What is the guidance on updating citizen ID number in TIN in Vietnam?

What is the guidance on updating citizen ID number in TIN in Vietnam?

To safeguard the interests of taxpayers, the General Department of Taxation of Vietnam recommends that individual taxpayers should update their Citizen Identification Card (citizen ID card) information in taxpayer registration. The updated taxpayer information forms the basis for the tax authorities to standardize data, aiming towards the goal of using the personal identification number as the TIN.

Below is guidance on how to update citizen ID card information into the TIN in taxpayer registration:

Method 1: Declare changes in taxpayer registration information electronically

- Step 1: Access the Tax Department's electronic information portal: https://thuedientu.gdt.gov.vn/

- Step 2: Select the "Individual" tab

- Step 3: Log in and enter the electronic tax transaction account information provided.

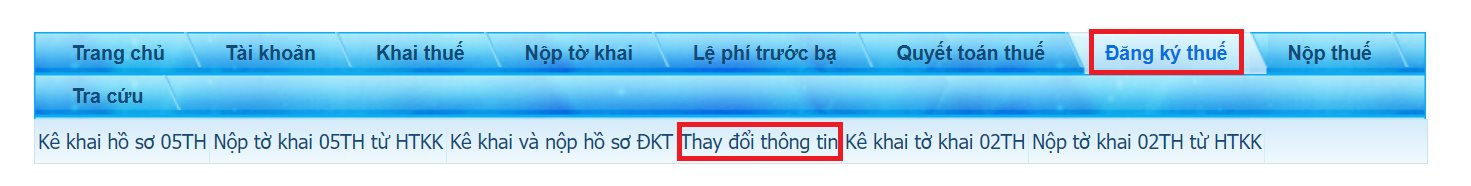

- Step 4: After successful login, on the function bar, click on Tax Registration --> Change Information

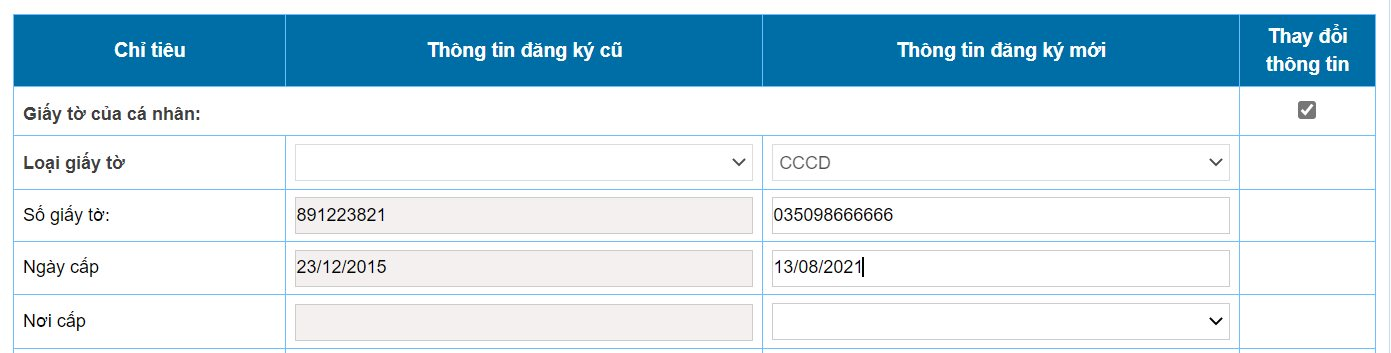

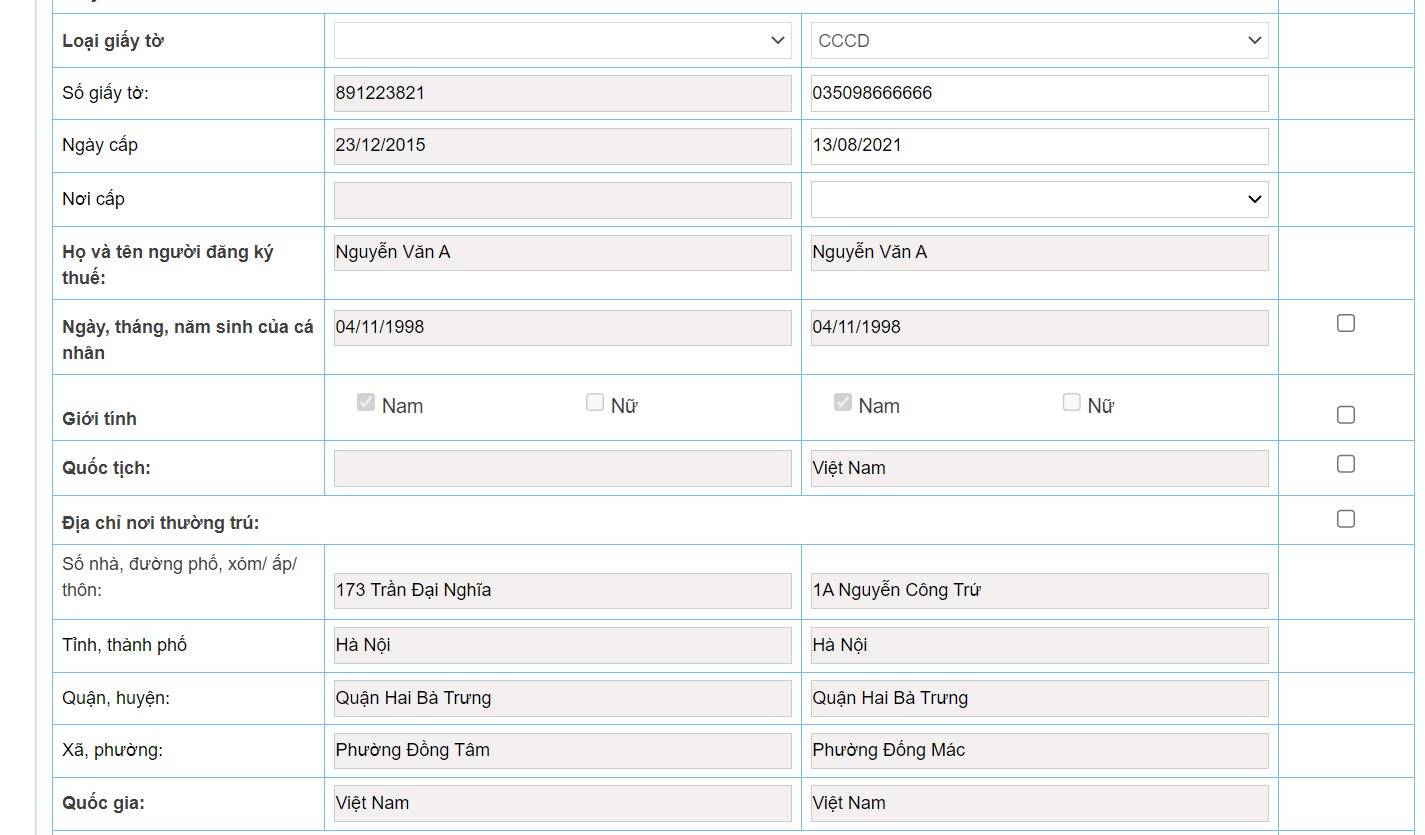

- Step 5: In the Personal Documents section, select “Change Information” and accurately enter the document number and issuance date according to the latest citizen ID card (12 digits).

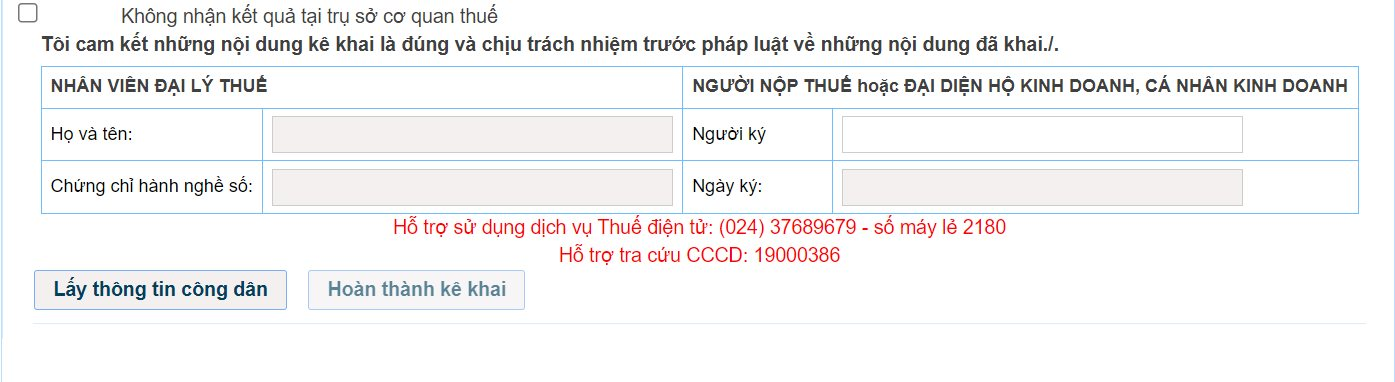

- Step 6: Continue by selecting: “Retrieve Citizen Information” to query personal information from the National Database on Population:

The system will immediately display the accurate information of citizens from the national population database.

- Step 7: After verification, the taxpayer confirms completion and selects: Complete Declaration and follows the steps as instructed on the General Department of Taxation of Vietnam’s electronic portal to submit the declaration and attached documents to the tax authority, concluding the process of changing taxpayer registration information.

Method 2: Declare changes to taxpayer registration information through the income-paying agency.

According to Clause 3, Article 10 of Circular 105/2020/TT-BTC, the documents for changes in taxpayer registration information are stipulated as follows:

- Individual taxpayers submit the documents for changing taxpayer registration information to the paying agency, which include:

+ Authorization letter (in case there hasn’t been a prior authorization letter for the income-paying agency);

+ Copies of documents that have changes related to the individual or dependent’s taxpayer registration.

- The income-paying agency aggregates the information of the employees, submits the documents for changing taxpayer registration information to the directly managing tax authority, with the document components including:

+ Tax registration declaration Form 05-DK-TH-TCT issued along with Circular 105/2020/TT-BTC to change taxpayer information (ensure to fully update all three fields: Name, Date of Birth, and Personal Identification Documents (prioritize updating the latest citizen ID card number)).

Download Form 05-DK-TH-TCT.

Method 3: Declare changes to taxpayer registration information directly with the tax authority

Based on Clause 3, Article 10 of Circular 105/2020/TT-BTC, the required documents for changes in taxpayer registration information are specified as follows:

- Where to submit the documents:

The Tax Department, Regional Tax Department where the individual is registered for permanent or temporary residence (in case the individual does not work at the income-paying agency).

- Document components:

+ Adjustment declaration, supplementary taxpayer registration information, Form number 08-MST issued along with Circular 105/2020/TT-BTC to declare changes in the taxpayer registration information of the taxpayer.

Download Form 08-MST.

+ Copy of the Citizen Identification Card or a valid copy of the Identity Card for Vietnamese nationality taxpayers; a valid copy of the Passport for foreign nationality taxpayers or Vietnamese nationals residing abroad in cases where the taxpayer registration information on these documents has changed.

Note: The content on "Guidance on Updating citizen ID number in TIN?" is for reference purposes only.

What is the guidance on updating citizen ID number in TIN in Vietnam? (Image from the Internet)

How long does it take to process the documents for changing taxpayer registration information in Vietnam?

According to Clause 1, Article 11 of Circular 105/2020/TT-BTC, the processing time for documents to change taxpayer registration information is stipulated as follows:

(1) In cases where the information changes do not appear on the taxpayer registration certificate or TIN notice:

Within 02 (two) working days from the date of receiving complete documents from the taxpayer, the directly managing tax authority must update the changes in information into the taxpayer registration application system.

(2) In cases where the information changes on the taxpayer registration certificate or TIN notice:

Within 03 (three) working days from the date of receiving complete documents from the taxpayer, the directly managing tax authority must update the changes in information into the taxpayer registration application system; simultaneously issuing a taxpayer registration certificate or TIN notice with the updated information changes.

Is there a penalty for overdue notification of changing information in taxpayer registration in Vietnam?

According to Article 11 of Decree 125/2020/ND-CP, dealing with violations of the timeline for notification of changes in taxpayer registration information is specified as follows:

Penalties for violations of the timeline for notification of changes in taxpayer registration information

- A warning shall be issued for any of the following acts:

a) Notifying changes in the content of taxpayer registration beyond the prescribed timeframe by 01 to 30 days but without affecting the taxpayer registration certificate or TIN notice, provided there are mitigating circumstances;

b) Notifying changes in the content of taxpayer registration beyond the prescribed timeframe by 01 day to 10 days, affecting the taxpayer registration certificate or TIN notice, provided there are mitigating circumstances.

- A fine of between 500,000 VND and 1,000,000 VND for notifying changes in the content of taxpayer registration beyond the prescribed timeframe by 01 to 30 days but without affecting the taxpayer registration certificate or TIN notice, except in cases penalized as per point a of clause 1 of this Article.

- A fine of between 1,000,000 VND and 3,000,000 VND for any of the following acts:

a) Notifying changes in the content of taxpayer registration beyond the prescribed timeframe by 31 to 90 days but without affecting the taxpayer registration certificate or TIN notice;

b) Notifying changes in the content of taxpayer registration beyond the prescribed timeframe by 01 day to 30 days, affecting the taxpayer registration certificate or TIN notice, except as regulated at point b clause 1 of this Article.

- A fine of between 3,000,000 VND and 5,000,000 VND for any of the following acts:

a) Notifying changes in the content of taxpayer registration beyond the prescribed timeframe by 91 days or more but without affecting the taxpayer registration certificate or TIN notice;

b) Notifying changes in the content of taxpayer registration beyond the prescribed timeframe by 31 to 90 days, affecting the taxpayer registration certificate or TIN notice.

- A fine of between 5,000,000 VND and 7,000,000 VND for any of the following acts:

a) Notifying changes in the content of taxpayer registration beyond the prescribed timeframe by 91 days or more, affecting the taxpayer registration certificate or TIN notice;

b) Failing to notify changes in the information in the taxpayer registration file.

- This regulation does not apply in the following cases:

a) Individuals not conducting business who have been issued a personal income tax number delay updating information on their ID card upon receiving a citizen identification card;

b) Income-paying agencies delay notifying changes in the ID card information when the individual taxpayer authorized to finalize personal income tax has received a citizen identification card;

c) Notification of changes in taxpayer registration file information related to taxpayer address beyond the prescribed timeframe due to administrative boundary changes according to the resolution of the National Assembly Standing Committee or the National Assembly resolution.

- Measures to rectify consequences: Compel submission of documents changing taxpayer registration content for acts stipulated at point b clause 5 of this Article.

Furthermore, according to clause 5, Article 5 of Decree 125/2020/ND-CP regarding principles on penalties for administrative violations in taxation and invoices, it specifies:

Principles on penalties for administrative violations in taxation and invoices

...

- For the same administrative violation in tax or invoices, the fine for organizations is twice the fine imposed on individuals, except for the fines specified in Articles 16, 17, and 18 of this Decree.

Additionally, per point a clause 4, Article 7 of Decree 125/2020/ND-CP regarding principles on applying fines for administrative violations in tax, invoices, it illustrates:

Forms of penalties, remedies, and principles for applying fines for administrative violations in tax and invoices

...

- Principles for applying fines

a) The fines prescribed in Articles 10, 11, 12, 13, 14, 15, clauses 1, 2 of Article 19, and Chapter III of this Decree are applicable to organizations.

For taxpayers who are households or businesses, apply fines as for individuals.

...

Hence, overdue notification of changes in taxpayer registration information will incur administrative penalties as provided by law, with the lightest penalty being a warning and a fine ranging from 250,000 VND to 3,500,000 VND depending on the overdue period.

However, cases involving overdue notification of changes in taxpayer registration information below will not incur the above penalties, including:

- Non-business individuals who have been issued a personal income tax number delay updating their ID card information when issued a citizen identification card;

- Income-paying agencies delay notifying changes in ID card information when the individual taxpayer is authorized to finalize personal income tax and has been issued a citizen identification card;

- Notification of changes in taxpayer registration file information related to taxpayer address beyond the prescribed timeline due to administrative boundary changes according to the resolution of the National Assembly Standing Committee or the resolution of the National Assembly.