What is the form of report on the use of invoice of enterprises in Vietnam?

What is the form of report on the use of invoice of enterprises in Vietnam?

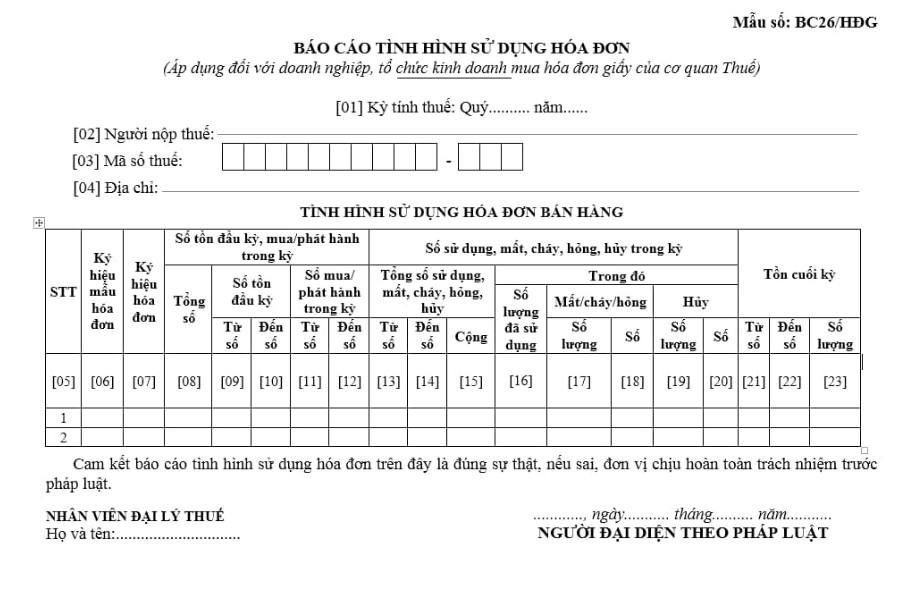

The form of report on the quarterly use of invoice is prescribed as Form No. BC26/HDG, Appendix IA issued together with Decree 123/2020/ND-CP.

Download the report template on the use of invoice (Form No. BC26/HDG)

What is the form of report on the use of invoice of enterprises in Vietnam? (Image from the Internet)

What are regulations on reporting on use of invoices quarterly in Vietnam?

According to Article 29 Decree 123/2020/ND-CP prescribing the reporting on the usage of pre-ordered invoices purchased from tax authorities and the list of invoices used during the period:

Report on the usage of pre-ordered invoices purchased from tax authorities and the list of invoices used during the period

1. Quarterly, enterprises, economic organizations, households, and individuals engaged in business activities purchasing invoices from tax authorities are responsible for submitting reports on the usage of invoices and the list of invoices used during the period to the directly managing tax authority.

The report on the usage of invoices is submitted quarterly no later than the last day of the first month of the subsequent quarter following the use of invoice period according to Form No. BC26/HDG, Appendix IA issued together with this Decree.

In case there are no invoices used during the period, enterprises, economic organizations, households, and individuals engaged in business activities shall submit the report on use of invoice indicating the number of invoices used as zero (= 0), without having to submit the list of invoices used during the period. If in the previous period, all invoices were used up and the report on the previous period's use of invoice showed zero (0) inventory and no purchase or use of invoices occurred in the period, then enterprises, economic organizations, households, and individuals engaged in business activities are not required to report on use of invoice.

2. Enterprises, economic organizations, households, and individuals engaged in selling goods and services are responsible for submitting reports on the usage of invoices and the list of invoices used during the period in case of division, separation, merger, dissolution, bankruptcy, change of ownership; transfer, sale, contract, or lease of state enterprises along with the timeframe for submitting tax finalization dossiers.

3. In case an enterprise, economic organization, household, or individual engaged in business activities relocates its business premises to another area outside the jurisdiction of the directly managing tax authority, it must submit reports on use of invoice and the list of invoices used during the period to the tax authority of the transferred location.

Thus, according to the above regulations, quarterly, enterprises, economic organizations, households, and individuals engaged in business activities who purchase invoices from tax authorities are responsible for submitting reports on use of invoice and the list of invoices used during the period to the directly managing tax authority.

The report on use of invoice must be submitted no later than the last day of the first month following the quarter in which use of invoice occurs.

How much is the fine for late submission of the report on use of invoice in Vietnam?

The penalty level for the act of late submission of the use of invoice report is prescribed in Article 29 Decree 125/2020/ND-CP corrected by Clause 2 Official Dispatch 29/CP-KTTH of 2021 as follows:

Penalty for Violations on Preparing, Submitting Notices, Reports on Invoices

1. A warning penalty applies to the act of submitting notices, reports on invoices after the deadline by 01 to 05 days, from the deadline specified and with mitigating circumstances.

2. A fine of 1,000,000 VND to 3,000,000 VND applies to one of the following acts:

a) Submitting notices, reports on invoices past the specified deadline from 01 to 10 days, except for cases stipulated in Clause 1 of this Article;

b) Incorrectly preparing or not fully completing the content of notices, reports on invoices as required and submitting them to the tax authority.

In case the organization or individual self-discovers the errors and prepares a replacement notice, report conformably submitted to the tax authority before the tax authority or competent agency issues a tax inspection, audit decision at the taxpayer's headquarters, no penalty shall apply.

3. A fine of 2,000,000 VND to 4,000,000 VND applies to acts of submitting notices, reports on invoices to the tax authority past the specified deadline from 11 to 20 days, from the end of the specified deadline.

4. A fine of 4,000,000 VND to 8,000,000 VND applies to acts of submitting notices, reports on invoices to the tax authority past the specified deadline from 21 to 90 days, from the end of the specified deadline.

5. A fine of 5,000,000 VND to 15,000,000 VND applies to one of the following acts:

a) Submitting notices, reports on invoices to the tax authority past the specified deadline by 91 days or more, from the end of the specified deadline;

b) Not submitting notices, reports on invoices to the tax authority as required.

...

7. Remedial measure: Required preparation and submission of notices, reports on invoices for acts defined in point b, Clause 2, and point b, Clause 5 of this Article.

Thus, according to the above regulations, the penalty level for the act of late submission of the use of invoice report depends on the number of days delayed in submitting the report by the organization.

Additionally, the remedial measure for the act of late submission of the use of invoice report is the required preparation and submission of notices, reports on invoices for acts defined in point b, Clause 2, and point b, Clause 5, Article 29 Decree 125/2020/ND-CP.

* Note: Violations regarding the preparation, and submission of notices, reports on invoices are stipulated in Articles 23, 25 Decree 125/2020/ND-CP, thus Article 29 of Decree 125/2020/ND-CP is not applicable in administrative penalty cases.

The fine levels mentioned above apply to organizations; in cases of individuals or households violating, the fine level is half that of the organization.