What is the formula for calculating environmental protection tax in Vietnam?

What is the formula for calculating environmental protection tax in Vietnam?

Under the Environmental Protection Tax Law 2010, the concept of environmental protection tax is defined in Clause 1, Article 2 of the Environmental Protection Tax Law 2010 as follows:

Environmental protection tax means indirect-collected tax, collected on products and goods (hereafter referred to as goods) when used to cause negative environmental impacts.

The environmental protection tax can be understood as a tax on consumers through the tax payments made by producers and traders for products and goods that, when used, negatively impact the environment.

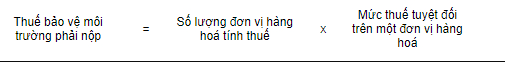

In addition, regarding the formula for calculating environmental protection tax, Article 4 of Circular 152/2011/TT-BTC specifies as follows:

08 objects subject to environmental protection tax

Under the provisions of Article 3 of the Environmental Protection Tax Law 2010, the 08 objects subject to environmental protection tax include:

| No. | Objects |

| 1 |

Gasoline, oil, lubricants, including: - Gasoline, excluding ethanol; - Aviation fuel; - Diesel oil; - Kerosene; - Fuel oil; - Lubricating oil; - Lubricating grease. |

| 2 |

Coal, including: - Brown coal; - Anthracite coal; - Fat coal; - Other types of coal. |

| 3 | Hydrogen-chlorofluorocarbon liquid (HCFC) |

| 4 | Taxable-plastic bag |

| 5 | Herbicide which is restricted from use. |

| 6 | Pesticide which is restricted from use. |

| 7 | Forest product preservative which is restricted from use. |

| 8 | Warehouse disinfectant which is restricted from use. |

*Note: When it is necessary to supplement other taxable objects as per period, the National Assembly Standing Committee shall consider and regulate.

What is the formula for calculating environmental protection tax in Vietnam? (Image from the Internet)

What is the basis for calculating environmental protection tax in Vietnam?

Under the provisions of Article 5 of Circular 152/2011/TT-BTC as amended and supplemented by Article 1 of Circular 106/2018/TT-BTC, Article 3 of Circular 159/2012/TT-BTC, the basis for calculating environmental protection tax includes the taxable quantity of goods and the absolute tax rate.

Specifically, the determination of tax calculation bases is carried out as follows:

Tax Calculation Basis

The basis for calculating environmental protection tax is the taxable quantity of goods and the absolute tax rate.

- The taxable quantity of goods is prescribed as follows:

+ For domestically produced goods, the taxable quantity of goods is the quantity of goods produced and sold, exchanged, internally used, given, promoted, or advertised.

+ For imported goods, the taxable quantity of goods is the quantity of goods imported.

In cases where the taxable quantity of goods subject to environmental protection tax is exported, sold, and imported measured in units other than those specified for tax calculation in the tax schedule issued by the Standing Committee of the National Assembly, it must be converted to the measurement units specified in the tax schedule for calculating the tax.

+ For mixed fuels containing fossil-derived gasoline, oil, lubricants, and biofuels, the taxable quantity of goods within the period is the quantity of fossil-derived gasoline, oil, lubricants present in the quantity of mixed fuel imported or produced for sale, exchange, gifting, and internal use converted to the measurement units specified for tax calculation of the corresponding goods.

Determination Method:

Taxable fossil-derived gasoline, oil, lubricants quantity = Quantity of mixed fuel imported, produced, sold, consumed, exchanged, gifted x Fossil-derived gasoline, oil, lubricants percentage (%) in the mixed fuel

Based on the technical standards for mixed fuel processing approved by the competent authority (including cases of changing the fossil-derived gasoline, oil, lubricants percentage (%) in the mixed fuel), the taxpayer calculates, declares, and pays environmental protection tax for the quantity of fossil-derived gasoline, oil, lubricants.

In addition, they are responsible for informing the tax authority of the fossil-derived gasoline, oil, lubricants percentage (%) in the mixed fuel and submitting it with the tax declaration form of the following month of the starting month of selling (or changing the ratio) mixed fuel.

+ For multi-layer plastic bags produced or processed from single-layer plastic film HDPE, LDPE, LLDPE, and other plastic films (PP, PA,...) or other materials such as aluminum, paper... the environmental protection tax is determined based on the percentage weight of single-layer HDPE, LDPE, LLDPE plastic films in the multi-layer plastic bags.

Based on the ratio of HDPE, LDPE, LLDPE plastic film weight used for producing or processing multi-layer plastic bags, the producer or importer of multi-layer plastic bags shall self-declare and be responsible for their declarations.

Example 8: Company A produces or imports 100 kg multi-layer plastic bags, of which the weight of single-layer HDPE, LDPE, LLDPE plastic films in the multi-layer plastic bags is 70% and the weight of other plastic films (PA, PP,...) is 30%.

Thus, Company A must pay environmental protection tax for 100 kg multi-layer plastic bags as: 100 kg x 70% x 40,000 VND/kg = 2,800,000 VND.

- The absolute tax rate used as the basis for calculating environmental protection tax for each type of goods subject to environmental protection tax is the tax rate specified in the Environmental Protection Tax Schedule issued alongside Resolution 579/2018/UBTVQH14 dated September 26, 2018, by the Standing Committee of the National Assembly on the Environmental Protection Tax Schedule.