What is the last day of the VAT period declared monthly and quarterly in Vietnam?

What is the last day of the VAT period declared monthly and quarterly in Vietnam?

According to Point a, Clause 1, Point a, Clause 4 of Article 8 Decree 126/2020/ND-CP as follows:

Types of taxes declared monthly, quarterly, yearly, each time a tax obligation arises, and tax finalization declarations

1. Types of taxes and other amounts payable to the state budget under tax management agency management, declared monthly, include:

a) Value-added tax, personal income tax. If taxpayers meet the criteria specified in Article 9 of this Decree, they may choose to declare quarterly.

b) Special consumption tax.

c) Environmental protection tax.

d) Resource tax, excluding resource tax as stipulated in Point e of this Clause.

...

4. Types of taxes and other amounts payable to the state budget declared each time a tax obligation arises, include:

a) Value-added tax of taxpayers stipulated in Clause 3, Article 7 of this Decree or taxpayers who declare VAT using the direct method on value-added but generate VAT obligations related to real estate transfers.

...

VAT is a tax that can be declared monthly, quarterly, or each time a tax obligation arises.

Clause 1 and Clause 3 of Article 44 of the Tax Administration Law 2019 stipulate:

Deadline for tax declaration submission

1. The deadline for submitting tax declaration documents for types of taxes declared monthly, quarterly is as follows:

a) No later than the 20th day of the next month after the month the tax obligation arises for monthly declarations;

b) No later than the last day of the first month of the next quarter after the quarter the tax obligation arises for quarterly declarations.

...

3. The deadline for submitting tax declaration documents for taxes declared each time a tax obligation arises is no later than the 10th day from the day the tax obligation arises.

...

Thus, for VAT declared monthly, the last day of the VAT period is the 20th of the month following the month the tax obligation arises, i.e., the 20th of each month.

For VAT declared quarterly, the last day of the tax declaration period is the last day of the first month of the following quarter after the quarter the tax obligation arises, i.e., the 30th or 31st of the first month of the next quarter.

What is the last day of the VAT period declared monthly and quarterly in Vietnam? (Image from the Internet)

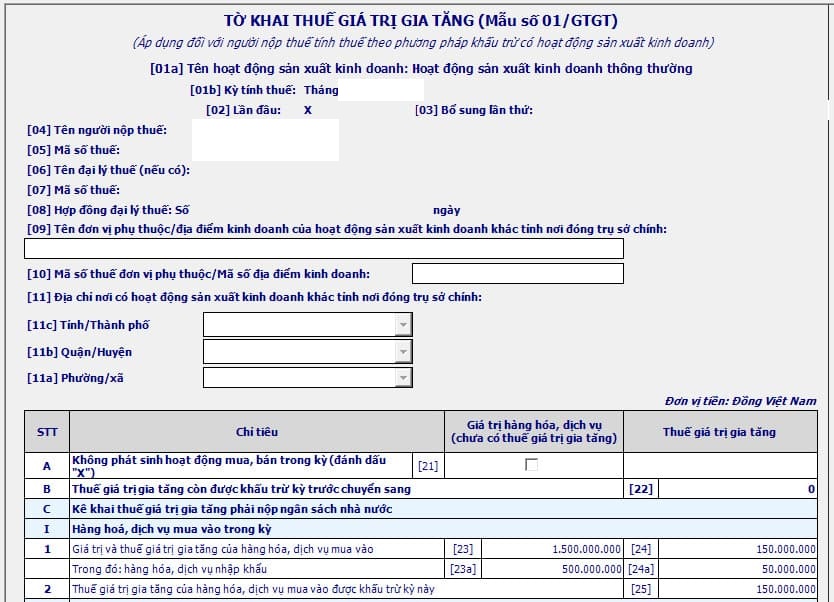

How to prepare the VAT declaration form 01/GTGT for quarterly and monthly on HTKK in Vietnam?

Step 1: Select the VAT declaration

Log into the HTKK software => Select: "Value-added tax" => Select: “VAT declaration (01/GTGT)(TT80/2021)”

Step 2: Select the tax period:

In the Select tax period tab, the taxpayer selects as follows:

- Select the place to submit the VAT declaration:

The software automatically displays according to the initial declaration information of the enterprise on the HTKK software (can be edited)

- Choose to declare VAT monthly or quarterly:

If the taxpayer meets the conditions for quarterly declaration, they may choose to declare VAT quarterly, specifically:

+ Enterprises subject to monthly VAT declaration with a total revenue from selling goods and providing services of up to 50 billion VND in the previous year may declare VAT quarterly. Revenue is determined as the total revenue on VAT declarations for tax periods in the calendar year.

For enterprises conducting centralized tax declarations at their head offices for dependent units or business locations, the revenue includes the revenue of dependent units and business locations.

+ In the case of a new business starting operations, they can choose to declare VAT quarterly. After engaging in production or business for 12 months, from the next calendar year after the 12-month period, the tax declaration will be based on the revenue level of the previous calendar year (a full 12 months) to declare VAT on a monthly or quarterly basis.

=> If the enterprise does not meet the above conditions, it is subject to monthly VAT declaration.

Note:

+ Taxpayers are responsible for self-identifying as meeting the quarterly declaration requirements to perform tax declaration according to the regulations.

+ Taxpayers who meet the criteria for quarterly tax declaration may choose to declare taxes monthly or quarterly annually.

- Choose whether the declaration is "First time" or "Supplementary":

Tick “First time Declaration” if this is the first time the enterprise prepares a VAT declaration for that tax period.

If a taxpayer discovers errors in the initially submitted tax declaration, they must submit supplementary declarations in the order of each amendment.

Note: From the time the Etax System issues a notification accepting a “First time” tax declaration, all subsequent tax declarations for the same tax period and business activity will be “Supplementary” declarations. Enterprises must submit “Supplementary” Declarations following the regulations on supplementary declaration.

- Choose the industry category:

The software defaults to selecting "Ordinary business activity."

If the enterprise is declaring VAT for other activities listed below, choose according to the actual operations the enterprise wishes to declare:

+ Lottery, computerized lottery operations.

+ Oil and gas exploration and extraction activities.

+ Investment projects for infrastructure development, housing for transfer outside the province where the headquarters is located.

+ Power plant production outside the province where the headquarters is located.

Note: If a taxpayer engages in multiple business activities listed above, multiple tax declarations should be prepared, each corresponding to a different business activity.

- Choose an appendix attached to the declaration (if applicable):

If your company has activities related to the appendices below, tick the corresponding appendix for the declaration:

+ Appendix on the distribution of VAT payments to localities that benefit from hydropower production revenue, Form 01-2/GTGT, issued with Appendix II Circular 80/2021/TT-BTC.

+ Appendix on the distribution of VAT payments to localities benefited from computerized lottery business, Form 01-3/GTGT, issued with Appendix II Circular 80/2021/TT-BTC.

+ Appendix on distributing VAT to localities benefiting from revenue (excluding hydropower, computerized lottery), Form 01-6/GTGT, issued with Appendix II Circular 80/2021/TT-BTC.

+ Appendix “PL_GiamThue_GTGT_23_24” for declaring goods and services with reduced VAT for the first 6 months of 2024: If your company sells goods or services with reduced VAT during Q1/2024 or Q2/2024 according to Decree 94/2023/ND-CP under Resolution 110/2023/QH15, choose this appendix for declaration.

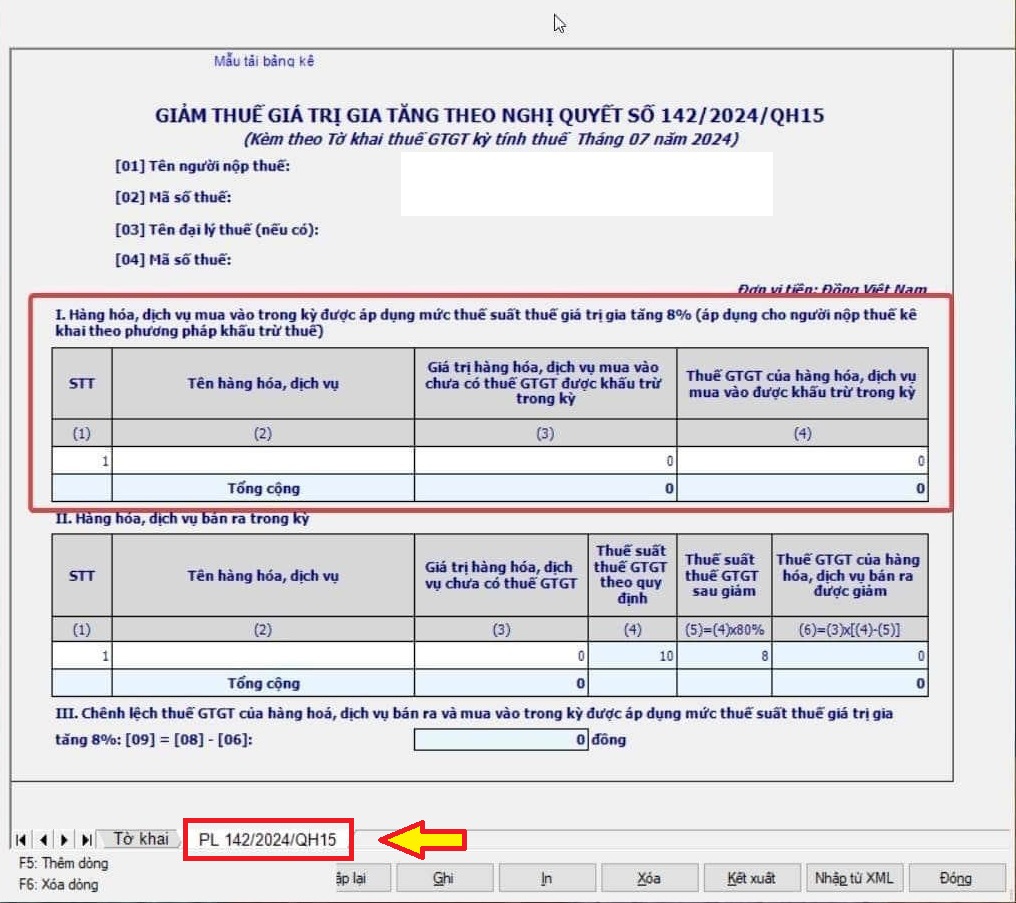

+ Appendix “PL 142/2024/QH15” for declaring goods and services with reduced VAT for the second half of 2024:

If during Q3/2024, Q4/2024 (for quarterly declaration) or July to December 2024 (for monthly declaration), your company sells goods or services eligible for reduced VAT under Decree 72/2024/ND-CP as per Resolution 142/2024/QH15, choose this appendix for declaring goods and services with a reduced VAT rate of 8%.

Note: From software version HTKK 5.2.2 updated on August 16, 2024, the reduced tax appendix “PL 142/2024/QH15” is available.

- Click "Agree" to display the VAT declaration form 01/GTGT in HTKK.

- To declare the Reduced VAT Appendix under Resolution 142/2024/QH15, the taxpayer should select as follows:

What is the current status of goods and services not eligible for VAT reduction in Vietnam?

According to Article 1 of Decree 72/2024/ND-CP, VAT reduction is applied to groups of goods and services currently subject to a 10% tax rate, except for the following goods and services:

- Telecommunications, financial activities, banking, securities, insurance, real estate, metals and products from fabricated metal, mining products (excluding coal mining), coke, refined petroleum products, chemical products.

Details in Appendix I issued with Decree 72/2024/ND-CP.

- Goods and services subject to excise tax.

Details in Appendix II issued with Decree 72/2024/ND-CP.

- Information technology according to the laws on information technology.

Details in Appendix III issued with Decree 72/2024/ND-CP.

- VAT reduction for each type of goods and services stipulated in Clause 1, Article 1 of Decree 72/2024/ND-CP is applied uniformly at importation, production, processing, commercial business steps. For coal sold (including coal processed and screened according to a closed process for sale) falls under the VAT reduction category. Coal listed in Appendix I issued with Decree 72/2024/ND-CP, at steps other than mining sales are not eligible for VAT reduction.

Major corporations and economic groups conducting a closed process before selling also qualify for VAT reduction on sales of mined coal.

For goods and services listed in Appendices I, II, and III issued with Decree 72/2024/ND-CP that are subject to VAT exemptions or a 5% VAT rate under the Value-Added Tax Law, follow the Value-Added Tax Law regulations without VAT reduction.