What is the land and water surface rental declaration form - Form 01/TMDN in Vietnam?

What is the land and water surface rental declaration form - Form 01/TMDN in Vietnam?

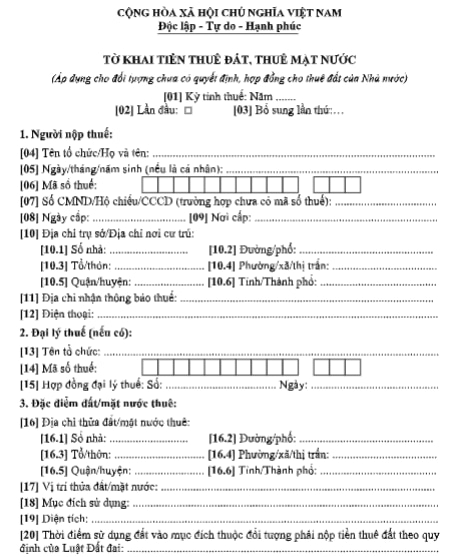

The land and water surface rental declaration form - Form 01/TMDN in Vietnam applies to entities without a lease decision or contract from the state as stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC:

Download the land and water surface rental declaration form - Form 01/TMDN in Vietnam: Here

What is the land and water surface rental declaration form - Form 01/TMDN in Vietnam? (Image from Internet)

What are the instructions for declaring land and water surface rental in Vietnam?

Under the instructions of the Ministry of Finance in sub-section 13 Section 1 Administrative Procedures issued together with Decision 1462/QD-BTC in 2022:

Step 1: In the case of land and water surface lease where the financial obligation determination dossier for land and water surface rental under the single-window system is simultaneously a tax declaration dossier: The deadline for submitting the dossier is no later than 30 days from the date the competent state agency signs the decision to lease land or water surface. In cases where there is no decision but there is a land or water surface lease contract, the deadline for submitting the dossier is no later than 30 days from the date of signing the contract.

In cases where the single-window system does not have regulations, submit the dossier to the tax authority where the taxable land is located.

For cases of land and water surface lease without a lease decision or contract: The deadline for submitting the land and water surface rental declaration dossier is no later than 30 days from the date of using the land for the purpose subject to land and water surface lease.

The deadline for submitting the land and water surface rental declaration dossier in the case of changes during the year in factors for determining financial obligations for land and water surface rental is no later than 30 days from the date the competent authority issues a document recording the change.

Taxpayers who do not have changes in factors leading to changes in the land and water surface rental amount payable for the year do not need to declare for the subsequent year.

Step 2: The tax authority receives:

The tax authority receives and processes the dossier according to regulations for dossiers submitted directly at the tax office or sent via postal service. In the case of electronic submission, the receipt, inspection, acceptance, and processing of the dossier are done through the tax authority's electronic data processing system.

What are the instructions for compiling the land and water surface rental declaration dossiers in Vietnam?

The dossier for land and water surface rental declaration issued together with Appendix 1 List of tax declaration dossiers Decree 126/2020/ND-CP includes:

Cases with a land lease decision or without a decision but with a land lease contract

- The declaration dossier to determine financial obligations for land and water surface rental under the single-window system;

- A written request from the land user to be exempted or reduced from financial obligations related to land (original) according to form 01/MGTH in Appendix 1 issued together with Circular 80/2021/TT-BTC on September 29, 2021, of the Minister of Finance guiding the implementation of certain provisions of the Tax Administration Law 2019 and Decree 126/2020/ND-CP on October 19, 2020, of the Government of Vietnam detailing certain provisions of the Tax Administration Law, and copies of documents proving eligibility for exemption or reduction according to legal regulations (if any);

- Documents and papers related to amounts deductible from payable land rent according to legal regulations (if any).

Cases without a land lease decision or contract

- land and water surface rental declaration form 01/TMDN in Appendix 2 issued together with Circular 80/2021/TT-BTC on September 29, 2021, of the Minister of Finance, guiding the implementation of certain provisions of Tax Administration Law 2019 and Decree 126/2020/ND-CP on October 19, 2020, of the Government of Vietnam detailing certain provisions of Tax Administration Law 2019.

- Other related documents (if any).