What is the form of value-added tax invoice issued by the Tax Department in Vietnam under Circular 78?

What is the form of value-added tax invoice issued by the Tax Department in Vietnam under Circular 78?

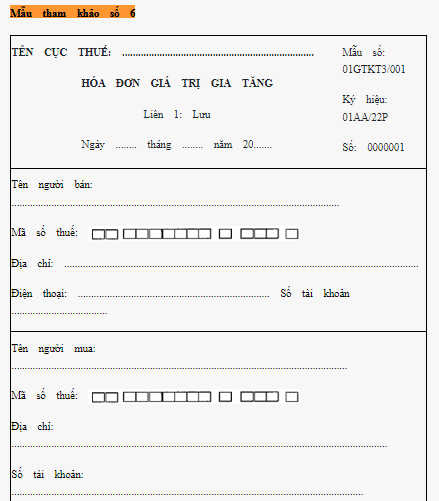

Based on Appendix 2 on sample e-invoices/receipts for reference issued together with Circular 78/2021/TT-BTC, the reference form number 6 is as follows:

Download The reference form for value-added tax invoices issued by the Tax Department under Circular 78.

What is the form of value-added tax invoice issued by the Tax Department in Vietnam under Circular 78? (Image from Internet)

Does the letter G in the e-card signify a value-added invoice in Vietnam?

According to Clause 1, Article 4 of Circular 78/2021/TT-BTC the regulations are as follows:

Symbol of form number, invoice symbol, name of the invoice copy

1. e-invoice

a) The symbol of the e-invoice form number is a character with one natural number reflecting the type of e-invoice as follows:

- Number 1: Reflects the type of value-added e-invoice;

- Number 2: Reflects the type of sales e-invoice;

- Number 3: Reflects the type of public asset sales e-invoice;

- Number 4: Reflects the type of national reserve sales e-invoice;

- Number 5: Reflects other types of e-invoices such as e-stamps, e-tickets, e-cards, e-collection notes, or other e-documents with content of an e-invoice as per Decree 123/2020/ND-CP;

- Number 6: Reflects e-documents used and managed like invoices, including internal transfer warehouse slips and consignment sales slip notes.

b) The e-invoice symbol is a group of 6 characters including both letters and numbers representing the symbol of the e-invoice, reflecting information about the type of e-invoice with or without tax code, the year of invoice creation, and the type of e-invoice used. These six (06) characters are stipulated as follows:

- The first character is one (01) letter, defined as C or K: C denotes an e-invoice with a tax code, K denotes an invoice without a code;

- The next two characters are two (02) Arabic numerals representing the year the e-invoice was created, defined by the last 2 digits of the calendar year. Example: An e-invoice created in the year 2022 is shown as 22; in 2023 as 23;

- The next character is one (01) letter defined as T, D, L, M, N, B, G, H representing the type of e-invoice used, specific details:

+ Letter T: Applicable for e-invoices registered by businesses, organizations, and individuals for use with the tax agency;

+ Letter D: Applicable for sales of government assets and national reserve sales invoices or specific e-invoices not necessarily having some required criteria registered for use by businesses, organizations;

+ Letter L: Applicable for e-invoices issued by the tax agency per each issue;

+ Letter M: Applicable for e-invoices generated from cash registers;

+ Letter N: Applicable for internal transfer warehouse note invoices;

+ Letter B: Applicable for consigned goods warehouse note invoices;

+ Letter G: Applicable for stamps, tickets, e-cards as value-added invoices;

+ Letter H: Applicable for stamps, tickets, e-cards as sales invoices.

- The last two characters are letters determined by the seller based on management needs. If the seller uses multiple e-invoice forms of the same type, the last two characters are used to differentiate different invoice forms. If there is no management need, it is set as YY;

- In the form representation, the symbol of the e-invoice and the form number symbol is shown at the upper right of the invoice (or an easily recognizable position);

- Example representation of e-invoice form symbols and symbols:

+ “1C22TAA” – is a value-added invoice with a tax code issued in 2022 and is an e-invoice registered for use by a business with the tax agency;

+ “2C22TBB” – is a sales invoice with a tax code issued in 2022 and is an e-invoice registered for use by a business, organization, or individual with the tax agency;

+ “1C23LBB” – is a value-added invoice with a tax code issued in 2023 and is an e-invoice issued by the tax agency per occurrence;

+ “1K23TYY” – is a value-added invoice without a code issued in 2023 and is an e-invoice registered for use by a business with the tax agency;

+ “1K22DAA” – is a value-added invoice without a code issued in 2022 and is a specific e-invoice not necessarily having some required criteria registered for use by businesses, organizations;

+ “6K22NAB” – is an internal transfer warehouse slip without a code issued in 2022 registered by the business with the tax agency;

+ “6K22BAB” – is a consigned goods warehouse slip without a code issued in 2022 registered by the business with the tax agency.

c) Name, address, taxpayer identification number of the entrusted party for e-invoices authorized.

...

Therefore, according to the above regulation, the letter G in the e-card is the symbol of a single letter stipulated for value-added invoices.

Apart from value-added invoices, what are other types of e-invoices in Vietnam?

According to Clause 2, Article 89 of Tax Management Law 2019, the regulations are as follows:

e-invoices

...

2. e-invoices include value-added invoices, sales invoices, e-stamps, e-tickets, e-cards, e-collection notes, internal transfer warehouse slips, or other e-documents with different names.

3. e-invoices with a tax agency's code are e-invoices coded by the tax agency before the sale of goods or provision of services sent to buyers.

The tax agency's code on the e-invoice includes a unique transaction number generated by the tax agency's system and a string of characters encrypted by the tax agency based on the seller's information made on the invoice.

4. e-invoices without a tax agency's code are e-invoices sent by the sales organization or service provider to buyers without the tax agency's code.

5. The Government of Vietnam provides detailed regulations for this Article.

Therefore, apart from value-added invoices, e-invoices also include e-stamps, e-tickets, e-cards, e-collection notes, internal transfer warehouse slips, or other e-documents with different names.