What is the guidance on registering for the use of e-invoices for selling public assets in Vietnam in 2025?

What is the guidance on registering for the use of e-invoices for selling public assets in Vietnam in 2025?

Based on Official Dispatch 14590/BTC-QLCS of 2024 from the Ministry of Finance regarding the registration for the use of e-invoices for selling public assets and the destruction of unused paper public asset sale invoices, the registration process is as follows:

(1) Agencies, organizations, and units using public assets (hereinafter referred to as units) that have not been issued a Tax Identification Number should contact the provincial tax authority (where the headquarters is located) to obtain a Tax Identification Number.

(2) The registration for new use, changes in the registered content, and use of invoices for selling public assets on the General Department of Taxation's e-portal "https://hoadondientu.gdt.gov.vn" shall follow the provisions of Decree 123/2020/ND-CP. To register for the use of e-invoices for Selling Public Assets, the registering unit must have a digital certificate.

(3) Before January 31, 2025, ministries, central, and local authorities shall compile the list for registering the use of Sale Invoices for Public Assets on the General Department of Taxation's e-invoice portal. To be specific:

- Step 1: The finance departments of ministries, equivalent agencies, agencies under the Government of Vietnam, and other central agencies compile lists of units registering for services within their management scope; Finance Departments of provinces, centrally-run cities compile lists of units registering for services under local management.

- Step 2: Send the registration list to the provincial tax authority (where the asset-using unit is headquartered). The information sent to the tax authority includes: (i) Unit name; (ii) Tax Identification Number; (iii) Budget relation code.

+ Units currently using e-invoice services do not need to re-register. They should update their registration to add "Sale Invoices for Public Assets" as required.

+ After March 31, 2025, ministries, central, and local authorities that have not sent the registration list as directed above must allow units to independently proceed as described in point (2).

(4) People's Committees of provinces, centrally-run cities shall direct the Finance Departments:

- Destroy unused paper Sale Invoices for Public Assets remaining as of December 31, 2024; execution deadline: before January 31, 2025.

- The destruction of paper Sale Invoices for Public Assets follows the procedures stipulated in Article 27 of Decree 123/2020/ND-CP.

- Notify the results of invoice destruction to the Ministry of Finance (Department of Public Asset Management) within 5 working days from the date of invoice destruction.

- Report on the management and use status of Sale Invoices for Public Assets until December 31, 2024, to the Ministry of Finance (Department of Public Asset Management) before January 31, 2025.

What is the guidance on registering for the use of e-invoices for selling public assets in Vietnam in 2025? (Image from Internet)

Which public assets does e-invoices in sale and transfer apply to in Vietnam?

Based on Clause 1, Article 95 of Decree 151/2017/ND-CP, amended by Clause 60, Article 1 of Decree 114/2024/ND-CP, regulates types of public assets using e-invoices in sale and transfer:

- Public assets in agencies, organizations, and units (including state-owned housing).

- Infrastructure assets invested and managed by the State (including cases of sale, transfer of fee collection rights for State-invested, managed infrastructure assets, transfer of rights to exploit those assets).

- Public assets allocated to enterprises by the State not calculated as state capital within the enterprise.

- Assets of projects using state capital.

- Assets established under public ownership.

- Public assets revoked as per decisions from competent agencies or individuals.

- Materials and equipment retrieved from maintenance, repair, disposal of public assets.

What is the current form of e-invoices for selling public assets in Vietnam?

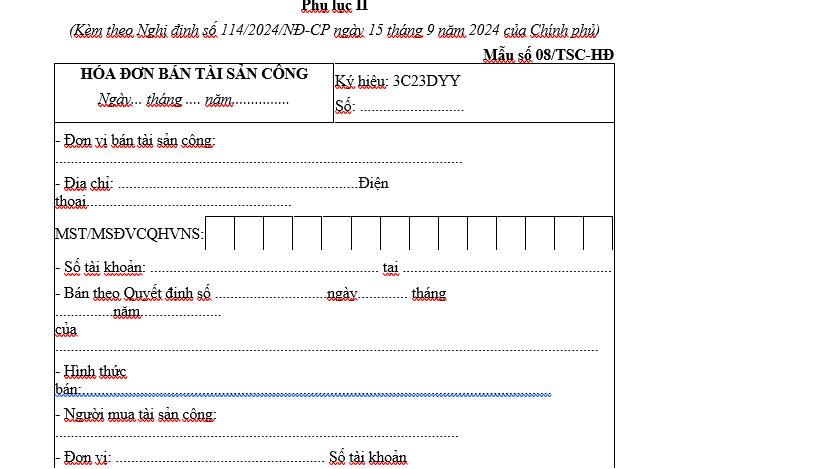

Based on point a, Clause 2, Article 95 of Decree 151/2017/ND-CP, amended by Clause 60, Article 1 of Decree 114/2024/ND-CP, the form for public asset sale invoices is as follows:

Public Asset Sale Invoice

...

- e-Sale Invoices for Public Assets:

a) The form for e-public asset sale invoices follows Form 08/TSC-HD issued with this Decree.

b) Agencies tasked with organizing the handling of public assets issue e-invoices through service providers of e-invoices (for agencies as VAT taxpayers with a tax code) or through the General Department of Taxation's e-portal (for non-VAT taxpayer agencies with a tax code) as stipulated in the Government of Vietnam's regulations on invoices, documents for buyers when selling, transferring types of public assets specified in this Article's Clause 1. Agencies handling public assets prepare sales invoices with the tax authority's code following regulations applicable to non-business organizations with sales transactions; no payment is required for using e-invoice services.

...

Thus, the e-sale invoice form for public assets is Form 08/TSC-HD issued with Decree 114/2024/ND-CP.

Form 08/TSC-HD is as follows:

Download Form 08/TSC-HD: e-invoice for selling public assets