What is the guidance on looking up PIT payment history on the iCanhan of the General Department of Taxation in Vietnam?

What is the guidance on looking up PIT payment history on the iCanhan of the General Department of Taxation in Vietnam?

Currently, taxpayers can look up their personal income tax payment history on the General Department of Taxation’s icanhan according to the following guidelines:

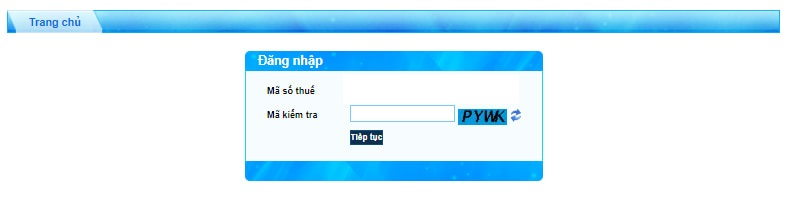

Step 1: Visit the website: https://canhan.gdt.gov.vn

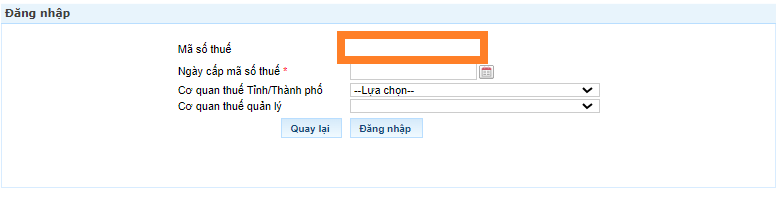

Step 2: Taxpayer logs into the system using their TINs of individuals

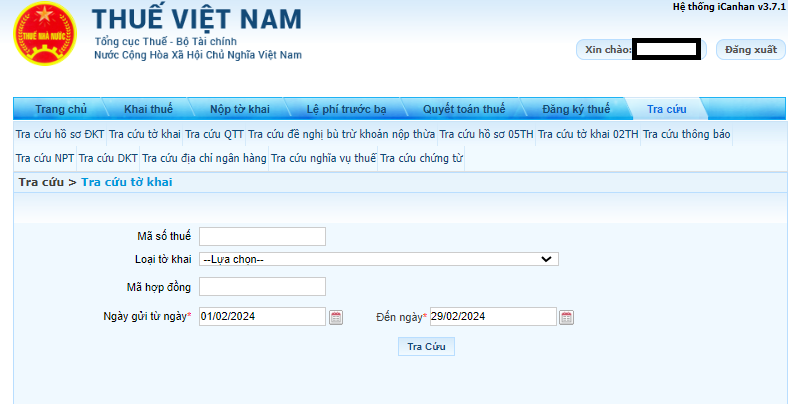

Step 3: After successfully logging into the personal income tax lookup account, select the "Lookup" section.

Step 4: Fill in the type of declaration needed, the status, and the period you want to look up (day, month, year).

Step 5: Click to look up, and the information about the paid taxes will appear.

Taxpayers can check the amount of tax they have paid. If there are any errors, they can print it out for review and comparison.

Note: This lookup method is applicable for individuals who have declared their personal income tax returns at the system canhan.gdt.gov.

What is the guidance on looking up PIT payment history on the iCanhan of the General Department of Taxation in Vietnam? (Image from Internet)

When is the deadline for paying PIT in Vietnam?

According to Article 28 of Decree 65/2013/ND-CP, employees will be organized to declare provisional payments based on their income from salaries and remunerations.

Under Clause 1, Article 55 of the Tax Administration Law 2019, it is stipulated as follows:

Tax payment deadlines

1. In case tax is calculated by the taxpayer, the tax payment deadline is the deadline for submission of the tax declaration dossier. In case of submission of supplementary tax documents, the tax payment deadline is the deadline for submission of the erroneous tax declaration dossier.

The deadline for paying corporate income tax, which is paid quarterly, is the 30th of the first month of the next quarter.

...

Furthermore, according to Clause 2, Article 44 of the Tax Administration Law 2019, the deadline for PIT finalization filing is stipulated as follows:

Deadlines for submission of tax declaration dossiers

...

2. For taxes declared annually:

a) For annual tax statement dossiers: the last day of the 3rd month from the end of the calendar year or fiscal year. For annual tax declaration dossiers: the last day of the first month from the end of the calendar year or fiscal year

b) For annual personal income tax statements prepared by income earners: the last day of the 4th month from the end of the calendar year;

c) For presumptive tax declarations prepared by household businesses and individual businesses: the 15th of December of the preceding year. For new household businesses and individual businesses: within 10 days from the date of commencement of the business.

...

Thus, the deadline for PIT finalization is divided into two timing points for two cases as follows:

- No later than the last day of the third month from the end of the calendar year or fiscal year for tax finalization declarations made by enterprises on behalf of employees.

- No later than the last day of the fourth month from the end of the calendar year for personal finalization tax declarations of individuals directly finalizing tax.

How to calculate the late payment fine of PIT in Vietnam?

According to Clause 2, Article 59 of the Tax Administration Law 2019, it is stipulated as follows:

Handling for Late Tax Payment

...

2. The calculation of late payment interest and the time to calculate late payment interest are stipulated as follows:

a) The late payment interest is 0.03%/day on the overdue tax amount;

b) The time to calculate late payment interest is continuously from the day following the day of overdue tax as stipulated in Clause 1 of this Article until the day before the overdue tax, refunded tax, additional tax, and assessed tax are paid to the state budget.

...

Thus, the calculation for late PIT payment is:

Late payment interest = 0.03% x Overdue tax amount.