependant through the income-paying organization.

Employees working at dependant units, business locations, receiving income from salaries and wages from head office in different provinces may register personal exemption for their dependants at the tax authority managing the head office or the dependant units, business locations.

In case an individual changes their workplace, the registration and submission of documentation proving the dependant must still be carried out.