What is the import-export duty rate in Vietnam?

What is the import-export duty rate in Vietnam?

Currently, the law does not define what an import-export duty rate is. However, based on Clause 1, Article 5 of the Law on Export and Import Taxes 2016, it can be understood that the import-export duty rate is the level of tax applied to goods and services when they are traded across national borders.

This tax plays an important role in adjusting trade flows and ensuring national income.

What is the import-export duty rate in Vietnam? (Image from the Internet)

What are the import-export duty rates for used cars in Vietnam?

According to Article 7 of Decree 26/2023/ND-CP, the import-export duty rates for used cars are as follows:

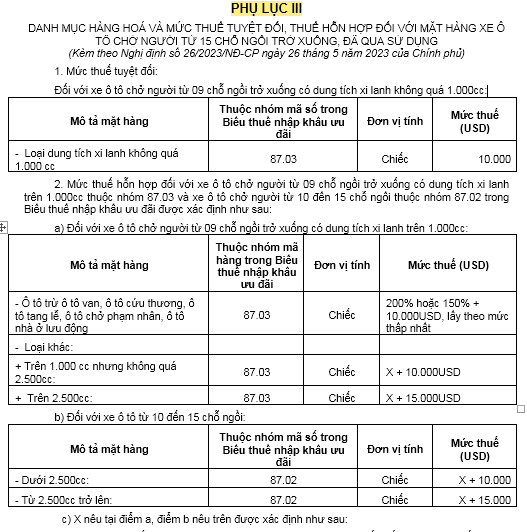

- Used passenger cars with up to 9 seats and an engine capacity of no more than 1,000cc, classified under heading 87.03, are subject to the absolute duty rates specified in Appendix 3, List of Goods and Absolute Taxes, Hybrid Taxes for Used Passenger Cars with up to 15 seats, issued together with Decree 26/2023/ND-CP.

- Used passenger cars with up to 9 seats and an engine capacity over 1,000cc classified under heading 87.03 and from 10 to 15 seats classified under heading 87.02 are subject to hybrid duty rates specified in Appendix 3, List of Goods and Absolute Taxes, Hybrid Taxes for Used Passenger Cars with up to 15 seats, issued together with Decree 26/2023/ND-CP.

- Used passenger cars with 16 seats or more classified under heading 87.02 and used motor vehicles for transporting goods with a total design weight not exceeding 5 tons, classified under heading 87.04 (excluding refrigerated trucks, waste collection trucks with compactor units, tank trucks, armored trucks for transporting valuable goods, silo trucks, and sludge trucks with detachable liftable tanks) are subject to an import duty rate of 150%.

- Other types of used cars classified under headings 87.02, 87.03, 87.04 are subject to a duty rate equal to 1.5 times the preferential import duty rate of the same type of new cars classified under the same heading as specified in Section 1, Appendix 2, List of Goods and Absolute Taxes, Hybrid Taxes for Used Passenger Cars with up to 15 seats, issued together with Decree 26/2023/ND-CP.

>>> Download the complete Appendices 1, 2, and 3, List of Goods and Absolute Taxes, Hybrid Taxes for Used Passenger Cars with up to 15 seats, issued together with Decree 26/2023/ND-CP.

What principles need to be ensured when issuing the import-export tax tariff schedules in Vietnam?

According to Article 10 of the Law on Export and Import Taxes 2016, when issuing the import-export tax tariff schedules, the following principles need to be ensured:

- Encouraging the import of raw materials, prioritizing types that the domestic market does not meet the demand; focusing on the development of high-tech, source technology fields, energy saving, and environmental protection.

- Being consistent with the socio-economic development orientation of the State and commitments on export and import taxes in the international treaties that the Socialist Republic of Vietnam is a member of.

- Contributing to market stabilization and state budget revenue.

- Being simple, transparent, facilitating taxpayers, and implementing tax administrative procedure reforms.

- Applying consistent duty rates for goods with the same nature, structure, usage, similar technical features; the import duty rate decreases from finished products to raw materials; the export duty rate increases from finished products to raw materials.

Moreover, the authority to issue tax tariff schedules and duty rates is regulated in Article 11 of the Law on Export and Import Taxes 2016 as follows:

- The Government of Vietnam, based on the provisions of Article 10 of the Law on Export and Import Taxes 2016, the Export Tariff Schedule according to the List of Taxable Groups and the Export duty rate Framework for each taxable group released with this Law, the Preferential Tariff Commitments in the Protocol for Accession to the World Trade Organization (WTO) ratified by the National Assembly and other international treaties that the Socialist Republic of Vietnam is a member of, to issue:

+ Export tariff schedules; Preferential export tariff schedules;

+ Preferential import tariff schedules; Special preferential import tariff schedules;

+ List of goods and absolute taxes, hybrid taxes, import taxes beyond tariff quotas.

- In necessary cases, the Government of Vietnam shall submit to the Standing Committee of the National Assembly for amendment and supplementation of the Export Tariff Schedule according to the List of Taxable Groups and the Export duty rate Framework for each taxable group released with this Law.

- The authority to apply anti-dumping tax, anti-subsidy tax, and safeguard tax shall be in accordance with the provisions of Chapter 3 of the Law on Export and Import Taxes 2016.