What is the Gregorian date for the 2025 Tet holiday? May taxpayers submit e-tax dossiers during the 2025 Tet holiday in Vietnam?

What is the Gregorian date for the 2025 Tet holiday in Vietnam?

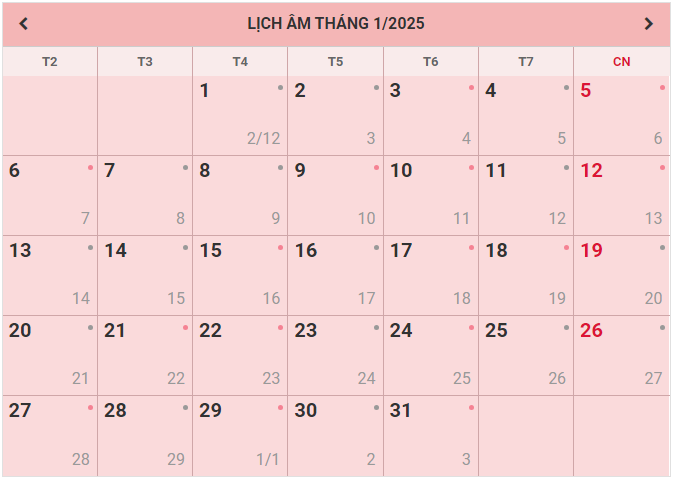

The 2025 Tet holiday will fall on the following days:

- 29th of the 12th lunar month of Giap Thin year (29 Tet): Tuesday, January 28, 2025, Gregorian calendar

- 1st of the 1st lunar month of At Ty year (1 Tet): Wednesday, January 29, 2025, Gregorian calendar

- 2nd of the 1st lunar month of At Ty year (2 Tet): Thursday, January 30, 2025, Gregorian calendar

- 3rd of the 1st lunar month of At Ty year (3 Tet): Friday, January 31, 2025, Gregorian calendar

- 4th of the 1st lunar month of At Ty year (4 Tet): Saturday, February 1, 2025, Gregorian calendar

- 5th of the 1st lunar month of At Ty year (5 Tet): Sunday, February 2, 2025, Gregorian calendar

Thus, the 1st of the 2025 Tet holiday is on January 29, 2025, Gregorian calendar.

How many days are left until the 2025 Tet holiday?

The 1st of the 2025 Tet holiday is on January 29, 2025, Gregorian calendar.

Today is December 26, 2024, with the Lunar New Year on January 29, 2025.

Thus, there are 34 days left until the 2025 Tet holiday.

What is the Gregorian date for the 2025 Tet holiday? May taxpayers submit e-tax dossiers during the 2025 Tet holiday in Vietnam? (Image from the Internet)

May taxpayers submit e-tax dossiers during the 2025 Tet holiday in Vietnam?

Based on point a, clause 1, Article 8 of Circular 19/2021/TT-BTC, it is stipulated as follows:

How to determine the time for e-tax document submission, e-tax payment of taxpayers, and the time tax authorities send notices, decisions, documents to taxpayers

- Time for e-tax document submission, e-tax payment

a) Taxpayers can perform e-tax transactions 24 hours a day (from 00:00:00 to 23:59:59) and 7 days a week, including holidays and Tet holidays. The time for submitting tax documents is considered as the day if the documents are successfully signed and sent from 00:00:00 to 23:59:59 on the day.

b) The time for confirming the e-tax document submission is determined as follows:

b.1) For e-taxpayer registration documents: it is the date the tax authority’s system receives the documents and is recorded in the e-taxpayer registration document receipt notice of the tax authority sent to the taxpayer (according to form No. 01-1/TB-TDT issued with this Circular).

b.2) For tax declaration documents (except tax declaration documents in cases where the tax administration agency calculates the tax and notifies tax payment as prescribed in Article 13 of Decree 126/2020/ND-CP): it is the date the tax authority’s system receives the documents and is recorded in the e-tax declaration document receipt notice of the tax authority sent to the taxpayer (according to form No. 01-1/TB-TDT issued with this Circular) if the tax declaration documents are accepted by the tax authority as stated in the e-tax declaration acceptance notice of the tax authority sent to the taxpayer (according to form No. 01-2/TB-TDT issued with this Circular).

...

According to the above regulations, taxpayers can perform e-tax transactions 24 hours a day (from 00:00:00 to 23:59:59) and 7 days a week, including holidays, holiday days, and Tet holidays.

Thus, taxpayers can perform e-tax transactions, including online tax document submissions during the 2025 Tet holiday holidays.

What are regulations on e-tax declaration in Vietnam?

According to Article 16 of Circular 19/2021/TT-BTC, e-tax declaration is regulated as follows:

- Taxpayers prepare and submit tax declaration documents:

+ Taxpayers conduct e-tax declarations (including additional declarations, submitting additional information explanation of tax declaration documents) according to one of the methods stipulated in clause 5 Article 4 of Circular 19/2021/TT-BTC.

+ In cases where tax declaration documents include materials as prescribed by law and the taxpayer cannot send them electronically, they shall be submitted directly at the tax office or sent by registered mail to the tax office.

+ Taxpayers who have submitted e-tax declaration documents, but the tax office has notified not accepting the taxpayer's tax declaration, and the taxpayer does not resubmit tax declaration documents or submits them again but still not accepted by the tax office, are considered not to have submitted tax declaration documents.

- Tax authorities' acceptance of taxpayers' tax declaration documents

+ The General Department of Taxation’s e-portal sends a receipt notice for e-tax declaration documents (according to form No. 01-1/TB-TDT issued with Circular 19/2021/TT-BTC) to taxpayers according to point 2 Article 5 of Circular 19/2021/TT-BTC within a maximum of 15 minutes from receiving the taxpayer's e-tax declaration documents.

+ A maximum of one (1) working day from the date recorded in the e-tax declaration documents receipt notice, the tax office sends an acceptance/non-acceptance notice for e-tax declaration documents (according to form No. 01-2/TB-TDT issued with Circular 19/2021/TT-BTC) to taxpayers according to clause 2 Article 5 of Circular 19/2021/TT-BTC.

+ If accepting e-tax declaration documents, the tax office sends an acceptance notice for e-tax declaration documents (following form No. 01-2/TB-TDT issued with Circular 19/2021/TT-BTC) to taxpayers according to clause 2 Article 5 of Circular 19/2021/TT-BTC.

+ If not accepting the tax declaration documents, the tax office sends a non-acceptance notice for the e-tax declaration documents (following form No. 01-2/TB-TDT issued with Circular 19/2021/TT-BTC) to taxpayers according to clause 2 Article 5 of Circular 19/2021/TT-BTC, citing the reasons.

+ Particularly for tax declaration documents that include accompanying materials submitted directly or sent by post, the tax office must immediately compare the paper version with the one received through the General Department of Taxation's e-portal.

A maximum of one (1) working day from the complete receipt of accompanying documents as required, the tax office sends an acceptance/non-acceptance notice for e-tax declaration documents (following form No. 01-2/TB-TDT issued with Circular 19/2021/TT-BTC) according to point b of this clause to taxpayers under clause 2 Article 5 of Circular 19/2021/TT-BTC.