What is the form of the Certificate of Income Tax Paid in Vietnam?

What is the form of the Certificate of Income Tax Paid in Vietnam?

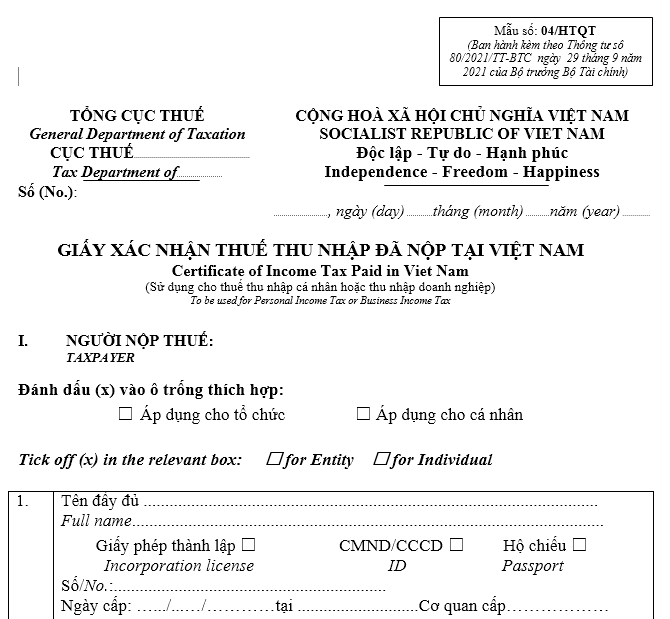

Pursuant to the Appendix issued together with Circular 80/2021/TT-BTC, the form of the Certificate of Income Tax Paid in Vietnam is form number 04/HTQT as follows:

>>> Download Form of the Certificate of Income Tax Paid in Vietnam.

What is the form of the Certificate of Income Tax Paid in Vietnam? (Image from the Internet)

How many days does it take for the Tax Department to issue the Certificate of Income Tax Paid in Vietnam?

Pursuant to Clause 2, Article 70 of Circular 80/2021/TT-BTC, the regulation is as follows:

Confirmation of tax obligations fulfillment

...

2. Confirmation of income tax paid in Vietnam for foreign residents:

In case a resident of a country that has signed a tax treaty with Vietnam must pay income tax in Vietnam according to the provisions of the tax treaty and Vietnamese tax law and wishes to confirm the paid tax amount in Vietnam to be deducted from the tax payable in the country of residence, the following procedures must be performed:

a) In case the taxpayer requests confirmation of the income tax paid in Vietnam, they shall send the request file to the Tax Department of the province or centrally-affiliated city where the tax registration is done for confirmation. The file includes:

a.1) The request for confirmation of the income tax paid in Vietnam according to the tax treaty, using form number 03/HTQT issued together with Appendix I of this Circular, providing information on transactions related to taxable income and the tax amount arising from that transaction, which falls under the scope of the tax treaty;

a.2) The original (or a certified copy) of the Certificate of Residence of the country of residence issued by the tax authority (clearly stating the tax residency period) which has been consularized;

a.3) Power of attorney in case the taxpayer authorizes a legal representative to carry out the procedures for applying the tax treaty.

Within 07 working days from the date of receiving the file, the Tax Department where the taxpayer is registered must issue the Certificate of Income Tax Paid in Vietnam using form number 04/HTQT or form number 05/HTQT issued together with Appendix I of this Circular. Form number 04/HTQT is used to confirm personal income tax and corporate income tax; Form number 05/HTQT is used to confirm tax on dividends, interest, royalties, or technical service fees.

If the file is incomplete or lacking information that requires explanation or supplement of documents, the tax authority shall send a Notice to explain and supplement information and documents according to form number 01/TB-BSTT-NNT issued together with Decree 126/2020/ND-CP to the taxpayer for explanation or supplementation of the information and documents.

Within 10 working days from the date the tax authority issues the Notice, the taxpayer must send a written explanation or supplement the information and documents as requested by the tax authority.

...

Thus, according to the above regulation, the Certificate of Income Tax Paid in Vietnam is issued by the Tax Department within 07 working days from the date of receipt of the file.

What is the use of the Certificate of Income Tax Paid in Vietnam?

Pursuant to Article 70 of Circular 80/2021/TT-BTC, the regulation is as follows:

Confirmation of tax obligations fulfillment

...

2. Confirmation of income tax paid in Vietnam for foreign residents:

In case a resident of a country that has signed a tax treaty with Vietnam must pay income tax in Vietnam according to the provisions of the tax treaty and Vietnamese tax law and wishes to confirm the paid tax amount in Vietnam to be deducted from the tax payable in the country of residence, the following procedures must be performed:

a) In case the taxpayer requests confirmation of the income tax paid in Vietnam, they shall send the request file to the Tax Department of the province or centrally-affiliated city where the tax registration is done for confirmation. The file includes:

a.1) The request for confirmation of the income tax paid in Vietnam according to the tax treaty, using form number 03/HTQT issued together with Appendix I of this Circular, providing information on transactions related to taxable income and the tax amount arising from that transaction, which falls under the scope of the tax treaty;

a.2) The original (or a certified copy) of the Certificate of Residence of the country of residence issued by the tax authority (clearly stating the tax residency period) which has been consularized;

a.3) Power of attorney in case the taxpayer authorizes a legal representative to carry out the procedures for applying the tax treaty.

Within 07 working days from the date of receiving the file, the Tax Department where the taxpayer is registered must issue the Certificate of Income Tax Paid in Vietnam using form number 04/HTQT or form number 05/HTQT issued together with Appendix I of this Circular. Form number 04/HTQT is used to confirm personal income tax and corporate income tax*; Form number 05/HTQT is used to confirm tax on dividends, interest, royalties, or technical service fees.*

If the file is incomplete or lacking information that requires explanation or supplement of documents, the tax authority shall send a Notice to explain and supplement information and documents according to form number 01/TB-BSTT-NNT issued together with Decree 126/2020/ND-CP to the taxpayer for explanation or supplementation of the information and documents.

Within 10 working days from the date the tax authority issues the Notice, the taxpayer must send a written explanation or supplement the information and documents as requested by the tax authority.

...

Thus, form number 04/HTQT—Certificate of Income Tax Paid in Vietnam is used to confirm personal income tax and corporate income tax.