What is the guidance for filling out the travel warrant in Vietnam according to Circular 200?

What is the guidance for filling out the travel warrant in Vietnam according to Circular 200?

The travel warrant used in corporate accounting serves as a basis for employees to complete necessary procedures when traveling for work and to settle travel expenses, including transportation, after returning to the company.

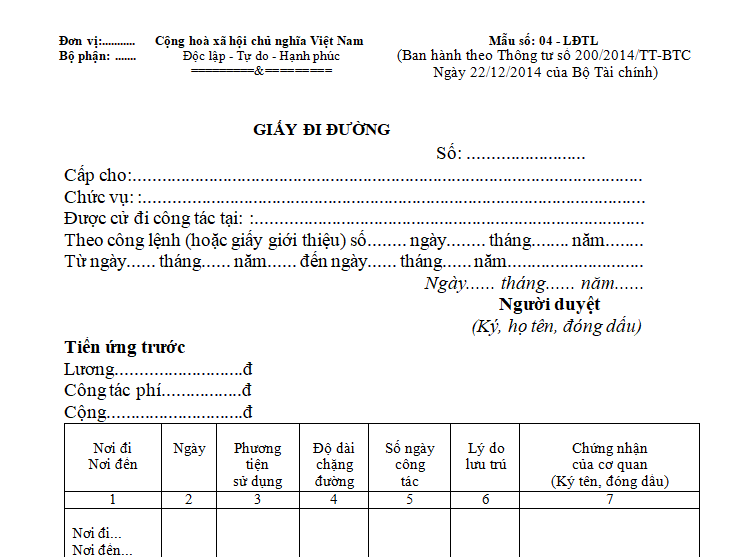

Currently, the travel warrant in corporate accounting is specified in Form No. 04 – LDTL issued in conjunction with Circular 200/2014/TT-BTC. To be specific:

Download travel warrant according to Circular 200/2014/TT-BTC.

Below is the guidance for completing the travel warrant according to Circular 200.

After receiving the order for business travel, the administrative department will process the issuance of the travel form. Employees with a need for advances on transportation costs, travel allowances, etc., should take the travel form to the accounting department for advance procedures.

- Column 1: Record the departure and arrival destinations.

- Column 2: Record the departure and arrival dates.

Upon arrival at the destination, the office being visited must confirm the arrival and departure dates and times (stamp and signature required from a responsible person at the visited office).

- Column 3: Means of transportation: Specify clearly such as company car, passenger car, train, airplane, etc.

- Column 4: Distance from the departure to the arrival location.

- Column 5: Duration of the business trip.

- Column 6: Reason for the stay.

- Column 7: Obtain a signature from the authorized person and the seal from the office where the employee is visiting.

Upon returning, the individual should present the travel form to the department head to confirm the return date and duration of allowance for the stay. Then attach all travel-related documents (such as transportation tickets, ferry tickets, accommodation payment receipts, etc.) to the travel form and submit it to the accounting department to process travel expense and advance settlement. Finally, send it to the chief accountant for approval of the payment.

The travel form and related documents are stored in the accounting department.

Note on applicability of this form:

- Enterprises of all sectors and economic components.

- Small and medium-sized businesses that implement accounting according to the accounting regime applicable to small and medium-sized enterprises may apply regulations from Circular 200/2014/TT-BTC to align with their business characteristics and management requirements.

What is the guidance for filling out the travel warrant in Vietnam according to Circular 200? (Image from Internet)

What are the accounting principles of Account 141 - Advance in Vietnam?

Based on Clause 1, Article 22 of Circular 200/2014/TT-BTC, the accounting principles of Account 141 - Advance are regulated as follows:

- Account 141 is used to reflect advances made by the enterprise to employees within the company and the settlement of these advances.

- An advance is an amount of money or materials provided by the company to an individual for executing an approved production, business, or task. The recipient must be an employee of the company. Frequent advance recipients (in supply, administration divisions) must be designated in writing by the manager.

- The advance recipient (as an individual or a group) is accountable to the company for the advance received and is restricted to use the advance only for the approved purposes. Any unused amount or not fully utilized advance must be returned to the company fund. The advance recipient must not transfer the advance amount for another's usage.

Upon completing the assigned task, the advance recipient must prepare a settlement statement (with original documents) for a full settlement (per instance) of the advance received, the used advance, and any discrepancy between the received advance and the used amount (if applicable). Any unused advance not returned to the company fund should be deducted from the recipient’s salary. In the event of excess expenditure over the advance, the company will cover the shortfall.

- To receive a new advance, the previous one must be fully settled. Accountants must maintain detailed records for each advance recipient and thoroughly document the receipt and settlement status for each advance.

How to choose the currency unit in accounting in Vietnam?

Based on Articles 3 and 4 of Circular 200/2014/TT-BTC, the choice of currency unit in accounting is regulated as follows:

(1) The "currency unit in accounting" is the Vietnamese Dong (national symbol “đ”; international symbol “VND”) used for recording accounting books, compiling, and presenting the company's financial statements.

(2) If the accounting entity mainly transacts in foreign currencies and meets the following criteria, it can select a foreign currency as the currency unit for accounting records:

- Companies with primary revenue and expenditures in foreign currency, based on the Accounting Law, may decide on the currency unit for accounting and are responsible for this decision before the law. Upon selecting a currency unit for accounting, companies must inform their direct tax authorities.

- The currency unit in accounting is:

+ Primarily used in the unit's sales and service transactions that significantly influence pricing and is commonly used for price listing and payment; and

+ Primarily used for purchasing goods and services that affect labor, material costs, and other business expenses, usually being the unit for these payments.

- The following factors are also considered as evidence for the currency unit in the entity's accounting:

+ The currency used to raise financial resources (like issuing shares, bonds);

+ The currency frequently received from business activities and retained.

- The accounting currency unit reflects transactions, events, and conditions related to the unit's activities. Once the currency unit is determined, it cannot be changed unless there are substantial changes in transactions, events, and conditions.