What is the guidance on preparing the Form No. 01/GTGT on value-added tax declaration in Vietnam? What are regulations on the VAT deduction method?

What is the guidance on preparing the Form No. 01/GTGT on value-added tax declaration in Vietnam?

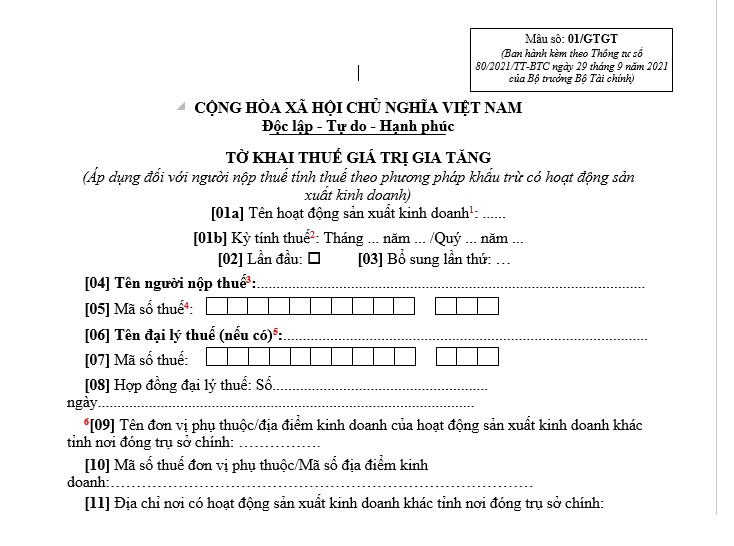

The value-added tax declaration form applied to taxpayers calculating tax using the deduction method engaged in production and business activities is Form No. 01/GTGT as stipulated in Appendix 2 attached to Circular 80/2021/TT-BTC

Download the latest value-added tax declaration form No. 01/GTGT... Download

Below is the guidance on preparing the latest value-added tax declaration form 01/GTGT:

[01a]: Taxpayers choose one among the fields depending on the enterprise's production and business activities, including:

+ Regular production and business activities.

+ Traditional lottery and computerized lottery activities.

+ Oil and gas exploration and extraction activities.

+ Power plant production activities outside the province where the headquarters is located.

+ Infrastructure investment projects, houses for transfer outside the province where the headquarters is located.

[09], [10], [11]: Declare the information of dependent units, business locations situated in a different province from the headquarters as prescribed in point b, c clause 1 Article 11 of Decree 126/2020/ND-CP.

Note: In the case of multiple dependent units or business locations across various districts managed by the Tax Department, select one representative unit to declare in this criterion.

In the case of multiple dependent units or business locations across various districts managed by the regional Tax Office, select one representative unit for the district managed by the regional Tax Office to declare in this criterion.

[21]: Check here if during the tax declaration period, no output invoices or input invoices arise;

[22]: Accountants take the deductible VAT amount from the previous period, corresponding to the tax amount recorded on the VAT declaration of the previous period (at criterion [43]);

[23]: The total value of goods and services purchased during the declaration period without VAT;

[24]: The total VAT of goods and services purchased;

[25]: Total deductible VAT of goods and services purchased;

[26]: The total revenue from selling goods and services that are not subject to VAT;

[27], [28], [34], [35], [36], [40], [41], [42], [43]: The HTKK software automatically updates;

[29]: The total revenue from selling goods and services with a 0% tax rate;

[30], [31]: The total revenue from goods and services with a 5% tax rate and the VAT;

[32], [33]: The total revenue from goods and services with a 10% tax rate and the VAT.

[32a]: Declare the value of goods and services not subject to declaration, calculation, or payment of value-added tax as stipulated by VAT law.

[37] and [38]: Declare the tax deduction increase/decrease adjustment at criterion II on the Supplementary Declaration. In cases where the tax authority or competent authority has issued conclusions, decisions regarding tax handling with adjustments corresponding to previous tax periods, declare on the tax declaration of the period receiving the conclusion, decision on tax handling (not to supplement the tax declaration profile).

[39a]: Declare the deductible VAT amount yet to be requested for refund of the investment project to be transferred for the taxpayer to continue deducting (the deductible VAT amount, not eligible for a refund, not refunded as declared by the taxpayer on a separate tax declaration for the investment project) when the investment project goes into operation or the deductible VAT amount not requested for refund of the dependent unit's production and business activities when it ceases operation,…

[40b]: Declare the total tax amount declared at criteria [28a] and [28b] of the Declaration Form No. 02/GTGT.

Note: Information is for reference purposes only!

What is the guidance on preparing the Form No. 01/GTGT on value-added tax declaration in Vietnam? (Image from the Internet)

What are regulations on the VAT deduction method in Vietnam?

Based on Article 10 of the Value Added Tax Law 2008 (amended and supplemented by clause 4 Article 1 of the Amended Value Added Tax Law 2013), the VAT deduction methods are specified as follows:

- VAT deduction method is regulated as follows:

+ The VAT amount payable by the deduction method equals the output VAT minus the deductible input VAT;

+ The output VAT equals the total VAT of goods and services sold as recorded on VAT invoices.

The VAT of goods and services sold as recorded on VAT invoices is computed as the taxable value of goods and services sold multiplied by the VAT rate of those goods and services.

In cases where vouchers indicate that the payment price includes VAT, the output VAT is determined by subtracting the taxable value of the goods and services from the payment price as specified in point k, clause 1, Article 7 of the VAT Law 2008.

+ The deductible input VAT equals the total VAT recorded on VAT invoices for purchases of goods and services, tax payment vouchers for imported goods, and meeting the conditions stated in Article 12 of the Value Added Tax Law 2008.

- The deduction method applies to businesses fully complying with regulations on accounting, invoices, and vouchers as stipulated by law on accounting, invoices, and vouchers, including:

+ Businesses with an annual revenue from selling goods and providing services of one billion VND or more, except for households, individual businesses;

+ Businesses voluntarily registered to apply the deduction method, except for households, individual businesses.

What are regulations on input VAT deduction in Vietnam?

Based on Article 12 of the Value Added Tax Law 2008 (amended and supplemented by clause 6 Article 1 of the Amended Value Added Tax Law 2013), input VAT deduction is regulated as follows:

- Businesses paying VAT using the deduction method can deduct input VAT as follows:

+ Input VAT of goods and services used for manufacturing, trading goods, services subject to VAT is fully deductible, including input VAT not compensated for goods, services subject to VAT that suffered loss;

+ Input VAT of goods, services simultaneously used for manufacturing, trading taxable and non-taxable goods, services is deductible only for input VAT of goods, services used for manufacturing, trading taxable goods, services. Businesses must separately account for deductible and non-deductible input VAT; if not, the deductible input VAT is calculated based on the percentage of revenue from VAT-taxable goods, services compared to total revenue of sold goods, services;

+ Input VAT of goods, services sold to organizations, individuals using humanitarian aid funds, non-refundable aid is fully deductible;

+ Input VAT of goods, services used for activities of searching, exploring, developing oil, gas mines are fully deductible;

+ Input VAT arising in any month is declared, deducted when determining the tax payable for that month. If businesses discover any errors in declared, deducted input VAT, they must declare, deduct the supplementary amount before the tax authority issues a decision on tax inspection, audit at the taxpayer's office.