What is the guidance on filling out Form 03-DK-TCT - Taxpayer registration application for household and individual businesses in Vietnam according to Circular 86?

What is the guidance on filling out Form 03-DK-TCT - Taxpayer registration application for household and individual businesses in Vietnam according to Circular 86?

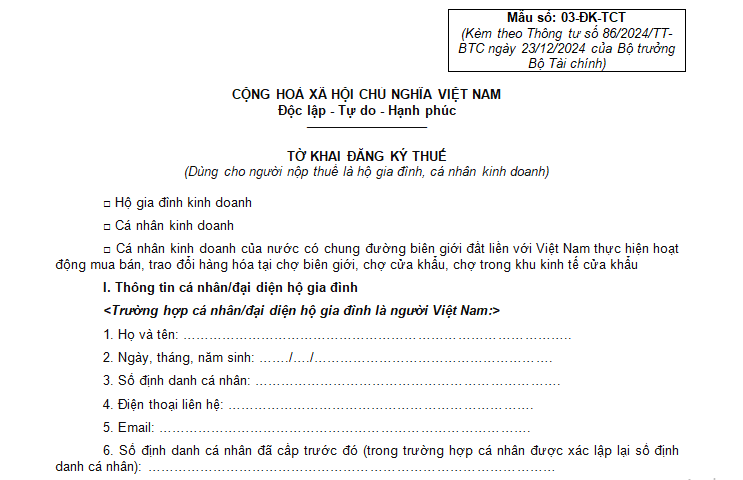

Based on section a.2, point a, clause 1, and section a.2, point a, clause 2, Article 22 of Circular 86/2024/TT-BTC (effective February 6, 2025), the Taxpayer registration application for household and individual businesses is designated as Form No. 03-DK-TCT issued in Appendix 2 attached to Circular 86/2024/TT-BTC.

Specifically, Form No. 03-DK-TCT - Taxpayer registration application for household and individual businesses appears as follows:

Download Form 03-DK-TCT - Taxpayer registration application for household and individual businesses.

Below is the guidance for filling out Form 03-DK-TCT - Taxpayer registration application for household and individual businesses.

Taxpayers must select one of the appropriate boxes before declaring in the detailed information section. Specifically:

- Business household

- Business individual

- Individual businessmen from countries sharing a land border with Vietnam conducting buying, selling, and exchanging goods at border markets, border-gate markets, or economic zone border markets.

I. Personal/Business Household Owner Information

- In case the individual/household representative is Vietnamese, they should declare in sections 1 to 5 below:

-

Full name: Clearly list the full name in uppercase letters of the individual/household representative for taxpayer registration.

-

Date of birth: Clearly list the date of birth of the individual/household representative for taxpayer registration.

-

**** Personal identification number: List the identification number of the individual/household representative for taxpayer registration.

Note: The individual/household representative must accurately declare their full name, date of birth, and personal identification number as stored in the National Population Database.

-

**** Contact phone: Correctly list the phone number of the individual/household representative (if available).

-

Email: Correctly list the email address of the individual/household representative (if available).

-

Previously issued personal identification number (in case an individual's personal identification number is re-established).

- In case the individual is a foreign national or a Vietnamese national living abroad without a personal identification number, they should declare in sections 1 to 8 below:

-

Full name: Clearly list the full name in uppercase letters of the individual for taxpayer registration.

-

Date of birth: Clearly list the date of birth of the individual for taxpayer registration.

-

Gender: Check one of the two boxes Male or Female.

-

Nationality: Clearly list the nationality of the individual for taxpayer registration.

-

Legal documents: select one of passport/laissez-passer/border identity papers/other valid personal documents of the individual and list the number, date of issuance, and “place of issue” which should only mention the province or city.

-

Permanent address: Fully list the information about the permanent address of the individual.

-

Current address: Fully list the information about the current residence address of the individual (only list if this address differs from the permanent address).

-

Other information: List phone number, email address (if available).

II. Tax Agent Information: Fully list the information of the tax agent if a Tax Agent is contracted with the taxpayer to perform taxpayer registration procedures on behalf of the taxpayer.

III. Business Location Information

If the taxpayer is a household or individual business that does not register business through the business registration agency as stipulated by the Government of Vietnam on household business, declare business activity information as follows:

-

Store/brand name: The name of the store or brand of the business location.

-

Business address:

- In the case of regular business activity and a fixed business location; individuals who rent real estate should clearly list the business address of the household, individual business, or the address where the individual is renting real estate, including: house number, street/village/block, ward/commune/commune-level town, district/district-level town/provincial city, province/city. If there is a phone number or Fax, clearly list the area code - phone number/Fax number.

- In the case of regular business activity without a fixed business location, clearly list the residential address of the individual.

-

Tax notice address: If there is a different address to receive tax office notices as opposed to the business address, clearly list the tax notice address for tax office contact.

-

Main business activity: List one main business activity currently conducted at the business location.

-

Start date of operations: Clearly list the start date of operations of the business location.

-

VAT calculation method: Choose one of the two VAT calculation methods, declaration or presumptive.

* Section for household/individual business representative signature, full name: The household/individual business representative must sign and list their full name in this section.

* Tax agent employee: In the case a tax agent completes the declaration on behalf of the taxpayer, clearly list the full name and professional certification number.

What is the guidance on filling out Form 03-DK-TCT - Taxpayer registration application for household and individual businesses in Vietnam according to Circular 86? (Image from Internet)

Where is the first-time taxpayer registration application for household and individual businesses submitted?

Based on Article 22 of Circular 86/2024/TT-BTC (effective from February 6, 2025), the location for submitting the first-time taxpayer registration application for household and individual businesses is stipulated as follows:

(1) In the case of households using identification numbers instead of tax codes

- In case of households, individuals having production, business activities of goods, services as prescribed by law but do not register household business through the business registration agency following the regulations of the Government of Vietnam on household business; individual businesses from countries sharing a land border with Vietnam conducting activities to buy, sell, and exchange goods at the border market, border-gate market, and economic border zone market.

+ At the District Tax Office or regional District Tax Office where the business location is set up in the case of households, individual businesses with a fixed business location, or where the individual has real estate for rent.

+ At the District Tax Office or regional District Tax Office where the individual business resides in the case of an individual business without a fixed business location.

- In the case of individuals with taxable personal income subject to personal income tax (excluding business individuals) and other individuals under obligation to the state budget, paying personal income tax through an income-paying agency and authorizing the income-paying agency to register taxpayer registration for the individual or dependent

+ At the income paying agency.

+ In cases where individuals pay personal income tax at multiple income-paying agencies during the same tax submission period, they only authorize taxpayer registration at one income-paying agency and notify their identification number and those of their dependents to other income-paying agencies for deduction, declaration, tax payment purposes.

- In the case of individuals with taxable personal income subject to personal income tax (excluding business individuals) and other individuals under obligation to the state budget paying personal income tax not via an income-paying agency or not authorizing the income-paying agency to register taxpayer registration

+ At the Tax Department where the individual works for residents with income from wages or salaries paid by International organizations, Embassies, Consulates in Vietnam, which have not implemented tax deduction.

+ At the Tax Department in Vietnam where work arises for individuals with income from wages or salaries paid from abroad by organizations or individuals.

+ At the District Tax Office, regional District Tax Office where the individual resides for other cases.

- In case the household, individual does not fall within the aforementioned cases, taxpayer registration through tax declaration dossier:

+ At the District Tax Office, regional District Tax Office where the household, individual incurs obligations with the state budget.

(2) In the case of individual tax code issuance by the tax authority

- In case of individual business activities of goods, services as prescribed by law but do not register business with the business registration agency as stipulated by the Government of Vietnam on household business; individual businesses from countries sharing a land border with Vietnam conducting buying, selling, exchanging goods at the border market, border-gate market, or economic zone border market.

+ At the District Tax Office or regional District Tax Office where the business location is set up in the case of individual businesses with a fixed business location or where the individual has real estate for rent.

+ At the District Tax Office or regional District Tax Office where the individual business resides in case the individual business has no fixed business location.

- In cases of individuals with taxable personal income subject to personal income tax (excluding business individuals) and other individuals under obligation to the state budget paying personal income tax through an income-paying agency and authorizing the income-paying agency to register taxpayer registration for the individual or dependent

+ At the income paying agency.

+ In cases where individuals pay personal income tax at multiple income-paying agencies during the same period, they only authorize taxpayer registration at one income-paying agency in order for the tax authority to issue a tax code. Individuals notify the tax code of themselves and their dependents to other income-paying agencies for deduction, declaration, tax payment purposes.

- In cases of individuals with taxable personal income subject to personal income tax (excluding business individuals) and other individuals under obligation to the state budget, paying personal income tax not via an income-paying agency or not authorizing the income-paying agency to register taxpayer registration

+ At the Tax Department where the individual works for residents with income from wages or salaries paid by International organizations, Embassies, Consulates in Vietnam which have not implemented tax deduction.

+ At the Tax Department where work arises in Vietnam for individuals with income from wages or salaries paid from abroad.

- In cases where individuals do not fall within the aforementioned cases, taxpayer registration through tax declaration dossier:

+ At the District Tax Office, regional District Tax Office where the individual incurs obligations with the state budget.

What is the first-time taxpayer registration deadline in Vietnam?

According to Article 33 of Law on Tax Administration 2019, the deadline for first-time taxpayer registration is defined as follows:

- Taxpayers engaging in taxpayer registration simultaneously with enterprise registration, cooperative registration, business registration will abide by the taxpayer registration deadline as the enterprise registration, cooperative registration, and business registration deadlines defined by law.

- Taxpayers registering taxpayer registration directly with the tax authority have a registration deadline of 10 working days from the following dates:

+ Issued with an enterprise registration certificate, establishment and operation license, investment registration certificate, decision of establishment;

+ Start of business activities for organizations not subject to business registration or household businesses, individual businesses subject to business registration but not yet issued with a business registration certificate;

+ Incurring tax withholding and tax payment responsibilities; organization paying on behalf of individuals according to contracts, cooperation business documentation;

+ Signing of main contract with foreign contractors or sub-contractors declaring and directly paying tax with the tax authority; signing contracts, petroleum agreements;

+ Incurring personal income tax obligations;

+ Incurring tax refund requirements;

+ Incurring other obligations with the state budget.

- Organizations, individuals paying income are responsible for taxpayer registration on behalf of individuals with income at the latest 10 working days from arising tax obligations in case the individual does not have a tax code; registration on behalf for dependents of taxpayers at the latest 10 working days from the date the taxpayer registers for family deduction in accordance with law in cases where dependents do not have a tax code.