What is the guidance on 02 methods to check camera fines for motorcycles and cars online in Vietnam in 2025? What types of motorcycles and cars are subject to excise tax in Vietnam?

What is the guidance on 02 methods to check camera fines for motorcycles and cars online in Vietnam in 2025?

Below is the guidance on 02 methods to check camera fines for motorcycles and cars online in 2025 with complete steps you can refer to.

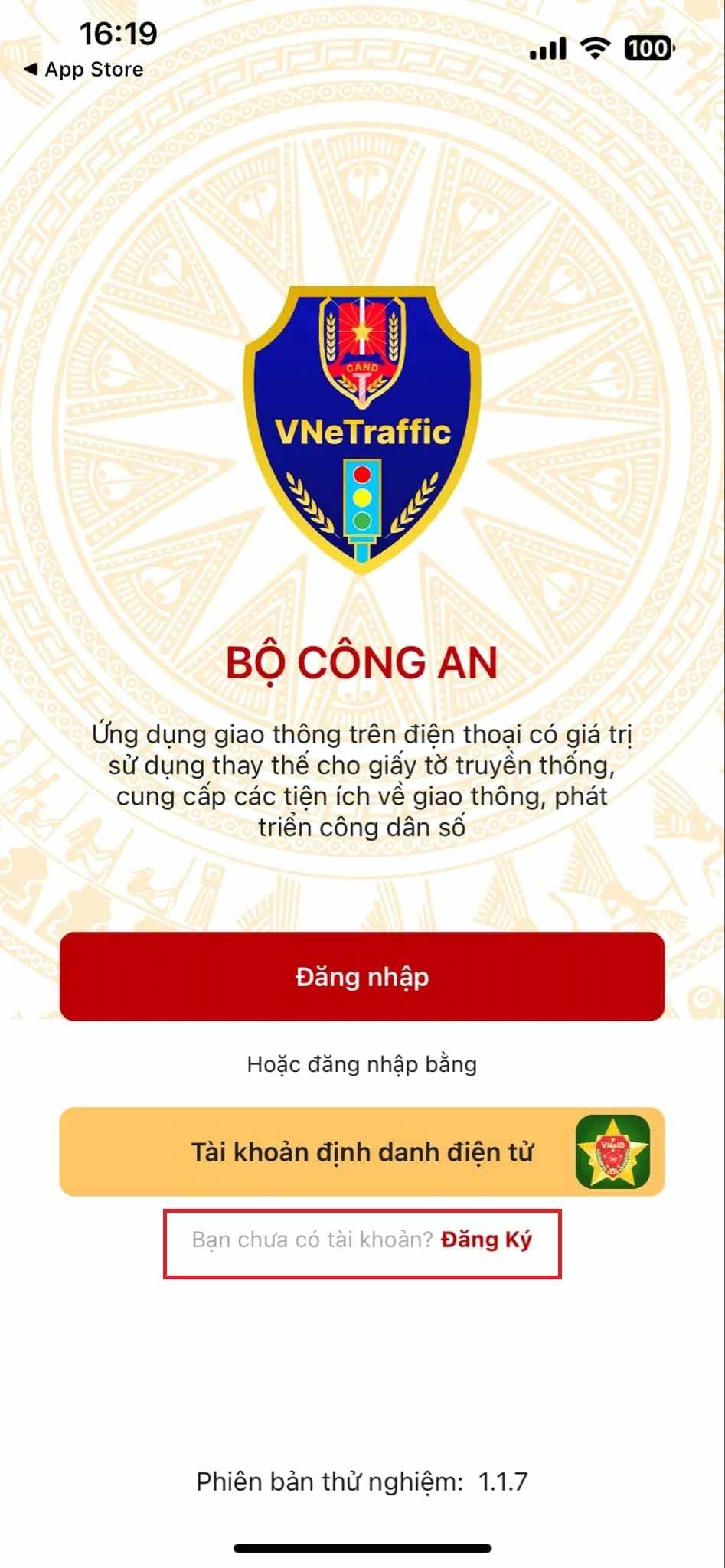

Method 1: Check camera fines via VNeTraffic

- Step 1: Download and install the VNeTraffic app on your phone from the App Store/CH Play.

- Step 2: Log in to your account

If you do not have an account, register one by following these steps:

Select register => Scan QR code at the upper right corner of the CCCD card => Check information => Enter phone number => Click confirm

After that, the system will send an OTP to your phone, input the OTP and set up a password.

- Step 3: Check fines

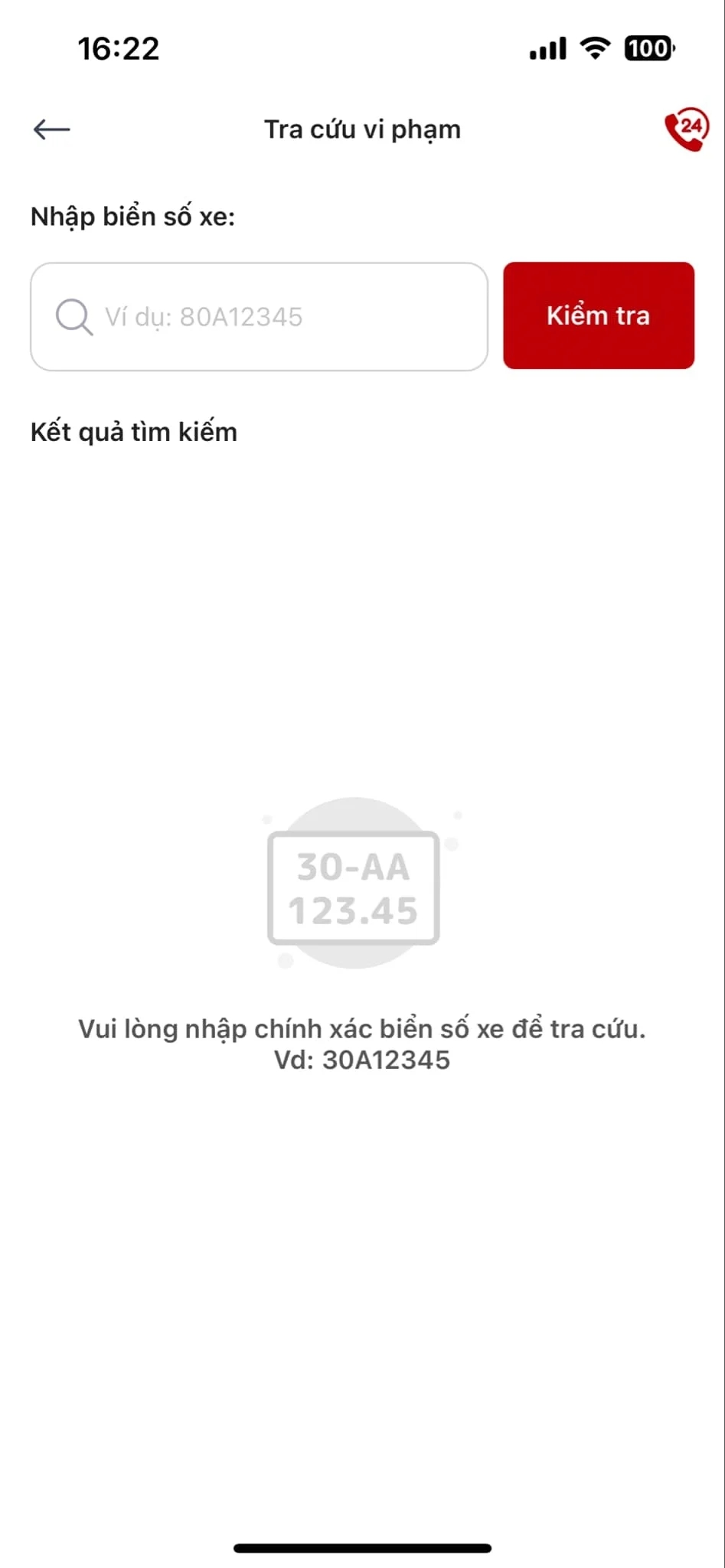

To check for fines, select "Violation Lookup".

- Step 4: Enter the vehicle license plate number you want to check and press "Check"

Method 2: Check camera fines on the Traffic Police Department Website

- Step 1: Access the Traffic Police Department website: http://www.csgt.vn/.

- Step 2: Fill in the information in the "Traffic Violation Lookup via Image" section on the right side of the screen.

- Step 3: In the lookup section, enter the full vehicle license plate number and select the vehicle type (car or motorcycle)

- Step 4: Enter the security code (The sequence of letters and numbers next to the empty box)

- Step 5: Press “Lookup” to find results.

At this point, the system will return the traffic violation results of the vehicle. If no results are found, it means the vehicle has not been fined.

Note: The guidance on 02 methods to check fines for motorcycles and cars online in 2025 with complete steps is for reference purposes only.

What is the guidance on 02 methods to check camera fines for motorcycles and cars online in Vietnam in 2025? What types of motorcycles and cars are subject to excise tax in Vietnam? (Image from the Internet)

What types of motorcycles and cars are subject to excise tax in Vietnam?

Pursuant to Clause 1 Article 2 Law on excise tax 2008 amended by Clause 1 Article 1 Law on excise tax Amendment 2014 stipulates the items subject to excise tax as follows:

Taxable Objects

- Goods:

a) Cigarettes, cigars, and other products from tobacco used for smoking, sniffing, chewing, inhaling, or sucking;

b) Alcohol;

c) Beer;

d) Automobiles with fewer than 24 seats, including those that transport both passengers and goods with two or more rows of seats and having a fixed partition between the passenger compartment and the cargo compartment;

dd) Motorcycles with two or three wheels with a cylinder capacity of over 125cm3;

e) Aircraft, yachts;

g) All types of gasoline;

h) Air conditioners with a capacity of 90,000 BTU or less;

i) Playing cards;

k) Votive papers, and votive goods.

...

Thus, the types of motorcycles and cars subject to excise tax include:

- Automobiles with fewer than 24 seats, including those that transport both passengers and goods with two or more rows of seats and having a fixed partition between the passenger compartment and the cargo compartment;

- Motorcycles with two or three wheels with a cylinder capacity of over 125cm3.

How to determine the excise tax value in Vietnam?

Based on Article 6 Law on excise tax 2008 amended by Clause 3 Article 1 Law on excise tax Amendment 2014, Clause 1 Article 2 Law on Value Added Tax, excise tax, and Tax Administration Amendment 2016 and partially repealed by Clause 2 Article 6 Law amending the Laws on Taxation 2014 stipulating the excise tax value as follows:

The excise tax value for goods, services is the selling price, service provision price excluding excise tax, environmental protection tax, and value-added tax as stipulated below:

- For domestic goods production, imported goods, it is the price at which production or importation establishments sell.

If goods subject to excise tax are sold to commercial business establishments that are parent or subsidiary companies, or subsidiary companies under the same parent company with the production, import establishments or affiliated commercial business establishments, the excise tax value must not be lower than a certain percentage (%) compared to the average selling price of commercial business establishments purchasing directly from the production, import establishments as prescribed by the Government of Vietnam.

- For imported goods at the import stage, it is the taxable import price plus import tax. If the imported goods are exempt from or reduced in import tax, the tax value does not include the exempted or reduced import tax. Imported goods subject to excise tax are deductible by the excise tax paid at the import stage when determining the excise tax payable upon sale.

- For manufactured goods, the tax value is the selling price of the goods sold by the manufacturing outsourcing facility or the price of similar or equivalent products at the same time of sale;

- For goods sold under installment or deferred payment methods, it is the selling price under a single-payment method of those goods, excluding installment or deferred payment interest;

- For services, it is the service provision price of the business establishment. Service provision price for some cases is defined as follows:

+ For golf business, it is the member card sale price, golf playing ticket price, including both golfing fees and deposit (if any);

+ For casino, reward-winning electronic gaming, and betting business, it is revenue from these activities minus the amount paid for prizes;

+ For nightclub, massage, karaoke business, it is the revenue from business activities in the nightclub, massage, karaoke business establishments;

- For goods, services used for exchange, internal consumption, or gifts, it is the excise tax value of similar or equivalent goods, services at the time these activities occur.

The excise tax value for goods, services stipulated in this Article includes additional charges, if any, that the business establishment is entitled to.